|

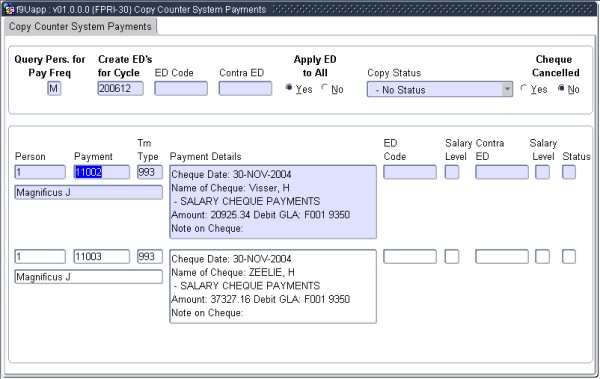

Payments to personnel members are frequently processed through the ITS Counter System. Some of these payments should be included in the calculation of personal tax. This screen allows users in the Payroll to automatically create individual earnings (and, if required, contra-deductions) that may be processed with the normal payroll calculations; this is to ensure that these payments are taken into consideration in the calculation of personal tax.

Furthermore, advances may be given to personnel members through the ITS Counter System: these advances may then be recovered by using this screen to create individual salary deductions.

The actual processing will be done on block 2. This block allows the user to set query and other parameters. Details are as provided below

| Field | Type & Length |

Description |

|---|---|---|

| Query Personnel for | ||

| Pay Frequency | A1 | (M)onthly

or (W)eekly Only payments for personnel with this pay frequency will be queried in block 2. |

| Create E/D's for Cycle | YYYYMM or YYYYWW | Earnings or Deductions that will be created will use, as Start and End Dates, the First and Last Day of the Payroll Cycle, as in Dates for Payroll Cycles {FPRM-21}. |

| ED Code | A4 | The Earning or Deduction Code to be used when an Individual Earning or Deduction is created. The value in this field will default into the field ED Code in block 2 if the field "Apply ED to All" is set to (Y)es. |

| Contra ED | A4 | The Earning or Deduction Code to be used as a "contra" for the Individual Earning or Deduction created by the previous field. The value in this field will default into the field Contra ED in block 2, if the field "Apply ED to All" is set to (Y)es. |

| Apply ED to All | A1 | (Y)es or (N)o. |

| Copy Status | A1 | The Status of the Payment in relation to this

program.

|

| Cheque Cancelled | A1 | If set to (Y)es,

only payments that were cancelled will

be queried in the next block.

|

| Field | Type & Length |

Description | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Person | N9 | The personnel number indicated on the Payment. This field is not navigable. |

||||||||||||||||

| Payment | N10 | The payment number A specific payment may be queried with this field. |

||||||||||||||||

| Trn Type | N4 | Transaction Type. Payments with a specific transaction type may be queried. |

||||||||||||||||

| Payment Details | The following details will display here

|

|||||||||||||||||

| Name | The Surname and Initials of the personnel member will display below the Person field. | |||||||||||||||||

| ED Code | A4 | The Earning or Deduction Code to be used when an

Individual Earning / Deduction is created for this payment. The ED Code, as entered in block 1, will default into this field. |

||||||||||||||||

| Salary Level | N2 | The Salary Level to be used when the Individual Earning / Deduction is created for this payment. The Salary Level, as in the definition of the Earning / Deduction Type {FPRG-6} will default into this field. | ||||||||||||||||

| Contra ED | A4 | The Earning or Deduction Code for the

"contra" earning or deduction. The Contra ED, as entered in block 1, will default into this field. |

||||||||||||||||

| Salary Level | N2 | The Salary Level to be used when the Contra Individual Earning / Deduction is created for this payment. The Salary Level, as in the definition of the Earning / Deduction Type {FPRG-6} will default into this field. | ||||||||||||||||

| Status | A1 | The Status of the Payment in relation to this

program. Detail is discussed in the processing rules for this block. The system will allow only the following changes to the status:

|

|

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 26-Apr-2007 | v01.0.0.0 | Frans | t122985 | New manual document. |

| 24-Aug-2007 | v01.0.0.0 | Amanda Nell | t122985 | New images. |

| 04-Sep-2008 | v01.0.0.0 | Magda van der Westhuizen | t152258 | Update manual - Language Editing: Juliet Gillies. |