|

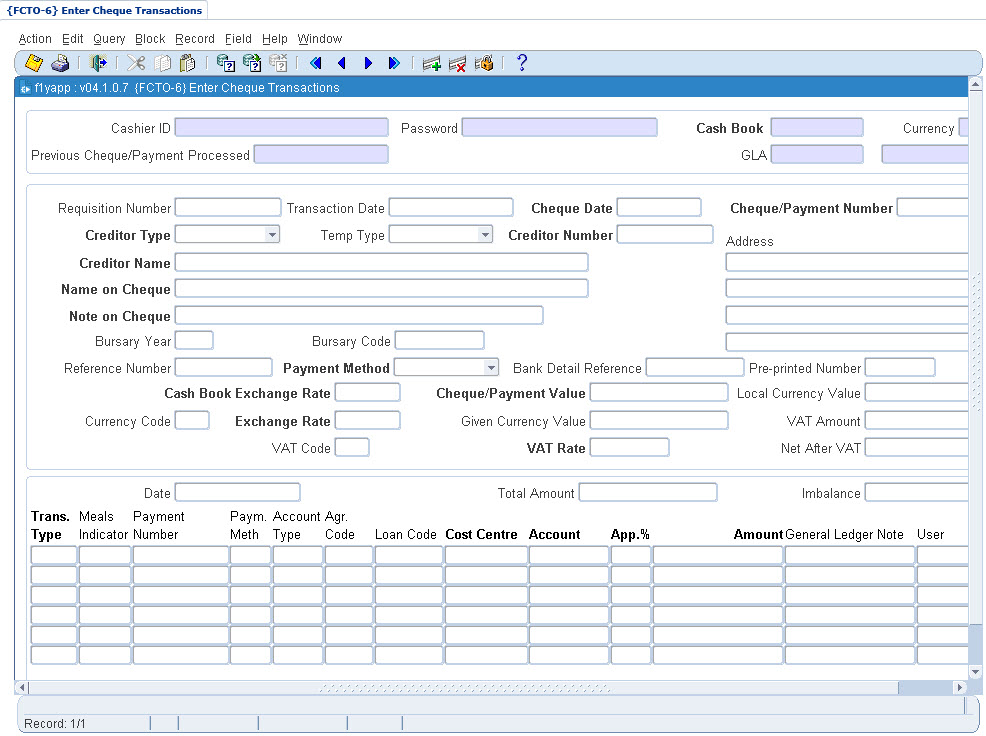

Cheque, Manual Cheque or ACB Payment Transactions are captured in this option.

To determine if exchange rates are updatable for foreign currency, the following must be set up on {FCSO-21b1}:

| Subsystem | Type of Document |

| CT (Counter System) | EX (Expense) |

| SD (Student Debtors) | DC (Manual Journals) |

| AR (Accounts Receivable) | AL (All Documents) |

| PM (Procurement Management) | AL (All Documents) |

Cash book restrictions are set up per Cashier in {FCSM-4b2} for Restriction Type FCTI. A Cashier can be restricted to only have access to certain Cash Books.

The Cashier must be logged on in Cashier Sign-On {FCTO-1} and have access to Cash Book(s) to process payments.

To process a payment

the cashier must be logged on and entered in this block.

The Cash Book from which the payment will be made must also

be entered.

| Field | Type & Length |

Description |

|---|---|---|

| Cashier ID | A20 | Cashier Identfication Code as defined in option Maintain Cashier ID and Passwords {FCTM-2}. |

| Password | A6 | Cashier Password. |

| Cash Book | A5 | Cash Book Code. |

| Currency | A3 | Cash Book Currency Code is displayed. Description and Exchange Rate is displayed on right-click. |

| GLA | Cash Book Cost Centre and Account are displayed. On right-click their respective descriptions are displayed. | |

| Previous Cheque/Payment Processed | N10 | After a Cheque/Payment has been saved, the previous Cheque/Payment Number is displayed. |

Cheque/Payment detail is entered here. The Cheque/Payment Value is in Cash Book currency.

