|

| FPMC | 1 | Creditor Categories |

| FPMC | 2 | Commodity Codes |

| FPMC | 3 | Creditor Types |

| FPMC | 4 | Payment Terms |

| FPMC | 5 | Note Classification Codes |

| FPMC | 6 | Action Codes |

| FPMC | 7 | Query Payment Methods |

| FPMC | 8 | Change/Cancellation Reasons |

| FPMC | 9 | Maintain Item Units |

| FPMC | 10 | Query Creditor Status Action Codes |

| FPMC | 11 | Group Classifications |

| FPMC | 12 | Maintain Financial Status Codes |

| FPMC | 21 | Kind Codes |

| FPMC | 22 | Document Validation Error Codes |

| FPMC | 23 | Query User Default Codes |

| FPMC | 24 | Query Linked User Defaults |

| User Selection | Prompt Text * an item between square brackets [ ] is the default answer |

Type & Length |

Comments |

|---|---|---|---|

| None |

| Sort Order Per | Per | Comments |

|---|---|---|

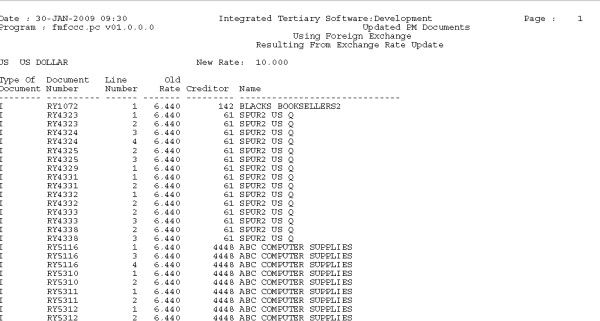

| Currency Code, Document Type , Document Number and Line Number | The report prints documents within each Currency. |

| System Select | |

|---|---|

| The program selects all Requisitions and Order

lines for update of the exchange rate where if the PM system uses a (B)uy, (S)ell or (N)ormal currency the currency on the document is foreign currency the (B)uy, (S)ell or (N)ormal currency has not previously been update with the rate (the field "Order Updated" is (N)o) an outstanding commitment exists for the line on the document the field Exchange Fixed = (N)o on the document line. |

|

| Processing Rules |

|---|

| If the flag Currency Fix is yes, on the Document, it

means that forward

cover provision was made. If the program is executed

This option can take some time, and users may prefer to execute it after hours. In such cases the user can update the exchange rate and exit from the program. The report program can then either be placed in deffered batch, scheduled or be executed after hours by a user. |

| Document Type | Option | Function Description | Main Function | Function

- Optional Printer 1 |

Function

- Optional Printer 2 |

Function - Optional Printer 3 |

Function

- Optional Printer 4 |

SOD |

| R | {FPMO1-1} | ORDER REQ the complete Document | REQ | REQ1 | REQ2 | REQ3 | REQ4 | PJ |

| O% | FPMO2-1} / {FPMO2-6} | ORDER DOCUMENTS | ORD | ORD1 | ORD2 | ORD3 | ORD4 | PA |

| O% | FPMO2-1} / {FPMO2-6} | GRV DOCUMENTS from Order undelivered items | GRVO | GRVO1 | GRVO2 | GRVO3 | GRVO4 | PC |

| G | FPMO2-1} / {FPMO2-6} / {FPMO3-1} | GRV DOCUMENTS from GRV undelivered items | GRVG | GRVG1 | GRVG2 | GRVG3 | GRVG4 | PC |

| G | {FPMO3-1} | GRV DOCUMENTS from GRV delivered items | GRVD | GRVD1 | GRVD2 | GRVD3 | GRVD4 | PB |

