|

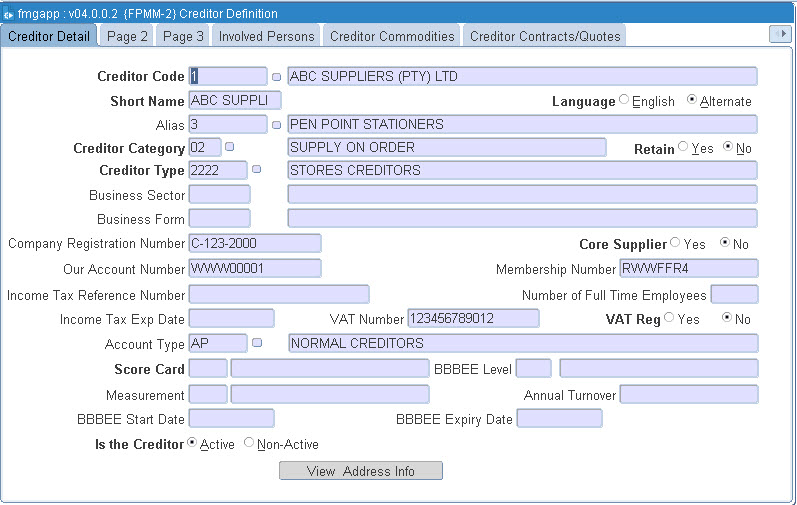

This option is used to define and maintain creditor biographical information.

The definition of a creditor allows for the classification at four levels, i.e. commodities supplied, categories, types and alias for external and internal purposes.

| Field | Type & Length |

Description |

|---|---|---|

| Creditor Code | N9 | A unique code to identify the creditor. Content Pop up Menu will take the user into Creditor Status {FPMM-5} Depending on the Creditor Status the user will not be allowed to use a creditor, or will be warned or no action taken. The warning will further allow the user to view any documentation relating to the status stored in a DSR and linked to the status. Auto generation of creditor numbers were changed to fill existing gaps before creating next maximum sequence number |

| Short Name | A10 | Short name for a quick reference. |

| Language | A1 |

Enter preferred language (English/Alternate). |

| Alias | N9 | Alias code used with this creditor. {FPMM-1}. |

| Creditor Category | A2 |

The creditor category linked to the creditor. {FPMC-1}. |

| Retain | A1 |

Setting the field to Yes will retain invoice from payment should it be required for the creditor. |

| Creditor Type | A4 |

The creditor type linked to the creditor. {FPMC-3}. |

| Business Sector |

A4 |

Business Sector is the section of economy related to the organization activities i.e. Exporter, Sales, and Manufacturer etc. |

| Business Form |

A4 |

Business Form is the entity that was formed and administered as per commercial law in order to engage in business activities. |

| Company Registration Number |

A15 |

The

code / number allocated to the organization to the organizations by the

organization responsible for keeping records of shareholders or

ownership relating to the business form where applicable. |

| Core Supplier |

A1 |

Creditor group |

| Our Account Number |

A10 |

Account Number with the Creditor. |

| Membership Number |

A12 |

Our membership number to be Displayed on correspondence. |

| Income Tax Reference Number |

A20 |

Income Tax reference Number. |

| Number of Full Time Employees |

N5 |

Number of full time employees working for the creditor. |

| Income Tax Exp Date |

D11 |

Date on which the Tax expires. |

| VAT Number |

A12 |

Creditor VAT number. |

| VAT Reg |

A10 |

Our Account Number with the Creditor. |

| Is the Creditor | A1 |

Indicates if a creditor is (Active/Non active).Should a creditor be none active the creditor may be used to process transactions. |

| Account Type |

A4 |

The default account type linked to the creditor. When processing a transaction the system will find the Creditor Account Type to default from the Cost Centre on the transactions expense GLA, else from the Transaction Type definition, else from the Creditor Definition or it must be entered by the user. The user can change any default values. Account type {FCSC-21}. |

| Score Card |

A4 |

In terms of Act 53 (2003) Codes of Good Practice for Black Economic Empowerment all enterprises in South Africa are divided into one of three categories in terms of the act each of these categories have differing sets of measurement criteria referred to as a scorecard. |

| BBBEEE Level |

A4 |

is a status / indicator of an organizations performance in

term of BBBEE applying the scorecard applicable to the specific organizations . |

