Overview of the iEnabler TGP (Total Guaranteed

Package) Salary Structure {P00005-28}

This option provides the

facility for Personnel Members to access and maintain their TGP salary

structures.

The following options are

available, however, depending on the status of a person and the rules defined

in {PTGP-1}, a maximum of one option will only be available to a person, at any

given time. If a person does not meet

the rule requirements, then no options will be available:

- Convert from a Salary +

Benefit Salary structure to a TGP Salary Structure

- Maintain TGP Salary Structure

i.e., change from one Medical Aid Provider and / or Plan to another.

- For newly appointed

personnel to setup their TGP Salary Structure

General Processing Rule

- The

options mentioned above are controlled by rules setup in {PTGP-1}.

- Based on

the status of the person or rules defined, only one of the three options will

be available to a personnel member at any given time, or none.

- In

{PTGP-1} for each TGP Component, rules may be setup regarding allowed changes

as well as what the effective payroll cycle will be for the component changes,

which may be a current payroll cycle if cycle date is null or a future payroll

cycle as defined.

- Whether a

change becomes effective immediately is not only dependant on the payroll cycle

linked to the rule, but also on the date it is approved (if approval is

required else it will be deemed approved).

In {PTGP-1} Tab 1, SOD ‘X1’ a cutoff date is setup (allowed values between

1 and 31), therefore, if the value of ‘X1’

is set to 20, Event Type C in {FPRM-2} is set to 202306 and the system date =

15 June 2023 and the change is approved on 15 June 2023 (i.e. before or on the

cutoff date (20)) then the change will become effective in the current Payroll

cycle of 202306. If this change is approved on 23 Jun 2023, then the

change will only become effective in Payroll cycle of 202307.

- All

changes are written into a staging table with an effective cycle and may only be

copied into the back office, in the cycle in which they become effective. {PTGPR-2} must be run to copy changes to the

back office and Event Type C must be set to the correct payroll cycle for which

changes are being copied. Until changes have been copied into the back office,

they will not be effective or active.

- {PTGPR-2}

can be setup to run via the scheduler on an hourly / daily / weekly basis as

required.

- Personnel

may be given access to use this functionality, on behalf of another personnel

member; this includes:

- Convert to a TGP Salary Structure

- Change/Maintain the

person's Salary Structure

- Structure a TGP Salary

structure for a new employee.

The setup of

this is done in {PTGP-2}.

- Validations

are done to ensure that the structuring of TGP Packages, both new employees and

existing employees making changes, equals the total TGP Package amount, which

is stored at Salary Notch Level {FPRI-1}.

If these amounts do not balance, or if there is a negative

Non-Pensionable Allowance amount (used as the variable), the process will be stopped,

and an error message displayed.

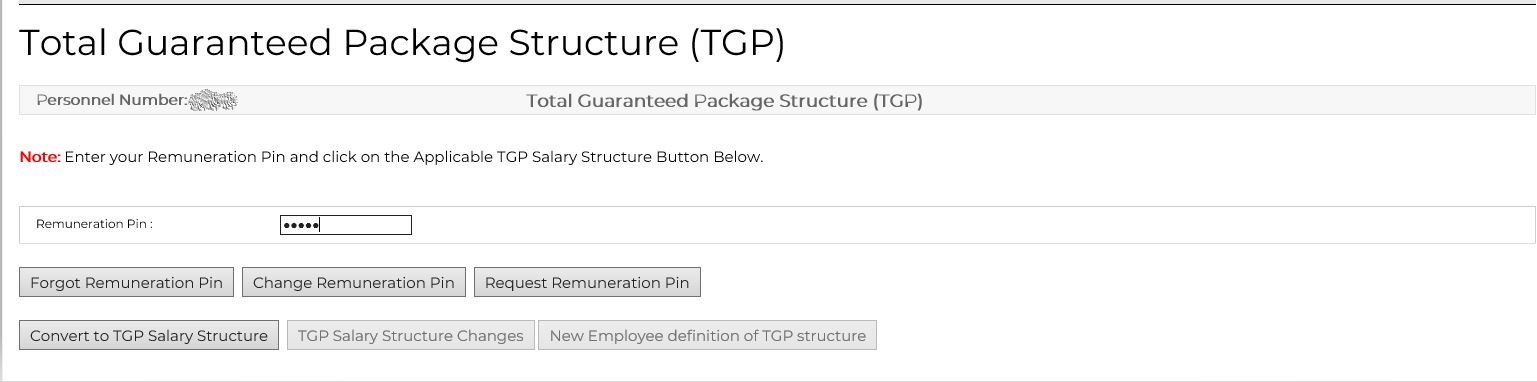

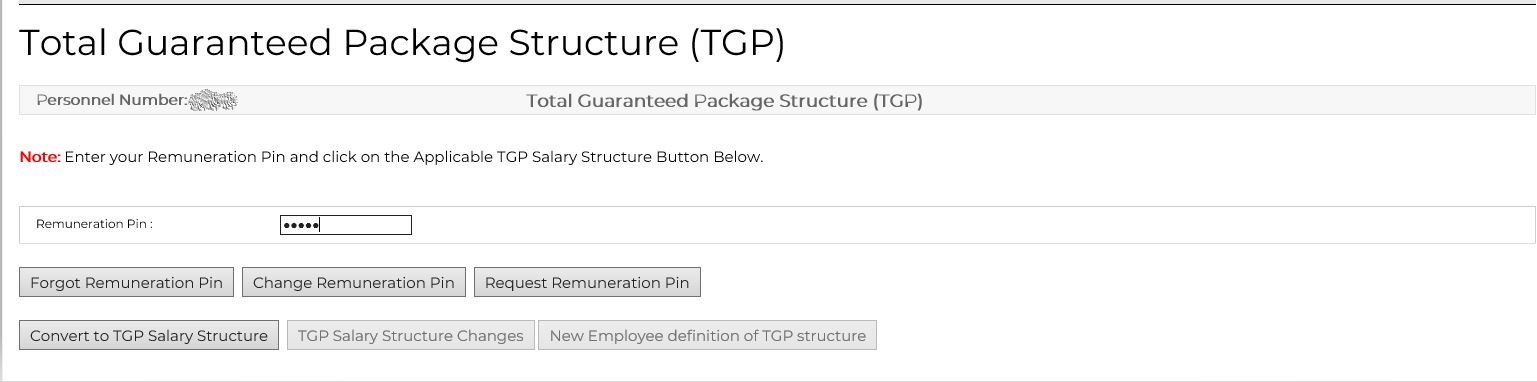

Convert to TGP Salary Structure

- If a

person is currently on a Salary + Benefits Salary Structure and the rules in {PTGP-1} allows the person to convert to a TGP Salary