| G | {FPMO3-1} | DELIVERY DOCUMENTS | DEV | DEV1 | DEV2 | DEV3 | DEV4 | PD |

| S | {FPMO3-2} | SUPPLIER RETURN DOCUMENTS | SUPR | SUPR1 | SUPR2 | SUPR3 | SUPR4 | PI |

| S% | {FPMO4-1} | STORE ISSUES | ISS | ISS1 | ISS2 | ISS3 | ISS4 | PK |

| T% | {FPMO4-2} | STORE DEPARTMENTAL RETURNS | RET | RET1 | RET2 | RET3 | RET4 | PL |

| PMIS50 | Print at Function printer only |

| PMIS51 | Print at Function Printer and allow Additional printers |

| PMIS52 | Print at Function Printer and allow Additional printers |

| PMIS52 | Print at Function Printer and allow Additional printers |

| PMIS53 | Print at Function Printer and allow Additional printers |

| Etc up to | |

| PMIS70 | Print at Function Printer and allow Additional printers |

| PA | Automatic printing - Order |

| PB | Automatic printing - GRV Delivered |

| PC | Automatic printing - GRV Undelivered |

| PD | Automatic printing - GRV Delivery Note |

| PG | Automatic printing - REQ |

| PI | Automatic printing - Supplier Return |

| PJ | Automatic printing - Store REQ |

| PK | Automatic printing - Store Issue |

| PL | Automatic printing - Store Departmental Return |

| Field | Type & Length |

Description |

|---|---|---|

| Account Type | A4 | A unique Account Type Code as defined by the User. |

| Description | A30 | Description of the Account Type Code. E.g. Name of a business area |

| Alternate Description | A30 | Provide an alternate name for Description above if required. |

| Earning/ Deduction Code | A4 | Not for the use of PM Subsystems. |

| Subsystem | A2 | Always PM |

| Fee/Deposit | A1 | Not for the use of PM Subsystems. |

| Control GLA | A4+A8 | The Cost Centre and Account that will act as the Creditor Control GLA for the business area. Control GLA’s on PM Documents default from this definition and cannot be changed by the user. |

| Non-/Active | A1 | Indicate whether the account type is (A)ctive or (N)on-active. |

| CB Code | A5 | This Cash Book will be used for the payments of the

Account Type. Also, users cannot pay a Creditor Document out of any

other Cash Book than the Cash Book linked to the Documents Account Type. |

| AR Category | A1 | Not for the use of PM Subsystems. |

| Include for Debt Collection | A1 | Not for the use of PM Subsystems |

| Show Account Type | A1 | Not for the use of PM Subsystems |

| Code | Description |

| 01 | REQUEST FOR QUOTATION |

| 02 | GOODS RECEIVED VOUCHERS |

| 18 | CREDITOR NUMBER |

| 19 | STORE ITEM NUMBER |

| 20 | GENERAL ITEM NUMBER |

| 22 | SUPPLIER RETURN |

| K0 | STORE ISSUE/EQUIVALENT |

| K1 | STORE RETURN/EQUIVALENT |

| K2 | REQUISITION NUMBER |

| K3 | ORDER NUMBER |

| SD | SETTEMENT DISCOUNT |

| Block 1 | |

| Subsystem | Max.# of Approvals |

| AR | 4 |

| PM | 3 |

| CT | 2 |

| Block 2 | |||

| Subsystem | # of App | Start | End Amount |

| AR | 4 | 0.00 | 9999999999999.99 |

| PM | 0 | 0.00 | 1000.00 |

| PM | 1 | 1000.01 | 10000.00 |

| PM | 3 | 10000.01 | 9999999999999.99 |

| CT | 1 | 0.00 | 1000000.00 |

| CT | 2 | 1000000.01 | 9999999999999.99 |

| Code | Description | Subsystem | System

Operational Definition {FCSM-1} |

Restriction/ Access/ Exclusive |

Use Sequence | Rule | Additional Information |

| FP | PM Allow Processing of All Documents | PM | Access | No |

Rule AD | A user can perform Document processing and quey functions for all Types of Documents on the PM Subsystem. | |

| FPCC | PMIS Allowed Cancelled Creditor Documents | PM | Access | No | Rule AD | A user can cancel all creditor input documents. | |

| FPCP | PMIS International Draft | PM | Access | No | Rule AD | A user can update the print indicator of International Drafts | |

| FPCR | PMIS Retain Access | PM | Access | No | Rule AD | A user is allowed to update creditor retain data | |