| Field | Type & Length |

Description | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Requisition Number | A10 | If this payment originates from a Requisition, enter the Requisition document number here. | ||||||||||||

| Transaction Date | DD-MON-YYYY | The system date will be the default date, and the user cannot change this date. | ||||||||||||

| Cheque Date | DD-MON-YYYY | The system date will be the default date, but may be changed by the user. This is the date that will appear on the cheque. | ||||||||||||

| Cheque/Payment Number | N10 | Will be allocated by the system and displayed in "Previous Cheque/Payment Processed" upon <SAVE> command. | ||||||||||||

| Creditor Type | A1 | The user must choose the type of creditor, and when the

transaction type is entered in Block 3, the system will validate that

the default from the transaction type is for the person type entered

here. The following Creditor Types are available: Student / Personnel / Other / Debtor / Creditor / Alumni. If the Type = Creditor, refer to the processing rules at the end of the manual. |

||||||||||||

| Temp Type | A1 | If a payment must be processed as an Other person type but biographical detail for the specific person is kept on the ITS system this field can be used to retrieve the name and address detail for the person. | ||||||||||||

| Creditor Number | N9 | Completion of this field is mandatory for creditor

types (S)tudent, (D)ebtor, (P)ersonnel, (C)reditor and (A)lumnus and if

the ACB system is in use, for (O)ther creditors being paid by ACB

transfer, as well. The system will check that the code is valid, and display the name and address. The system checks the validity of the code on entering of this field, displaying "Invalid number while debtor = Student, Personnel, Creditor, Debtor, Alumnus or Other Payments" if code is invalid. |

||||||||||||

| Creditor Name | A45 | The name of a "creditor" will be displayed, if the type is set to Student, Personnel, Creditor, Debtor, Alumnus or Other for ACB payments of Other creditors, provided a valid number is entered, but may be changed by the user. Enter the name that will appear on the cheque advice for creditor type "Other". | ||||||||||||

| Name on Cheque | A45 or A30 for ACB |

The creditor's name will default in this field, but the name on the cheque may differ from the "creditor's" name. This name will appear on the student statement in event of this payment being made to a student. | ||||||||||||

| Note on Cheque | A30 | The note entered here will be displayed on the cheque or ACB remittance advice. | ||||||||||||

| Address | 4 * A30 | Address which will appear on the cheque. In the case of a student or staff member, the system will insert this address. For staff it is the address of the primary Department to which he is linked. | ||||||||||||

| Reference Number | A10 | A reference number to appear on the cheque or ACB remittance advice. If the payment originated from a Requisition, the Requisition Number will default into the Reference Number. | ||||||||||||

| Payment Method | A1 | Che(Q)ue, (A)CB / (M)anual. The system will

default to Cheque unless an Other creditor is being paid by ACB in

which case it will default to ACB. In the case where

a manual cheque was made out and the user would like to record the

transaction, a Manual payment method may be used. The system will record the transaction but no cheque is generated. |

||||||||||||

| Pre-printed number | N6 | In the case of Manual cheques the external number of the cheque that was issued, must be entered here. This is necessary to permit cash book reconciliation of the cheque. This field is mandatory for payment method "Manual". | ||||||||||||

| Cash Book Exchange Rate | N5.3 | The Cash Book exchange rate defaults into this field.

If the Cash Book Currency is the same than the institution's Local

Currency (e.g. SAR), the Cash Book Exchange Rate may not be changed.

If the cheque is made out in Foreign Currency, and the "Updateable" Indicator is set to "Yes" in {FCSO-21 Block 1} for Subsystem CT and Type of Document EX, then this exchange rate may be changed by the cashier. Note: if the cashier changes the Cash Book exchange rate for the Cheque/Payment on FCSO-21, it will be written to a log file. |

||||||||||||

| Cheque/Payment Value | N15.2 | The Cheque/Payment Value in Cash Book currency.

This amount should balance with the amounts debited to

different GL-Allocations in Block 3. If the amount differs,

the user will be alerted to the fact by a message on the

screen. The field "Imbalance" in Block 3 also indicates that

the amounts are not in balance. Credit transactions can only be entered if the "creditor type" is Other, Personnel or Alumni. |

||||||||||||

| Currency Code | A3 | This value is the Cash Book Currency code, except if the creditor type is Student, Debtor or Creditor, in which case it is the currency of the creditor. | ||||||||||||

| Exchange Rate | N5.3 | The Exchange Rate of Currency Code above. If

the Currency Code is the same than the institution's Local

Currency (e.g. SAR), the Exchange Rate may not be changed. If the creditor type is Student, Debtor or Creditor and the creditor has Foreign Currency, Exchange Rate may be changed by the Cashier once the "Updateable" Indicator has been set to "Yes" in {FCSO-21 Block 1} for the following:

|

||||||||||||

| Given Currency Value | N15.2 | The value in Given Currency is calculated and may not be changed. | ||||||||||||

| VAT Code | A2 | A VAT Code may be entered for creditor types Personnel, Other and Alumni. The VAT Rate will be defaulted once a valid VAT Rate has been entered. | ||||||||||||

| VAT Rate | N1.3 | The VAT Rate may be entered/changed for creditor types Personnel, Other and Alumni. | ||||||||||||

| Local Currency Value | N15.2 | The Value of the Cheque is calculated in Local Currency and displayed here. | ||||||||||||

| VAT Amount | N15.2 | If a VAT Rate has been entered, the VAT Amount in Local Currency is calculated and displayed. | ||||||||||||

| Net After VAT | N15.2 | The Net Amount after VAT has been deducated from the Local Currency Value is displayed. |