structure, i.e. Tab 2 and 3 for the person’s current Appointment Type and / or

Grade and Rank and the system date falls within the From and To Date for which

the rules are active, then the Button for the first option mentioned above will

be active on the iEnabler in the Personal Confidential Information under the

Total Guaranteed Package (TGP) Option.

- The TGP

Components that form part of the new TGP Salary Structure for the person is

determined in {PTGP-1} tabs 4, 5 and 6.

These tabs define the Salary + Benefit ED Codes to be converted to TGP

Salary Structure ED Codes and include both Global ED Codes as well as

Individual ED Codes

- The TGP

Conversion process will result in a person having the same Earning and

Deductions and linked to the same Fund Codes, however in the conversion, different

ED Codes are used.

- The PAYE

and Net Pay will remain the same

- It is not

advisable to allow conversions during a General Increase cycle, as the employee

needs to compare their usual Standard Salary + Benefit Salary Structure to the

new TGP Salary Structure.

- The system will create a Notch

record in {FPRI-1} with TGP Indicator = 'Y' and

Pensionable Salary % as calculated.

- The new Notch value is the annual

Total Guaranteed Package vs the old Notch value, which was the Pensionable /

Basic Salary amount.

- A new Service Record is created {PBOP-2}

with the new TGP Appointment Type and Service Record Indicator.

- Individual Transactions as

applicable will be ended and new transactions started, using the new TGP ED

Codes.

- Future salary calculations will

use the Global setup of the new TGP Appointment Type.

- Nett Pay, PAYE, Contribution to

Funds etc. will remain the same in the conversion month.

- When future increases are

implemented, the Notch value will always be the total TGP Salary Package,

with Pensionable % defined and TGP Indicator set to ‘Y’. The Global setup will calculate the new

component values ensuring the total package amount is never exceeded in

the structuring.

- All conversions require an

Approval. The conversion is approved as one process by one-person,

individual TGP components are not approved individually.

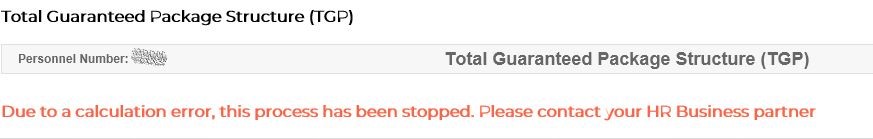

- If for any reason the

conversion process does not balance between the Salary + Benefit Salary

Structure and the TGP Salary Structure, the process is stopped, and an

error message is displayed.

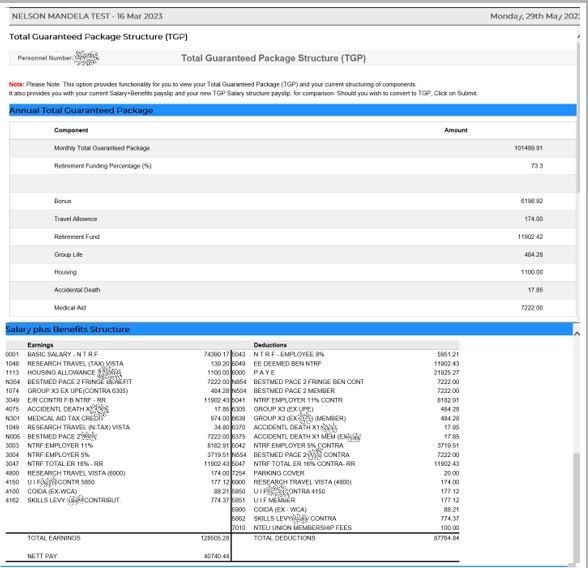

- If the

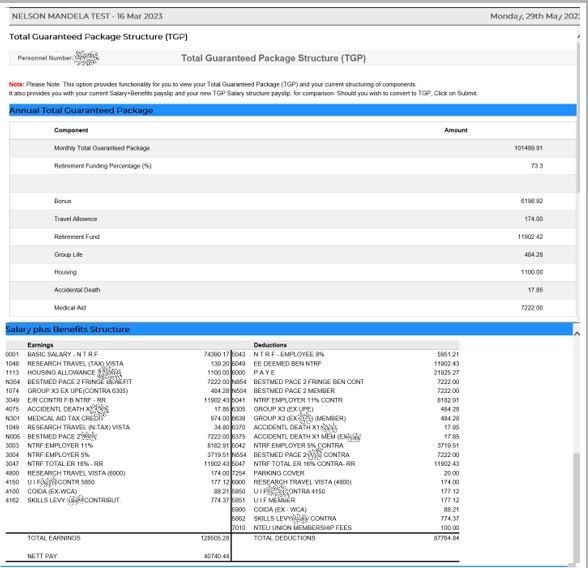

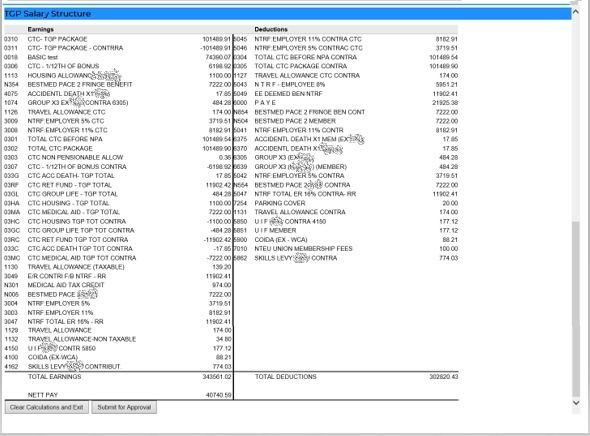

option is selected, the system will calculate the new TGP Salary Structure and display

proformas for both the Salary + Benefit Salary Structure and the TGP Salary Structure

for the person to compare.