| FPCY | PMIS Payment Terms Access | PM | Access | No | Rule AD | A user can update creditor payment term data | |

| FPFD | Processing of Future Documents | PM | Access | No | Rule AD | A user can perform document processing and query functions for all Type of Documents where the year and/or cycle is in the future. | |

| FPO | Processing of Order Documents | PM | Access | No | Rule AD | A user can perform document processing and query functions for Type of Documents O, OC and/or OP. | |

| FPR | Processing of Req Documents | PM | Access | No | Rule AD | A user can perform document processing and query functions for Type of Document R. | |

| FPS | PMIS Stock Documents | PM | Access | No | Rule AD | A user can perform document processing and query functions for all Type of Documents {FPMO-23}. | |

| FPSA | PMIS Stock Issue Documents | PM | Access | No | Rule AD | A user can perform document processing and query functions for Type of Docuemnts SA, SB and/or TA. | |

| FPSC | PMIS Stock Transfer Documents | PM | Access | No | Rule AD | A user perform document processing and query functions for Type of Documents SC and/or TC. | |

| FPSD | PMIS Stock Debit Sales Documents | PM | Access | No | Rule AD | A user perform document processing and query functions for Type of Documents SD, SE, TD and/or TE. | |

| FPSF | PMIS Stock Study Guide Documents | PM | Access | No | Rule AD | A user perform document processing and query functions for Type of Documents SF, SG, TF and/or TG. | |

| FPSH | PMIS Stock Cash Sales Documents | PM | Access | No | Rule AD | A user perform document processing and query functions for Type of Documents SH and/or TH. | |

| FPSK | PMIS Stock Adjustment Documents | PM | Access | No | Rule AD | A user perform document processing and query functions for Type of Documents SK and/or TK. | |

| FPSL | PMIS Stock Adjustment GRV Documents | PM | Access | No | Rule AD | A user perform document processing and query functions for Type of Documents SL and/or TL. | |

| FPSP | PMIS Stock Cash Purchase Documents | PM | Access | No | Rule AD | A user perform document processing and query functions for Type of Documents SP and/or TP. | |

| FVEN | Access Denied for Invoicing in Central Booking Venue | CR | Restriction | No | May process invoices to the Accounts Receivable Subsystem | ||

| FVTC | Access Limited to Vehicle Tracking in Central Booking | PM | Restriction | No | User prohibited to process bookings for vehicles in {FVTO-1} |

| Field | Type & Length |

Description |

|---|---|---|

| User Type | A1 | Supply the user type. The valid values are (P)ersonnel, (S)tudent, (O)ther. |

| Number | N9 | Supply the number of the user as defined on menu option {USERS-5}. A <LIST> function containing user number and name is available on this field. On providing the user number, the name will default to the name field. |

| User Code | A8 | Supply the UNIX user code as defined on menu option {USERS-5}. |

| A45 | Displays the user's name. | |

| Store | A2 | Supply the store code to which the user may have access. When a user is defined on menu option {USERS-5}, store code ZZ is automatically linked to the user. Store code ZZ grants the user access to ALL stores. This means that should the user have access to the store menu options, the user may access and process transactions for any of the stores defined. Thus, care must be taken when granting access to store menu options. This restriction applies primarily to the users who have access to the Stores System, which is within the Procurement Management System. Where a store user's ambit of responsibility is restricted to a specific store, the user may be restricted to the specific store by supplying the relevant store code. However, where a store user's ambit of responsibility covers all stores, the user must be linked to store code ZZ. Thus, users can be restricted to a specific store or has access to all stores. A <LIST> function containing store code and name is available. Stores are defined on menu option {FPMM-22}. |

| Access Level in PRS | N1 | Not for the use of PM Subsystems. |

| Override Insufficient Funds Rule | A1 | May this user override insufficient funds when such a condition exists? The valid values are (Y)es or (N)o. The completion of this field is dependent on rule BB, defined on menu option {FCSM-1b2}. If rule BB is set to (Y)es, all users in this option will be set to (Y)es and cannot be updated to (N)o. This implies that, as an institution, should any user encounter an insufficient funds situation, the user may override it to allow the transaction to be processed. If (N)o, all users on this option will be set to (N)o, but individual users who are granted privileges to override insufficient funds may be set to (Y)es in this option. This implies that, as an institution, the override of insufficient funds is not allowed except for those users who are authorised to. |

