|

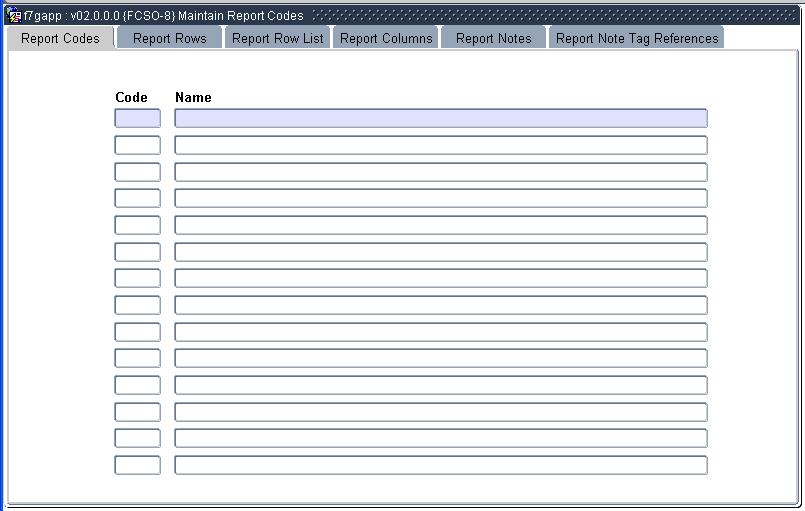

The purpose of the option is to define "GL

Report Writer" reports. The functionality allows the user to develop

customized Financial Reports as required. These reports can include

actual, budget, commitment, expense budget and/or formula figures. To

make use of the "GL Report Writer" the user must define reports.

Before you use this option use the information as described in the "The GL Report Writer" to assist you in creating and maintaining this option.

Define the report code to be used in the GL Report Writer.

| Field | Type & Length |

Description |

|---|---|---|

| Code | A2 | Any value to identify your report. |

| Name | A30 | Supply a suitable name to describe the report.. |

|

The rows for the report code is define in this block.

| Field | Type & Length |

Description |

|---|---|---|

| Report Code | A2 | Default value from block 1. |

| Row Number | N3 | Supply row number. This is the numerical sequence in which the rows will be printed. Use e.g. numbers 1, 5 10, 15, etc. to allow you to add rows if new information is required. Row numbers 1 to 999 may be used. |

| Description | A40 | The description to be printed on the report as required by the user. If the user needs blank lines on the report then do not complete this field and do not link Account List Codes to this row number in block 3 of this option. |

| Note Number | N10 | Enter the note number as defined on the Report Notes block 5. Note number will be printed in the note column and the note description at the end of the GL Report Writer report. |

| Row Value * -1 Actual |

A1 | Valid values are ticked or not ticked. The user can alter the value (negative or positive) by indicating (ticked) that the row value must be multiplied by -1 only for Actual columns. For example, this may apply to income (credit in the general ledger) where you may indicate that the row value must be multiplied by -1 to ensure differentiation between income and expenditure. |

| Row Value * -1 Budget |

A1 | Valid values are ticked or not ticked. The user can alter the value (negative or positive) by indicating (ticked) that the row value must be multiplied by -1 only for Budget columns. For example, this may apply to income (credit in the general ledger) where you may indicate that the row value must be multiplied by -1 to ensure differentiation between income and expenditure. |

| Row Value * -1 Commitments |

A1 | Valid values are ticked or not ticked. The user can alter the value (negative or positive) by indicating (ticked) that the row value must be multiplied by -1 only for Commitment columns. For example, this may apply to income (credit in the general ledger) where you may indicate that the row value must be multiplied by -1 to ensure differentiation between income and expenditure. |

| Row Value * -1 Expense Budget |

A1 | Valid values are ticked or not ticked. The user can alter the value (negative or positive) by indicating (ticked) that the row value must be multiplied by -1 only for Expense Budget columns. For example, this may apply to income (credit in the general ledger) where you may indicate that the row value must be multiplied by -1 to ensure differentiation between income and expenditure. |

| Formula | A4000 | Can do arithmetic calculation of row values less than the formula row. E.g If row 10 is a formula row then the following formula can be calculated (R3-R2)/R3*100. It reads as follow Row 3 minus Row 2, divided the result by Row 3 and multiply by 100

|

|

The purpose of this block is to link account lists to report rows. Each report row in a "GL Report Writer" report consists of a list of accounts. Account list are defined in the option "Maintain Account Lists" {FCSO-5} were accounts are linked to an account list. Using the cost centre (column) and accounts in the account list (row) the report writer calculates the value of each cell in a report.