- The

person may then submit the TGP Salary Structure conversion for approval, or clear the calculation and

exit.

- Conversions are written to a

stagging table and {PTGPR-2} must be run to copy these changes into the

back office to make them active and effective. {PTGPR-2} can be setup to run via the

scheduler on an hourly / daily / weekly basis as required.

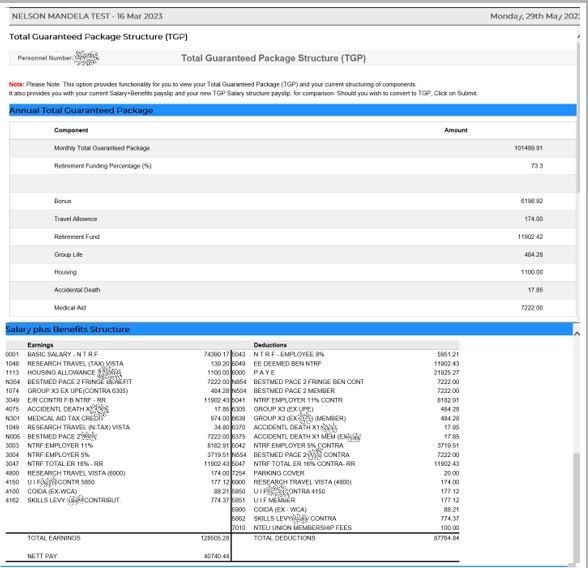

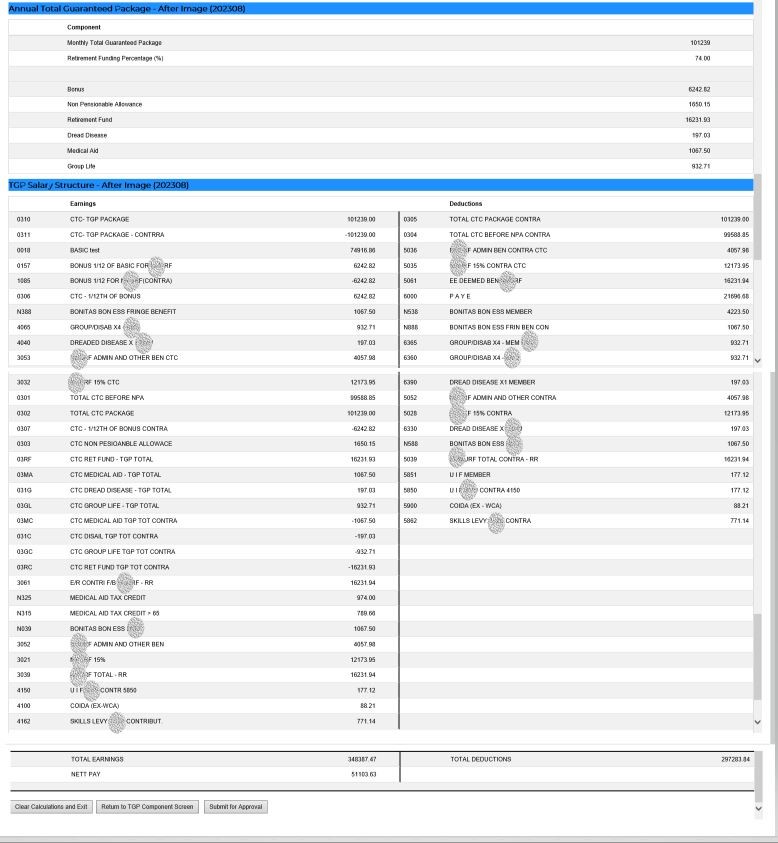

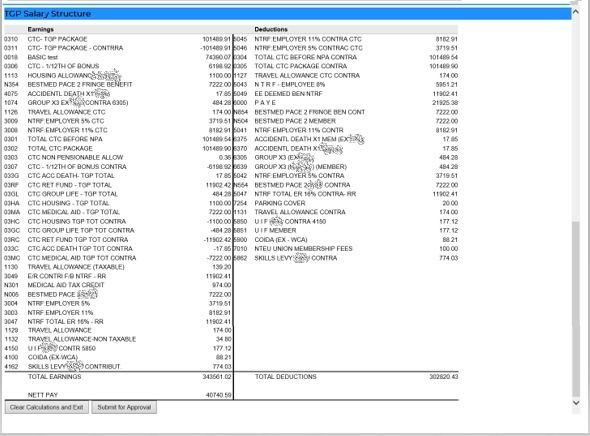

Example

If a conversion does not balance

If a conversion balances

The

PAYE Balances before and after to R21 925 with a difference of 11 cents

The Nett Pay Balances before and R40 740 with a cents difference of 6 cents.