| Approval Privilege | A1 | Valid values are (Y)es or (N)o. The field is secondary to the Alpha Field value of the System Operational Definition Rule Code EA to ES. Only rule codes that are Electronic can be Approved. If Yes the user can approve transactions / documents depending on access and restrictions. Otherwise the user has no Electronic Approval Privileges. |

| Buyer Privilege | A1 | Valid values are (Y)es or (N)o. If Yes the user can maintain PM Buyer document fields depending on access and restrictions. Otherwise the user has no Electronic Buyer Privileges. |

| Group Sequence | Range. |

| Requests / Orders | 1 to 10 |

| GRV/Supplier Returns | 11 to 15 |

| Not in use | 16 to 20 |

| Invoices /Credit notes | 21 to 60 |

| Stores | 61 to 90 |

| Not in use | 91 to 99 |

| Document Type | Description | Debit / Credit | Display Sequence |

| I | Web Requisition | C | 1 |

| E | External Request for Quotation | C | 2 |

| R | Request | C | 3 |

| O | Order | C | 4 |

| OC | Order COD | C | 5 |

| OP | Order Pre Paid | C | 6 |

| OS | Standing Order | C | 10 |

| G | Goods Received Voucher | D | 11 |

| S | Supplier Return | C | 12 |

| IN | Invoice | C | 21 |

| CN | Credit Note | D | 22 |

| IJ | Journal Credit | C | 23 |

| CJ | Journal Debit | D | 24 |

| IR | Repeating Inv | C | 25 |

| CR | Repeating Credit Note | D | 26 |

| IC | Cancel Invoice | C | 27 |

| CM | Cancel Credit Note | D | 28 |

| II | Inter Creditor CR Correction | C | 29 |

| CD | Inter Creditor DR correction | D | 30 |

| AP | Cancel Payment (Not Normal) | D | 31 |

| PP | Payment (Not Normal) | D | 32 |

| AA | Cancel ACB | C | 33 |

| AQ | Cancel Cheque | C | 36 |

| BC | Credit Balance | C | 37 |

| BD | Debit Balance | D | 38 |

| CC | Cash Book Debit Journal | D | 39 |

| CS | Settlement Discount | D | 40 |

| IB | Cash Book Credit Journal | C | 41 |

| PA | ACB Payment | D | 42 |

| PB | Bank Draft | D | 43 |

| PI | International draft | D | 44 |

| RR | Receipt | C | 45 |

| PQ | Cheque | D | 46 |

| RA | ACB Receipt | C | 47 |

| RC | Cancel Receipt | C | 48 |

| PD | PM Profit on For Curr Creditor | D | 49 |

| LC | PM Loss on For Curr Creditors | C | 50 |

| FD | Accumulation DR | D | 59 |

| FC | Accumulation CR | C | 60 |

| SA | Normal Issue | C | 61 |

| SB | Decentralised Issue | C | 62 |

| SC | Inter Item Transfer Credit | C | 63 |

| TC | Inter Item Transfer Debit | D | 64 |

| SD | Debit Sales AR | C | 64 |

| SE | Debit Sales SD | C | 65 |

| SF | Study Guide Issue | C | 66 |

| SG | Study Guide (Discontinued) | C | 67 |

| SP | Return Cash Purchase | C | 69 |

| TP | Cash Purchase | D | 70 |

| SK | Adjustment Credit | C | 70 |

| TA | Departmental Return | D | 71 |

| SL | Adjustment Grv Credit | C | 71 |

| TD | Return Debit Sales AR | D | 72 |

| TE | Return Debit Sales SD | D | 73 |

| TF | Return Study Guide | D | 74 |

| TG | Return S.G (Discontinued) | D | 75 |

| TH | Return Cash Sales | D | 76 |

| TK | Adjustment Debit | D | 78 |

| SH | Cash Sales | C | 78 |

| TL | Adjustment Grv Debit | D | 80 |

| WD | Withholding Tax | D | 83 |

| EX | Non ITS Source Document | C | 99 |

