|

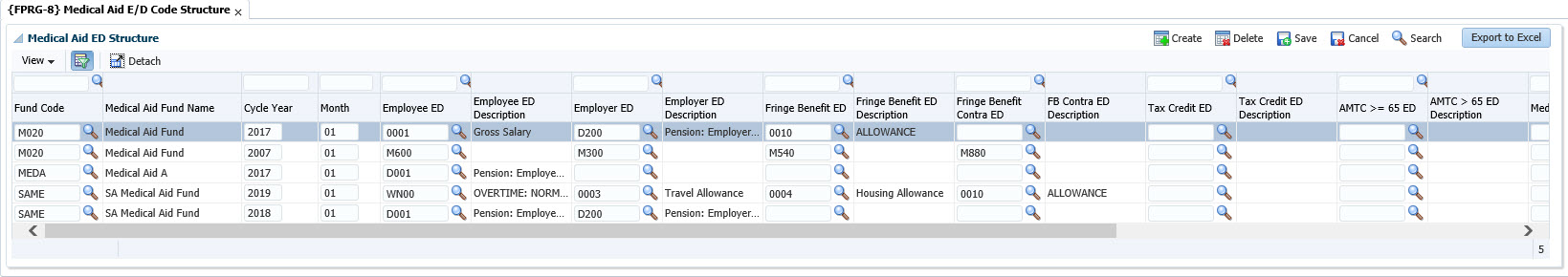

The Earning and Deduction Codes used by Calculation Method U - Medical Aid Local Software may be specified in this screen.

Inserts, changes and deletions to the information in this table are written to a logfile, which may be printed with the Salary Related Audit Trial {FPRNR1-27}.

| Field | Type & Length |

Description |

|---|---|---|

| Fund Code | A4 | The fund code for the medical aid as defined on {FPRG-3}. |

| Medical Aid Fund Name |

A4 | The fund code description for the medical aid as defined on {FPRG-3}. |

| Cycle Year |

(YYYY) | The Cycle Year in which this set-up becomes effective. |

| Month |

(MM) | The Cycle Month in which this fund becomes effective. |

| Employee ED |

A4 | An Earning / Deduction for the Employee Contribution to the medical aid.

|

| Employer ED |

A4 | An Earning / Deduction for the Employer's Contribution to the medical aid.

|

| Fringe Benefit ED | A4 | The code of the Fringe Benefit Earning.

|

| Fringe Benefit Contra Earning / Deduction | A4 | The contra of the Fringe Benefit Earning.

|

| Tax Credit ED |

A4 | The Code of the Medical Tax

Credit Earning

|

| AMTC >= 65 ED | A4 | The Code of the Additional Medical Tax Credit Earn for Employee`s >= 65 years old

|

| Medical Allow ED | A4 | This is a variable field that may be used

differently in each medical aid local software program, as defined by

the client. If this field is used, the code should be linked to the Appointment Types of the relevant personnel members in the Global Earning / Deduction Detail {FPRG-7}. |

| Reference ED | A4 | This is a variable field that may be used

differently in each medical aid local software program, as defined by

the client. If this field is used, the code should be linked to the Appointment Types of the relevant personnel members in the Global Earning / Deduction Detail {FPRG-7}. |

| Adult Amount | N17.2 | This is a variable field that may be used differently in each medical aid local software program, as defined by the client. |

| Calculation Mechanism | A1 | This is a variable field that may be used differently in each medical aid local software program, as defined by the client. |

|

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 11-Apr-2007 | v01.0.0.0 | Charlene van der Schyff | T134070 | New manual format. |

| 09 May 2007 | v01.0.0.0 | Allie | T128880 | Describe existing functionality. |

| 22-Aug-2008 | v01.0.0.0 | Magda van der Westhuizen | T152258 | Update manual: Language Editing - Juliet Gillies. |

| 07-Mar-2013 | v02.0.0.0 | Sister Legwabe | T189018 | Medical Tax Credits |

| 07-Apr-2016 | v03.0.0.0 | Sakhile Ntimane | T213274 | Adding new field and description and new image. |

| 10-Feb-2017 | 03.0.0.1 | Sakhile Ntimane |

T206202 | Accumulative calculation |

| 09-Oct-2017 |

v05.0.0.0 |

Sthembile Mdluli |

T220570 |

Convert image to the intergrator 5. |

| 12-Nov-2018 |

v04.1.0.0 |

Sthembile Mdluli |

T232368 |

ADF Conversion |