|

This option allows for the maintenance of Invioce without Orders. Invoices received for items acquired through an official order should processed through {FPMO5-1}, this option is for invoices for which no order exists for example invoice recieved in respect of a contract.

| Event | Description | Type of Document |

| AI | PM - Invoice Transaction | IN |

| Field | Type & Length |

Description |

|---|---|---|

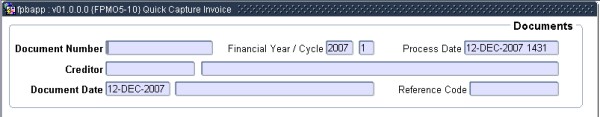

| Document Number | A15 | The document number as received from the supplier.Document number is unique per supplier and the user will not be allowed to enter a number that already exists.If the invoice was previously created as being received, under the option {FPMO-3}, the system will delete/remove the received information from {FPMO-3} as soon as this document is committed. |

| Financial Year/Cycle | YYYY/MM | Displays the year and cycle of the document. The year and cycle defaults from the current PM subsystem year and cycle and is not updateable. |

| Process Date | DD-MM-YYYY HHMM | The default of this field is the current system date and is not updateable. |

| Creditor | N9 | The creditor must be defined on option {FPMM-2}, TAB - Crediotor Detail. The List Of Values will display Creditor Codes, Name, Currency Code, Lead Time and Payment Term Code. The creditor name and currency selected will be displayed. |

| Document Date | DD-MM-YYYY | The default of this field is the current system date. The user is allowed to change the date as long as the date is in the range of 01-JAN-1980 up to the default date. |

| Reference Code | A15 | A reference relating to the document. |

| Document Total | N15.2 | The total invoice in local currency.. |

|

| Field | Type & Length |

Description |

|---|---|---|

| Description | A4000 | The item description as it appears on the invoice received. |

| Unit | A8 | The unit as it appears on the invoice received. |

| Unit Price | N15.4 | The unit price as it appears on the invoice

received. Pop up Menu

|

| Quantity | N10.3 | The quantity as it appears on the invoice received. Quantity can contain up to 3 decimals. |

| VAT Inclusive / Exclusive | A1 | Is VAT included/excluded in the unit price of this

item? (I)ncluded or (E)xcluded. The unit price entered will

remain unchanged if this value is changed. The system will default the value of system operational definition code AZ subsystem PM "ORDER/REQ DEF INC./EXC. IND" in to this field and the user is allowed to change the value. |

| VAT Rate | N8.3 | The VAT rate applicable to the ite. The system will default the value of system operational definition code AY subsystem PM "ORDER/REQ/STORE DEF VAT CODE" in to this field and the user is allowed to change the value. |

| Cost Centre/ Account |

A4 A8 |

The GLA that will fund for the expense, the cost centre and account name will be displayed. |

| Account Type | A12 | Creditor Account Type as defined in option

{FCSC-21}

for the subsystem PM to be used on the item. The creditors control

accounts to be used on the line is derived from the account type. and

the description will display. The List

of Values on the feilds list the account type and description

of available account types. |

| GL Note | A30 | An optional note to accompany the GL-transaction. The system will default the reference number plus the order number and creditor name into this field, depending on values available. The user can update. |

| VAT Apportionment % | N1.2 | Value range of this field is 0 to 1.000. The system will default the VAT apportionment precenatge linked to the VAT Rate Code {FCSC-1} linked to the cost centre {FCSO-1} of the expense GLA. It is the users responsibility to ensure that the VAT apportionment percentage is correct before committing the document. A VAT input transaction will be generated if the VAT rate and VAT apportionment percentage are both greater than 0.00. |

| Cost | N15.2 |

The total VAT inclusive cost value

before trade discount for the item in the creditors currency. |

| Line Total | N15.2 | The total for the item in local currency. |

|

| Processing Rules |

|

|---|---|

| No special processing rules |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 12-Dec-2007 | v01.0.0.0 | Amanda Nell | t144148 | New manual format. |

| 17-Mar-2008 | v01.0.0.1 | Kobus Kleinhans | t152121 | Proof Read System owner. |

| 17-Mar-2010 | v01.0.0.2 | Marchand Hildebrand | i166218 | Add unit price drill down and VAT App |

| 01-Jun-2012 | v02.0.0.0 | Jabu Mokonene | t183024 | Add new column showing the line total . |

| 04-Nov-2013 | v02.0.0.1 | Jacob Simelane | t195290 | Changed field length to 15 |