Please note any difference greater than 50 cents will result in a conversion

not balancing

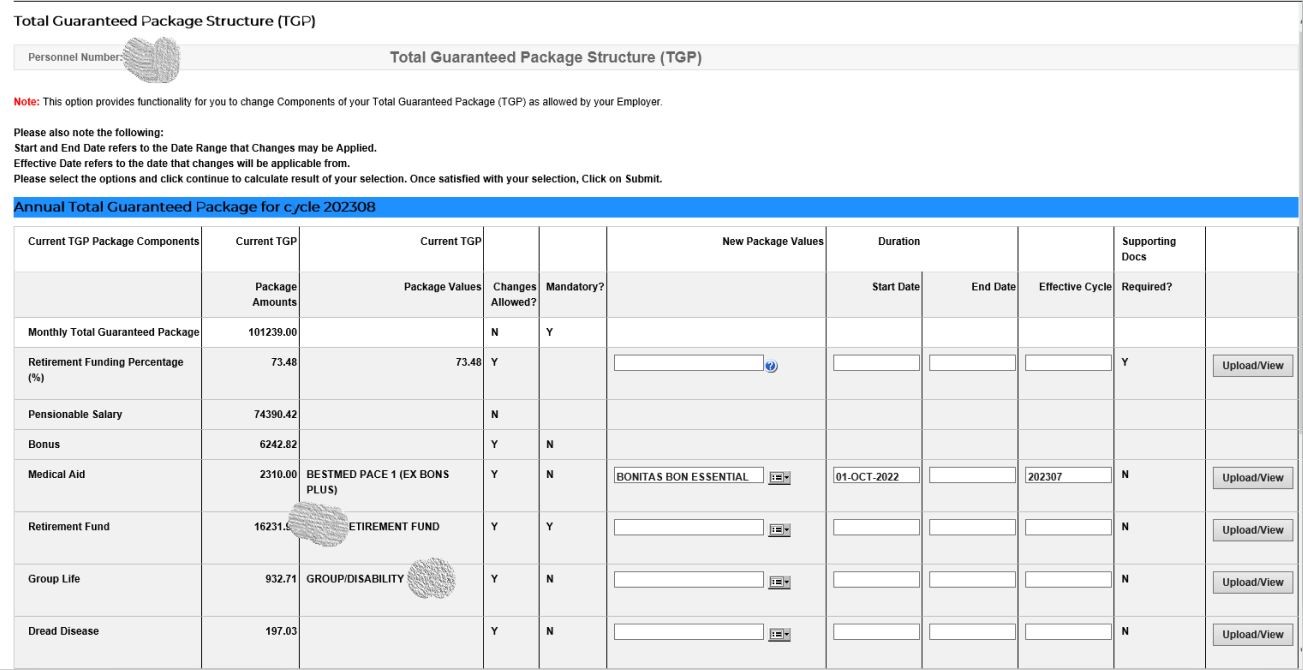

Changes to TGP Salary Structure

- A person must be on a TGP

Salary Structure and have been on the TGP Salary Structure for a minimum

of 1 cycle, in order to make changes to their package components i.e. the

person must be linked to TGP Appointment Type and have a TGP Notch where

TGP Indicator is set to yes, with cycle date minimum of 1 cycle less than

sysdate. If these conditions are

not met, the person will not be able to access this functionality.

- Rules are setup on {PTGP-1}

Tab 7 and 8 for Process Type E -Existing or All per component, per TGP

Appointment Type and Rank and / or Grade, To and From Date for which a

change may be made, the effective cycle of the change, whether approval is

required for the change, whether supporting documentation must be attached

and the ‘help note’ to be displayed. See below.

The rules will determine a valid % range.

This Component cannot be set to Yes or No and is a

display option only. A Bonus Provision

is determined by the TGP setup and whether a person has a bonus month defined

or not.

Allows the user to make changes to their Bonus

Month and to decide if a Bonus will form part of their TGP Package structure.

The following options are available:

- X - No Bonus

- S - Subsidy Month (Bonus

month = Apr (for birth month Jan-Mar, rest=Birth month)

- D - December Bonus Month

- J - January Bonus Month

-

- B - Birth Month Bonus

Month

Allows the user to select taxing

their Bonus either Annually (when received) or Monthly. These changes should only be applicable for

March payroll cycle:

The rule will determine how the

user can apply changes to the Housing Allowance. It is based on:

- A valid %

determined by the Min and Max % of Pensionable Earning rule OR

- Max % of

Pensionable % rule OR

- An amount

determined by the Min and Max amount rule OR

- Max % of

TGP Total rule OR

- Using the

Old and New Fund Code Rule, a LOV of valid Fund Codes. Only Fund Codes where the Fund Type = 'O'ther

may be selected here.

The rule will determine how the user can apply

changes to the Travel Allowance. It is

based on:

- A valid %

determined by the Min and Max % of Pensionable Earning rule OR

- Max % of

Pensionable % rule OR

- An amount

determined by the Min and Max amount rule OR

- Max % of

TGP Total rule OR

- Using the

Old and New Fund Code Rule, a LOV of valid Fund Codes. Only Fund Codes where the Fund Type = 'O'ther

may be selected here.

These TGP components were created for non-standard

components and rules as defined above may be defined.

Allows the user to make changes to their Group

Life. This is defined using the Old and

New Fund Code rule. A LOV of valid Fund Codes

will display, only Fund Codes where the Fund Type = 'G'roup Life will appear on

the LOV.

Allows the user to make changes to their Retirement

Funding. This is defined using the Old

and New Fund Code Rule. A LOV of

valid Fund Codes will display, only Fund Codes where the Fund Type = P -

Pension, R - Retirement Annuity or V - Provident Fund will appear on the LOV

from which the user may select a valid Option.