| Event Code | Description | Transaction

GLA's and Transaction Type Definition |

|||||||||||||

| BN | PM - Orders Normal |

|

|||||||||||||

| BR | PM - Orders Repeating |

|

|||||||||||||

| BY | PM - Orders Next Year |

|

|||||||||||||

| BQ | PM - Store Request |

|

|||||||||||||

| BO | PM - Store Order |

|

|||||||||||||

| BP | PM - Pay Roll Orders | Not yet functional | |||||||||||||

| BJ | PM - Job Costing Order |

|

|||||||||||||

| BC | PM - Print Costing Order |

|

|||||||||||||

| BV | PM - Vehicle Tracking Order |

|

|||||||||||||

| BM | PM - Media Booking Order |

|

|||||||||||||

| BB | PM - Venue Booking Order |

|

|||||||||||||

| BT | PM - Counter System Request |

|

|||||||||||||

| BF | PM - Store Request SG Free |

|

|||||||||||||

| BG | PM - Store Request SG Not Free |

|

| Event Code | Description | Transaction GLA's and Transaction Type Definition | ||||||||||||||||||

| SG | PM - Goods Received Voucher |

|

||||||||||||||||||

| SS | PM - Supplier Return |

|

| Event Code | Description | Transaction GLA's and Transaction Type Definition | ||||||||||||||||

| AI | PM - Invoice Transaction |

|

||||||||||||||||

| AN | PM - Credit Note Transaction |

|

||||||||||||||||

| AH | PM - Cancel Invoice Transaction |

|

||||||||||||||||

| AM | PM - Cancel Credit Note Transaction |

|

||||||||||||||||

| AC | PM - Credit Creditor Correction |

|

||||||||||||||||

| AD | PM - Debit Creditor Correction |

|

||||||||||||||||

| AJ | PM - Invoice Transaction To SD |

|

||||||||||||||||

| AK | PM - Invoice Transaction To AR |

|

||||||||||||||||

| AA | PM - Credit Note Transaction To SD |

|

||||||||||||||||

| AB | PM - Credit Note Transaction To AR |

|

||||||||||||||||

| AV | PM - Payment (Not Generated Normally) |

|

||||||||||||||||

| AW | PM - Cancel Payment (Not GEN. Normally) |

|

||||||||||||||||

| A4 | PM - Journal Debit Transaction |

|

||||||||||||||||

| A1 | PM - Repeating Invoice Transaction |

|

||||||||||||||||

| A2 | PM - Repeating Credit Note Transaction |

|

||||||||||||||||

| A3 | PM - Journal Credit Transaction |

|

||||||||||||||||

| FI | PM - ACB Payment Generation |

|

||||||||||||||||

| FH | PM - Cheque Payment Generation |

|

||||||||||||||||

| FL | PM - International Draft Payments |

|

||||||||||||||||

| FM | PM - Journal Payment Generation |

|

||||||||||||||||

| FK | PM - National Draft Payments |

|

||||||||||||||||

| FE | PM - Settlement Discount |

|

||||||||||||||||

| F4 | PM - Profit on Foreign Currency Creditor |

|

||||||||||||||||

| F5 | PM - Loss on Foreign Currency Creditors |

|

||||||||||||||||

| PP | PM - Pend - Accumulation Of Transactions |

|

||||||||||||||||

| PC | PM - Accumulation Of Transactions CR |

|

||||||||||||||||

| YC | PM - Yend - Balance Brought Forward |

|

||||||||||||||||

| YB | PM - Yend - Balance Brought Forward DT |

|

| Event Code | Description | Transaction GLA's and Transaction Type Definition | |||||||

| WK | AR Invoice from PM |

|

|||||||

| WB | AR Credit Note from PM |

|

| Event Code | Description | Transaction GLA's and Transaction Type Definition | |||||||