The General Ledger break-down per GLA must be specified here. Only six records are displayed, but more may be created. The following information is required:

| Field | Type & Length |

Description |

|---|---|---|

| Date |

DD-MON-YYYY HH:MI |

System date and time is stored and may not be changed. |

| Transaction Type | N4 | A valid code for the payment type is entered, the description will be displayed on right-click and the Creditor Type, entered in Block 2 will be validated. |

| Meals Indicator | A1 | This value will display from the Transaction Type Definition {FCSO-7}, and indicates if this is a Meals Transaction and the transaction must write to the card system. |

| Payment Number | N10 | This is system generated number and may be used to query transactions. |

| Payment Method | A1 | The method of payment (cheQue/Acb/Manual) is displayed and may not be changed. This field may be used for query purposes. |

| Bank Detail Reference | N5 | The Banking Details Reference Number links the payment of

person type “Other” to the banking detail with which the

payment was captured and or the payment was made. The list of values on the field displays banking details where the person type is “B” and the banking details is on Hold or Authorised and banking details has no end date entered. The end date on perosn type 'B' records are set on the banking details when payment is linked to banking details. Although the banking detail is entered for perosn type 'B' the payment is made on person type "O - Other" without a perosn number. The person type was introduced as the requirement exists to make EFT payments to a recipient where the recipient of the payment is not defined as person in the Integrator system. The following persons are defined in the integrator system Students, Personnel, Alumni, Debtors, Creditors and Other. These EFT payments made relate to people or organisation where the relationship or interaction to the institutions is not permanent or semi-permanent and the institution do not want to define the person or organisation using one of the available person types. If the person type of the payment is “Other” and the payment method is “A-ACB” the drill down on the field allows the user to drill down to the option “Maintain Baking Details” {FCTM-10} where users with access can maintain banking details for the recipient of the payment. The person type “B - Ad-hoc Payments” is used to capture banking detail for these ad hoc payment recipients. Once created the banking details reference is linked to the payment. Ad hoc banking details can only be used once with a payment. If the payment detail was created on a payment request for person type “Other” and the payment method is “A-ACB” the banking detail reference will display for the banking detail entered in the web. |

| Account Type | A4 | The account type will default from the transaction type, but will be updateable by the user. The account type field is mandatory if the person type of the transaction is (S)tudent,(D)ebtor or (C)reditor. For (P)ersonnel and (O)ther this field is also mandatory if the meals indicator in the transaction type definition is (Y)es. If this indicator on the transaction type definition is (N)o, an account type is not needed. The program will validate that the subsystem / account type combination is valid and active. |

| Agreement Code | A4 | Whenever a transaction is processed for person type

(S)tudent, the user will have to enter a payment agreement for the

transaction. A list of valid values for the specific student will be

available to choose from. This is a mandatory field for person type

(S)tudent unless the transaction is processed against the default

account type, when this field will be null. |

| Loan Code | N5 | If a payment is made as a staff or student loan, i.e.

the creditor type is "Debtor", the loan code must be entered here. For staff debtors the cumulative principal repayment and the reducing principal (outstanding amount) {FARS-2b2}, - will then be updated with the amount of the payment. It is essential that the debtor code be linked to an account type of which the category is "S" (Staff Loans) or else the user will not be allowed to enter a loan code. For student loans, the real payment amount, as indicated on the amortisation schedule {FBLO-22b4}, will be updated with the payment amount when the next amortisation calculation is run. Again it is essential that the debtor code be linked to an account type of which the category is "L" (Student Loans) or else the system will not allow the user to enter a loan code. The system validates that the loan code exists for the specific debtor code for both staff and student loans. |