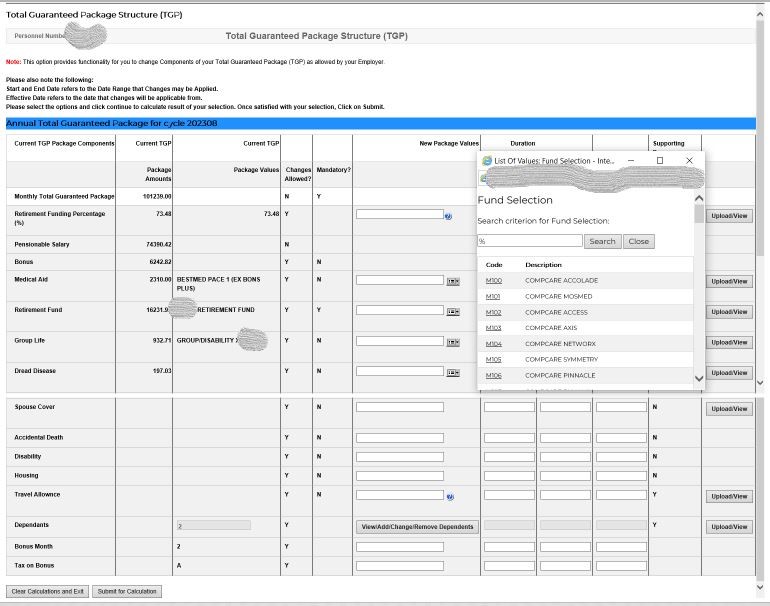

Allows the user to make changes to their Medical

Aid provider / plan. This is defined using

the Old and New Fund Code rule. A LOV of

valid Fund Codes will display, only Fund Codes where the Fund Type =

'M'edicalAid will appear on the LOV from which the user may select a valid option.

Allows the user to add new Dependants and maintain

existing dependants, as defined.

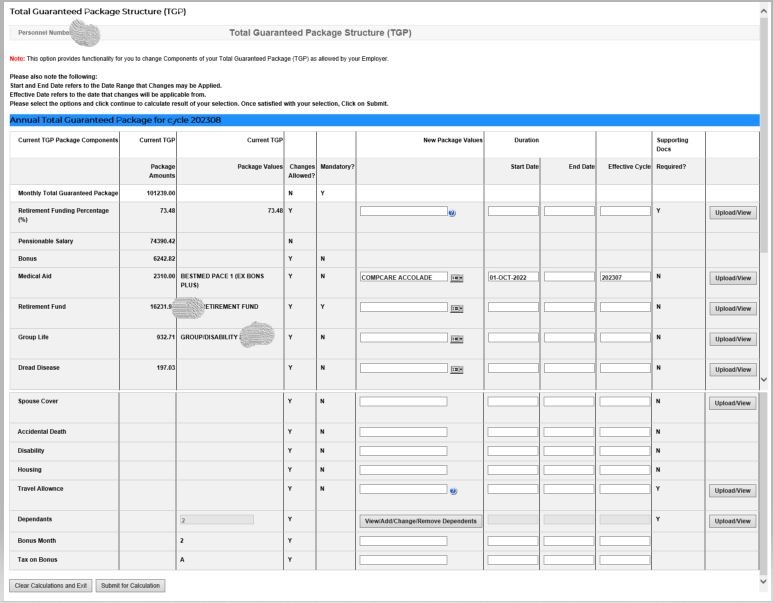

- Once the

user has applied all required changes, they may then click on the 'Submit for

Calculation' button

- The

system will calculate the effect of the changes selected and display before and

after proformas for each effective cycle, for which a change is being made.