| Field | Type & Length |

Description |

|---|---|---|

| Report Code | A2 | Default value from block 1. |

| Row Number | N3 | Default value from block 2. |

| Account List Code | A3 | Enter the Account List Code, as define in option {FCSO-5}, to be used to calculated the value of the line number. More than one account list code can be linked to a line number. The Description of the Account list will be displayed. |

|

The purpose of this block is to define the columns of the report. Each report must have at least one column of General Ledger / Expense Budget information representing a Cost Centre or Consolidation Cost Centre. A maximum of 99 columns can be defined.

| Field | Type & Length |

Description |

|---|---|---|

| Report Code | A2 | Default value from block 1. |

| Column Number | N4 | Supply the column number, which is the numerical sequence in which the columns will be printed. Use e.g. numbers 1, 5 10, 15, etc. to allow you to add columns if new information is required. Column numbers 1 to 99 may be used. |

| Column Description | A20x3 | The three description to be printed on the report as required by the user. |

| Financial Field | A1 | Valid values are A, B, C, E or F and represents Actual, Budget, Commitment, Expense Budget or Formula If Actual, Budget, Commitment or Expense Budget then the following field is mandatory

|

| Cost Centre | A6 | The Cost Centre Code or Consolidation Cost Centre Code, as defined in option {FCSO-1}, TAB - Cost Centre Detail that will be used to calculate the value of each cells in the report for the column and account lists. |

| Reporting Year | N1 | Enter the reporting year in format 0, -1, -2 up to -9 or 1 up to 9. In the GL Report Writer report you will be required to enter the Calendar Year and this Year will represent Reporting Year 0, the current year. Other columns will represent the time frame between the Calendar Year and the Reporting Year. E.g. Calendar Year 2003 then reporting year -5 will be 2003 minus 5 = 1998. |

| Start Cycle | N2 | Valid values between 0 and 12 Should the user enter a 0 as a start cycle,the report wil use logical cycles in calculating the column values else actual cycle will be usedin calculating the column values. |

| End Cycle | N2 | Must be equal to or greater the start cycle. Valid values between 1 and 12. |

| Cycle 13 Include/Exclude | A1 | Valid values are I or E |

| Cycle 14 Include/Exclude | A1 | Valid values are I or E |

| Type of Expense Budget | A1 | Valid values are F, R or A and stand for Forecast {MEBO-1}, Requested {MEBO-3} or Approve {MEBO-4} Expense Budget. Forecast budget cannot have variable start and end cycle, it must be set to 0 and 12. |

| Expense Budget List Code | A3 | To reflect expense budget figures in a "GL Report Writer" report, the user must set the financial field on the column to " (E)xpense Budget" and link an "Expense Budget List" to the column. The report will use the budget parameter sets, cost centre and account lists to calculate the column values. The Report Year, will determine the parameter sets in the list used in the report. Expense budget list are defined in option {FCSO-13}. |

| Formula | A4000 | Arithmetic calculation can be included in a "GL Report

Writer"report. These calulation can only be done

for columns preceding the the formula column. E.g If column 10 is a formula column then the following formula can be calculated (C3-C2)/C3*100. It reads as follow Column 3 minus Column 2, divided the result by Column 3 and multiply by 100

|

|

| Field | Type & Length |

Description |

|---|---|---|

| Report Code | A2 | Default value from block 1. |

| Financial Year | N4 | The note's financial year. |

| Note Number | N10 | The note number that must be linked to a row in the Report Rows block, block 2. |

| Style Sheet Code | A8 | The Style Sheet Code as define in option {GMNT-14} where the document classification is "INC". The Style Sheet Description will display. Use may drill down to option {GMNT-14}. |

|

The user is allowed to define there own Tags in the style sheets of the previous block.

These tags will be replaced by the row and column value in the report.

| Field | Type & Length |

Description |

|---|---|---|

| Report Code | A2 | Default value from block 1. |

| Style Sheet Code | A8 | Only Style Sheets link to the report code in the previous block may be used. |

| Row Number | N4 | The row number from the Report Rows, block 2, where the note number is linked. |

| Column Number | N4 | The column number from the Report Columns, block 4. |

| Tag Name | A30 | Tag is defined by the user in the style sheet. Tags must comform the the following rules: First character must be "<"

Last character must be ">" In between can be any alphanumeric character. The only special character allowed is the underscore "_".. |

|

| Processing Rules |

|

|---|---|

| No special processing rules |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 12-Oct-2006 | v01.0.0.0 | Amanda Nell | t133476 | New manual format. |

| 16-NOV-2009 | v01.0.0.1 | Ernie van den Berg | t163143 | Add the new enhancements |

| 18-Jan-2010 | v01.0.0.2 | Ernie van den Berg | t164165 | Add change to formula and row multiply by -1 |

| 27-Sep-2011 | v02.0.0.0 | Christel van Staden | t164302 | Fix version |