| Cost Centre and Account (GLA) |

A6 A8 |

1) If a Debit

Transaction Type has been used, the Debit GLA is

visible. In this case the Credit GLA will always be taken from the Cash

Book Definition {FCSC-5}

and may not be changed. Once

a payment has been queried, the Credit GLA will be visible on

right-click of Cost Centre and Account. 2) If a Credit Transaction Type has ben used, the Credit GLA is visible. The Debit GLA will alwasy be taken from the Cash Book Definition {FCSC-5} and may not be changed. Once a payment has been queried, the Debit GLA will be visible on right-click of Cost Centre and Account. When an account type is involved, i.e. for creditor types Student, Debtor, Creditor and (S)tudent, (O)ther, (P)ersonnel where the card (meals) system indicator on the transaction type definition is (Y)es, the GLA on screen is populated from the Account Type and may not be changed by the Cashier. If the debtor type is (A)lumni and (P)ersonnel, (O)ther where the card (meals) system indicator on the transaction type is (N)o the Debit GLA (if Debit Transaction) / Credit GLA (if Credit Transaction) will default from the Transaction Type Definition {FCSO-7} and will be updateable by the user if so indicated on the transaction type definition. If budget control must be performed, it is done after every GLA is entered. If a payment originated from a Requisition, the GLA comes from the Requisition and may not be changed. On <SAVE> the user must confirm that s/he wants to process the transaction even if there are insufficient funds available. The Cashier may only override insufficient funds if s/he has privileges according to Finance User Access Control {FCSM-5}, or in the case of Creditor type Alumni, Personnel or Other where it is not a Meals (card) transaction, if System Operational Definition {FCSM-1b2} for Code BB and Subsystem CS (Override Insufficient Funds) is set to (Y)es. |

| App. % | N1.3 | For Student, Debtor and Creditor, there is not VAT and

the VAT Apportionment

Percentage is also 0 in this case. For Other /

Personnel / Alumni the Apportionment Percentage is defaulted from the

Cost Centre and may be changed by the Cashier. If it is a Credit Transaction, the Apportionment Percentage may only be 0 or 1. For payments originating from a Requisition, the Apportionment Percentage comes from the Requisition and may not be changed. |

| Amount | N15.2 | The amount in Cash Book currency is entered here. |

| General Ledger Note | A40 | Any special note to be transferred to the General Ledger. The system will insert the Creditor Name above into this field. The Cashier may change this. |

| User | A8 | This is the User name of the Cashier that is processing the payment is displayed here and may not be changed. |

| Total Amount | N15.2 | The sum of all Amount fields in this block. This must balance with the Cheque/Payment Value in the block above. |

| Imbalance | N15.2 | If the Total Amount is out of balance with the Cheque/Payment Value above, the Imbalance will be displayed. |

|

| Processing Rules |

|

|---|---|

| Once a payment is saved, budget control is done for each record in the third block. The Cashier will be prompted to override each record that has Insufficient Funds. | |

| Withholding Tax | On commit of a cheque for a (C)reditor for which the tax Status is (N)ot Exempted or no status exists for

the year, this warning will be displayed: "Creditor Withholding

Tax Status is to Deduct Withholding Tax. Please ensure that Tax is

Withheld if required before continuing. Continue (Y)es or (N)o?" If (Y) the entry will be committed, else a rollback will be done. Creditor Withholding Tax is maintained in {FPMOWT-2}. This is controlled by SOD, Code = QA Subs = PM, use WITHHOLDING TAX Facility on {FCSM-1b2} |

| Students linked to a status with action 'S'- "Suspend Printing". | The creation of payments to students linked to a financial status with the action S-“Suspend Printing” can be prevented by setting the SOD “CK-CT:- Students linked to a status with action 'S' “ to “Y” else the cashier will receive a warning that the student is linked to a status code with action 'S'. |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 14-Jun-2006 | v01.0.0.0 | Elsabe | t125552 | For Integrator, the Cheque/Payment program's "face" was changed to view more information on one screen. The cheque/payment Value is now entered in Cash Book currency. |

| 22-Jan-2011 | v01.0.0.1 | Hermien Hartman | t170695 | Added Withholding Tax info to block 2 'Creditor Type' and the processing rules. |

| 07-Jun-2013 | v02.0.0.0 | Sakhile Nyoni | f191320 | Amended the description of Agreement Code and Loan Code field. |

| 27-Jun-2013 | v02.0.0.1 | Alucia Sabela | f191329 | Added FCSO-21 on Cash Book Exchange Rate. |

| 26-Oct-2015 | v03.0.0.0 | Gladness Morapedi | T210127 | Add field "Bank Details Reference" |

| 13-Jun-2016 | v04.0.0.1 | Marchand Hildebrand | t205772 | Add note on sod CK |

| 23-Jun-2020 | v04.1.1.0 | Isaac Matshela | t244324 | Update manual image |