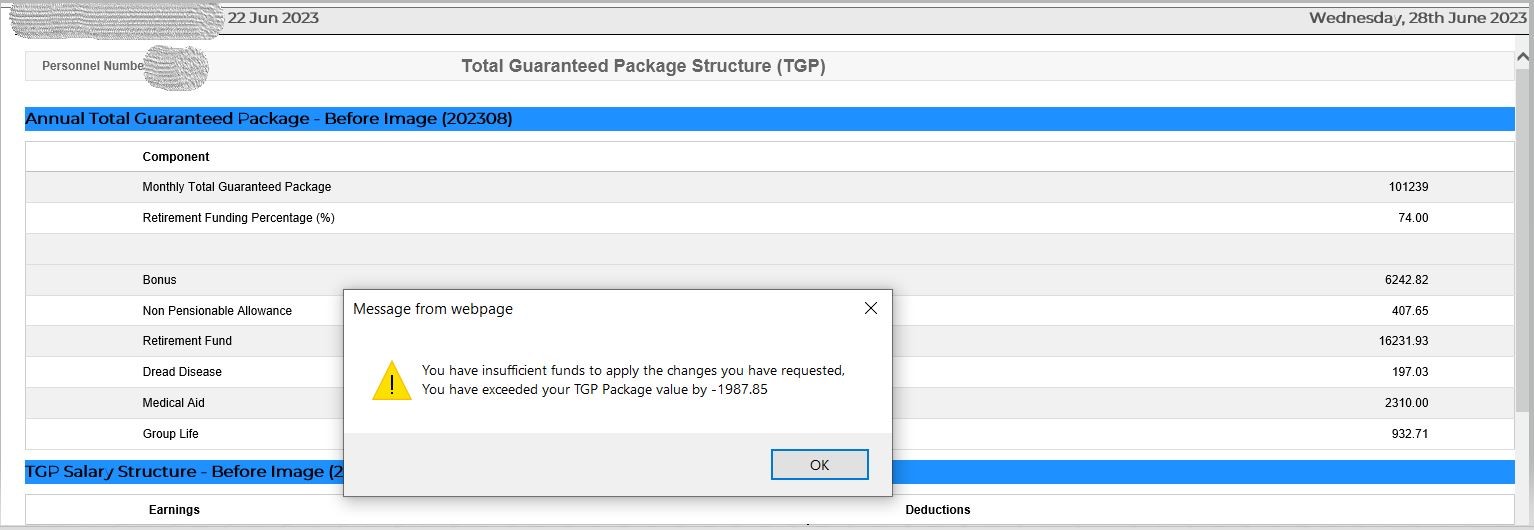

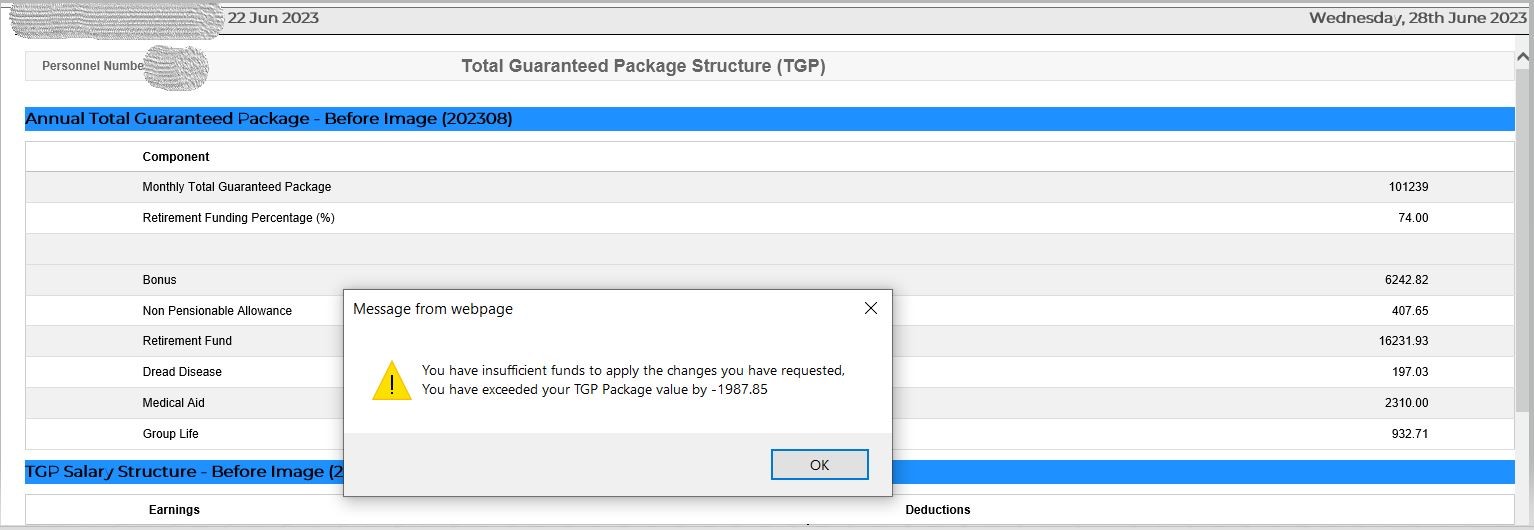

- Changes

to TGP Components may not exceed the total TGP Package amount (Notch record in

FPRI-1 where TGP = 'Y'). This is

controlled by the sum of all TGP Components that must equal the TGP Amount. Where exceeded, the program will stop the

process and display an error message.

- If

satisfied with the changes and effect on the payslip, the user may submit for

approval or may clear the calculation, make further changes or exit.

- Changes are written to a

stagging table and {PTGPR-2} must be run to copy these changes into the

back office to make them active and effective. {PTGPR-2} can be setup to run via the

scheduler on an hourly / daily, weekly basis as required.