| WA | SD - Credit Note from PM |

|

|||||||

| WJ | SD - Invoice from PM |

|

|||||||

| WX | SD - Raise Free Stock Items |

|

|||||||

| WY | SD - Cancel Free Stock Items Raised |

|

| Event Code | Description | Transaction GLA's and Transaction Type Definition | ||||||||||||||||

| SE | PM - Issue |

|

||||||||||||||||

| SD | PM - Returns For Departments |

|

||||||||||||||||

| SV | PM - Additional Cost Decrease |

|

||||||||||||||||

| SI | PM - Additional Cost Increase |

|

||||||||||||||||

| SA | PM - Adjust Values Decrease |

|

||||||||||||||||

| SQ | PM - Adjuste Values Increase |

|

||||||||||||||||

| SP | PM - Cash Purchase |

|

||||||||||||||||

| SU | PM - Cash Purchase Returns |

|

||||||||||||||||

| SN | PM - Cash Returns |

|

||||||||||||||||

| SK | PM - Cash Sales |

|

||||||||||||||||

| SC | PM - SD Credit Sales |

|

||||||||||||||||

| SB | PM - AR Credit Sales |

|

||||||||||||||||

| SF | PM - Returns SD Credit Sales |

|

||||||||||||||||

| SH | PM - Returns AR Credit Sales |

|

||||||||||||||||

| ST | PM - Inter Store Transfer Debit |

|

||||||||||||||||

| SM | PM - Inter Store Transfer Credit |

|

| Event Code | Description | Transaction GLA's and Transaction Type Definition | |||||||||||||||

| GI | GL - Stock Input VAT |

|

|||||||||||||||

| GJ | GL - Stock Output VAT |

|

| Field | Type & Length |

Description |

|---|---|---|

| Type | N4 | Any value in the range 0001 to 9999 is allowed. |

| Name | A30 | Name of the Transaction Type |

| Active Indicator | A1 | Active |

| Subsystem | A2 | PM |

| Default Value | N17.2 | Value is Null |

| Cash Book Code | A5 | Value is Null |

| Financial Field | A1 | Value is C for commitments or J |

| Income / Expense | A1 | Value is Null |

| Update Type | A1 | Value is A |

| Event Number | A2 | PM Events from option {FCSO-22} |

| Repeat Indicator | Y/N | Value is N |

| Credit / Debit | A1 | Same sign as the Document Type that

will use the Event |

| Person Type | A1 | Value is Null |

| Linked Transaction | N4 | Refer the section on PM events for a specific event |

| Card System | Y/N | Value is Null |

| VAT 201 Report Box | A2 | Value is Null or any valid VAT box. The VAT 201 report consists of pre-numbered boxes. If a transaction should be reported on the VAT 201 form, the user will specify here in which box it should be accumulated. It could range from 1 to 23. Please Note: ANY transaction without a number in this field will not be reported on the VAT 201 return. |

| Transaction Note | A29 | Value is Null, but if the Event created is SD

a transaction note must be entered. |

| Alternate note | A29 | Value is Null, but if the Event created is SD a transaction note must be entered. |

| VAT D/C indicator | A1 | Value is Null |

| Field | Type & Length |

Description |

|---|---|---|

| Post to General Ledger | A1 | Value is Yes |

| GL Note | A30 | Value is Null.. |

| Debit GLA | A4 | Refer the section on PM events for a specific event |

| Update CC | A1 | Value is Y |

| Update Account | A1 | Value is Y |

| Credit GLA | A8 | Refer the section on PM events for a specific event |

| Update CC | A1 | Value is Y |

| Update Account | A1 | Value is Y |

| How to post? | A1 | Can be D or S. |

| Financial Year | YYYY | Must be 0 (Zero) |

| Financial Cycle | MM | Must be 0 (Zero) |

| Update Account Type | A1 | Can be null or a valid PM Account Type as defined on option {FCSC-21}. |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 11-Jun-2008 | v01.0.0.0 | Magda van der Westhuizen |

t149068 | New manual format. |

| 29-Jan-2009 | v01.0.0.1 | Marchand Hildebrand | t152121 | Proof Read System Owner |

| 18-DEC-2012 |

V02.0.0.0 |

Marchand Hildebrand | t183060 |

Add new user restrictions |