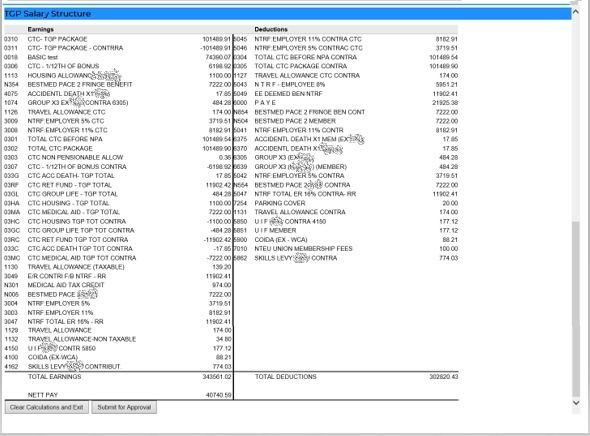

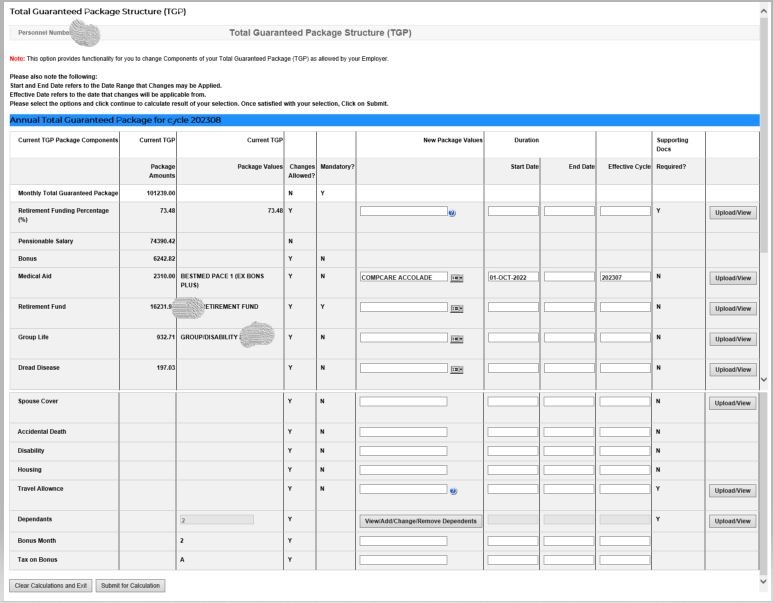

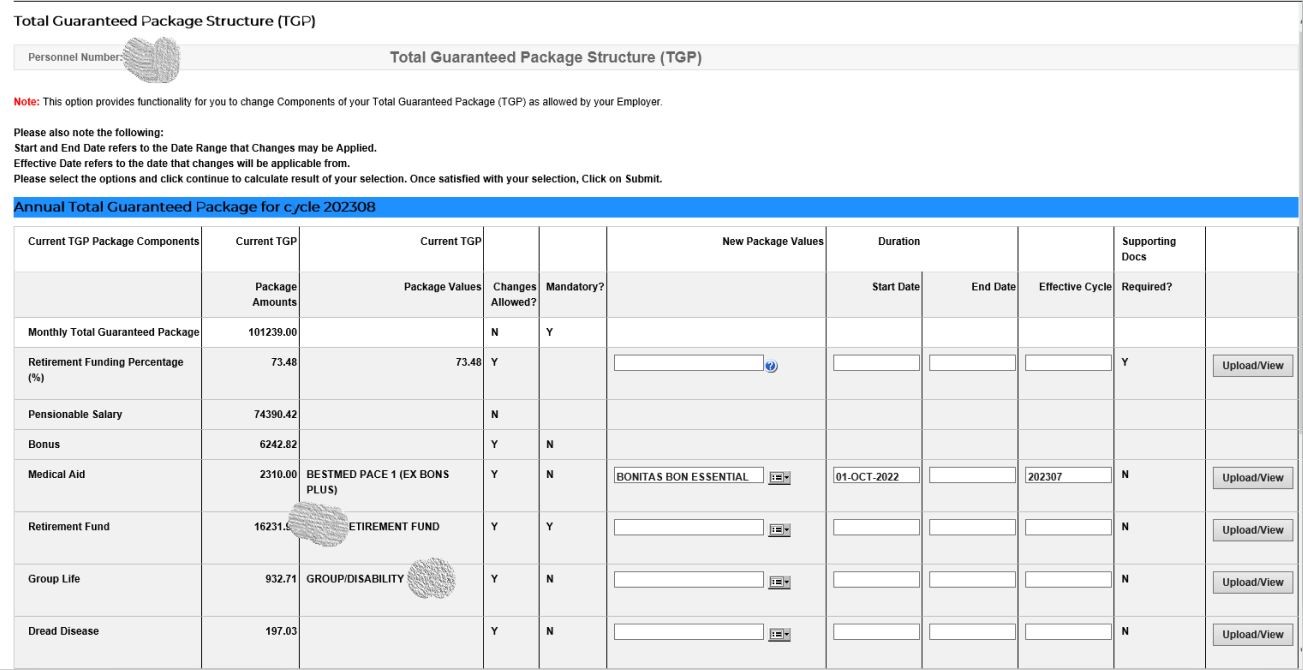

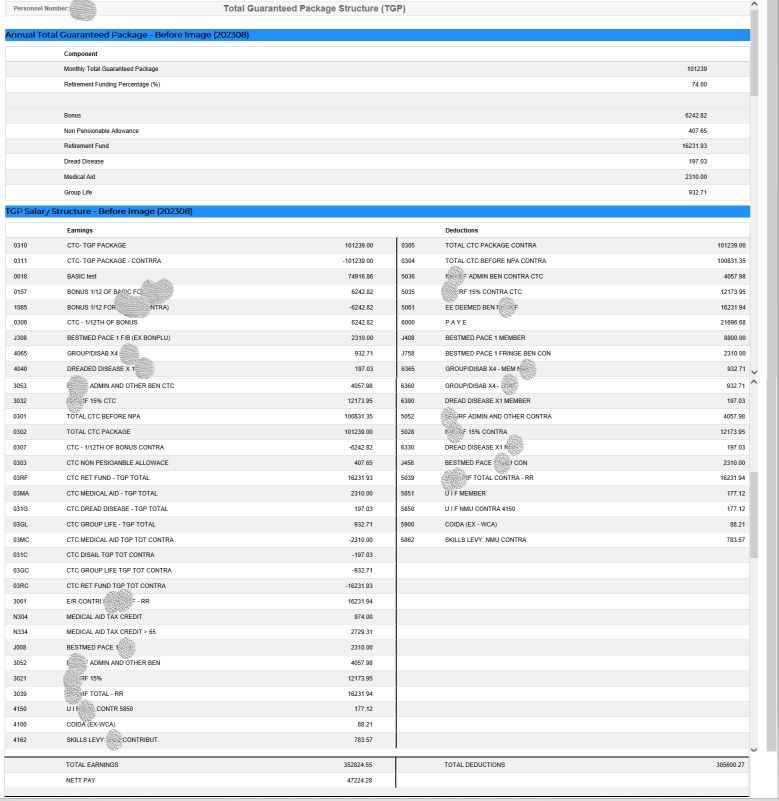

Example

Select an option that is to expensive where the change will exceed the TGP value.

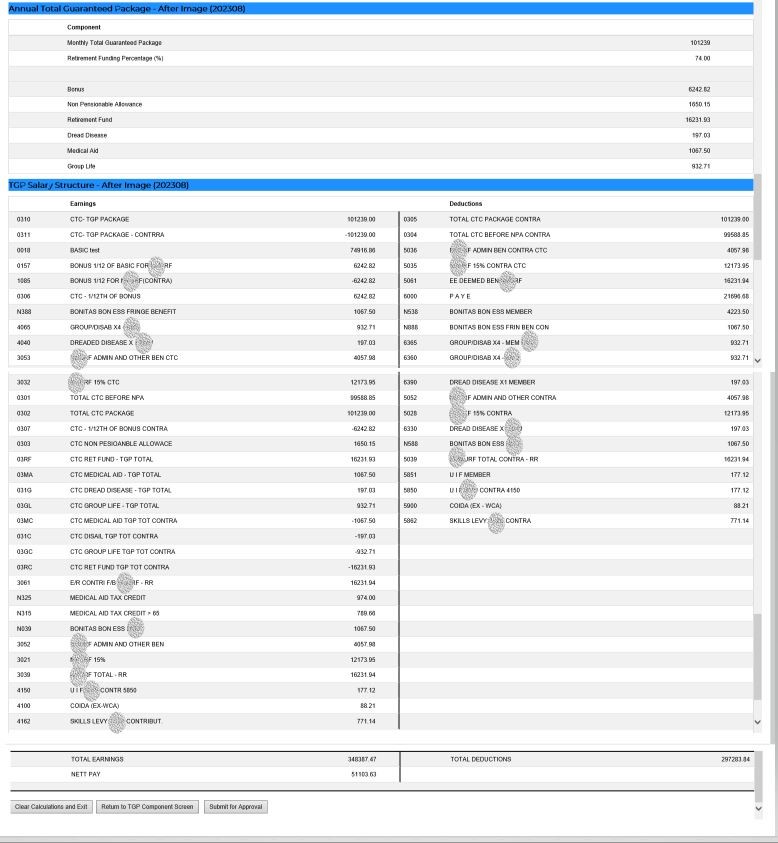

Select a Cheaper Medical Aid Option which will not exceed the TGP Value.

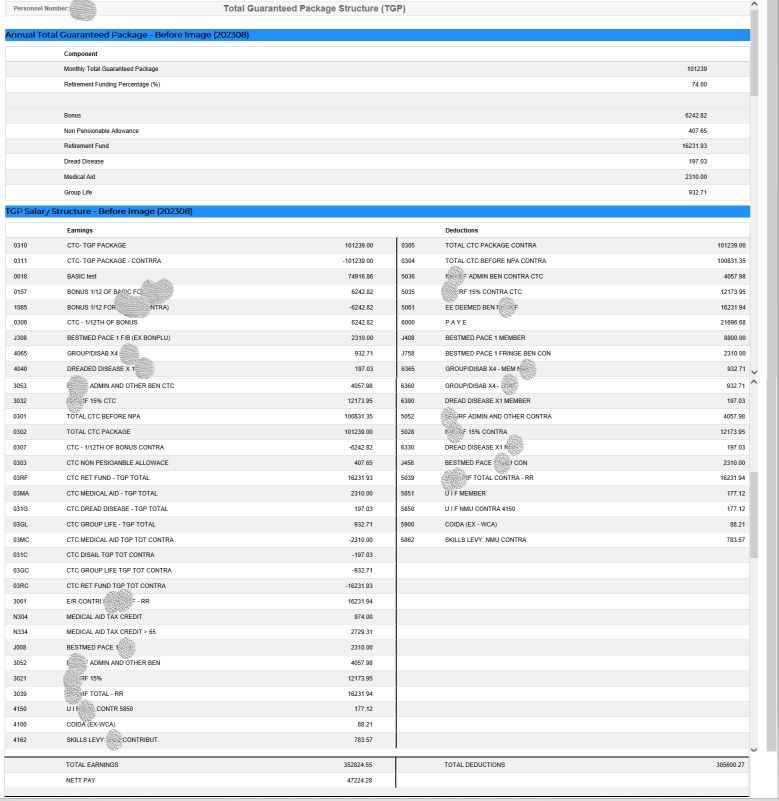

Before Image

After Image

Please note the new Nett pay calculated based on the new cheaper medical aid option.

New Employee TGP Salary

Structure.

- For a new employee to

structure their TGP Salary Package, the employee must:

- Be appointed with a

Service record linked to a TGP Appointment Type as defined in {PACS-1}.

- Have a Notch record in {FPRI-1} where the TGP Indicator = 'Y' and the Pensionable

% is null.

- Functionality

exists, for newly appointed employees to use this functionality and structure

their TGP Packages prior to their official Appointment Date. The employee must be linked to the Personnel Indicator

defined for SOD ‘X7’ as set up in {PTGP-1} Tab 1.

- The rules

defined on {PTGP-1} Tab 7 and 8 for Process Type N -New or All will determine

the requirements per component. This has been detailed above

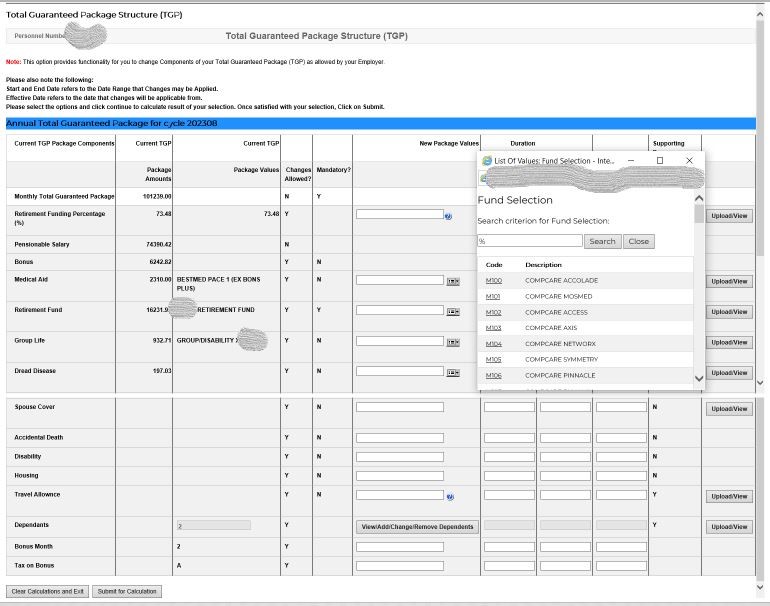

- Once the

user has selected the applicable option per TGP Components they may click on

the 'Submit for Calculation' button to view the results.

- The

system will calculate and display a proforma payslip, for the Appointment

cycle.

- The

selection of TGP Components may not exceed the total TGP value (Notch record in

FPRI-1 where TGP Indicator = 'Y'), this is controlled by the sum of all TGP

Components that must equal the TGP Value, where exceeded the program will stop

the process and display an error message

- The user

may submit the New TGP Salary structure for approval, if they are satisfied with the

proforma calculations and the effect of options chosen or clear the calculation

and exit or return to the TGP Component screen to make changes.

- The

Salary Structure request must be approved and each TGP Component selected that

requires approval as defined on {PTGP-1} Tab 4 is required to be approved separately.

- Changes are written to a

stagging table and {PTGPR-2} must be run to copy these changes into the

back office to make them active and effective. {PTGPR-2} can be setup to run via the

scheduler on an hourly / daily, weekly basis as required.

Example

See Also:

History of Changes

| Date |

System Version |

By Whom |

Job |

Description |

| 30 Jun 2023 |

v04.1.0.0 |

Allie de Nysschen |

T260995 |

New Manual TGP Package Calculator Overview |