| Measurement |

A4 |

The

measurement principles in terms of the preferential procurement code

applicable to the supplier i.e. Value Adding Supplier, Enterprise

Development Supplier etc. |

| BBBEE Start Date |

D11 |

The Date on which the Creditor Category started. |

| BBBEE Expiry Date |

D11 |

The Date on which the Creditor's Category expires. |

| Annual Turnover |

N17.2 |

Latest Available Turnover for the creditor. |

| View Address Info | Button | See Addresses. |

|

| Field | Type & Length |

Description |

|---|---|---|

| Statement Date | N2 | Normal date of statement. |

| Lead Time | N3 | Normal lead time (order to deliver time lapse in Days). |

| Trade Discount % | N3.2 | Trade Discount Percentage. |

| Payment Terms | A3 | The default Payment Term Code linked to the creditor. {FPMC-4}. |

| Credit Limit | N17.2 | Maximum Credit Limit. |

| Maximum Payment | N17.2 | Maximum Payment. |

| Deduct Debtor Balance | A1 | Enter (Yes or No). |

| Debtor Code | N9 | Debtor code (FARO-3}. |

| Payment Currency | A3 | The currency of this creditor in which transactions are processed. {FCSO-21}. |

| Payment Method | A1 | The default payment method of the creditor. |

|

| Field | Type & Length |

Description | |

|---|---|---|---|

| Bank Code | N2 | If the payment method used is A-ACB or B-National Drafts or E- International Drafts the bank account detail of the creditors account into which payments must be made is required. The bank code of the creditors bank.Bank codes are defined in the option Maintain Bank Detail. {FCSC-4} | Bank

details are stored as part of the biographical data of a creditor. Bank

details can be maintained directly from this screen by any user who has

access to the option. The user is not allowed to maintain banking details in this screen if the system operational definition Code DE and subsystem CT is set to Yes. The banking detail authorization screen {FCTM-9} should be used. If authorization of bank details is required the bank detail will not be used by the ITS system until authorized. If authorization is required, bank details are stored with a hold status. The status can only be changed to authorize by a user who has authorization privileges {FCSM-5}. Bank account number is validated and the user will be warned if the bank account number already exists for another creditor on entering or changing the account number. |

| Branch IT | N6 | The branch code of the creditors bank. Branch codes are defined in the option Maintain Bank Detail. {FCSC-4}. | |

| Bank Account Number Suffix |

N4 |

Enter Bank Account Number Suffix. |

|

| Account Number | N13 | The account number of the creditors bank.Bank. | |

| Bank Account Type | A1 | The type of bank account, C-Current, S-Savings or T-Transmission. | |

| Name on Cheque | A45 | Name to be printed on the cheque. | |

| Cost Centre | A6 | Cost centre to be credited if payment method is journal advice. | |

| Account |

A8 |

Account to be credited if payment method is journal advice | |

| IBAN-Bank Account Number |

A52 |

Enter the IBAN number. Note: If the payment method is not ‘E-International Draft’, The IBAN Bank Account Number is not required and the user is able to save the record without entering it. If the payment method is ‘E-International Draft’, The IBAN Bank Account Number is required and the system must not allow the user to save the record. |

|

|

| Field | Type & Length |

Description |

|---|---|---|

| Creditor | N9 | Creditor code. |

| I.D Number |

A13 | Enter the Identification Number of the creditor. |

| Init |

A6 |

Initials of the creditor. |

| Surname |

A30 |

Surname of the creditor. |

| Designation |

A60 |

Description of the Person Involved. |

| Title |

A60 |

The

title must be entered, preferably in the person's preferred language for

correspondence to be produced correctly. Titles may be maintained in Title Types {GCS-9}. |

| End Date |

D11 |

The date on which the Involved Person duties expires. |

| Address |

Button | See Addresses. |

| Passport |

A15 |

Passport

Number for a person who comes from other country. |

| Citizenship |

N4 |

A unique code.The Nationality of this person as defined in the Citizenship Codes {GCS2-6} may be recorded in this field. |

| Gender |

A1 |

Male/Female. |

| Race |

N2 |

Individual population within a species. |

| HDI Status |

A1 |

Historical Disadvantage Indicator. |

| % of Enterprise Owned |

N3 |

Percentage of Enterprise Owned. |

|

| Field | Type & Length |

Description |

|---|---|---|

| Creditor | N9 | Creditor code. |

| Commodity Code | A4 | Commodity codes linked to the creditor. |

|

| Field | Type & Length |

Description |

|---|---|---|

| Creditor | N9 | Creditor code. |

| File Number | A5 | The paper file number for this contract/quotation. |

| Quote/Contract Number | A12 | The ID code/name by which this contract/quote is known. |

| Quote Date | (DD-MON-YYYY) | The quotation / contract date. |

| Expiry Date | (DD-MON-YYYY) | The date on which this quote / contract expires. |

| Their Contact | A30 | The name of the person who is our Institutions contact person. |

| Our Contact | A30 | The name of the contact person at the contractor/quoting party. |

| Contract Amount | N17.2 | Enter contract amount. |

|

Block 5: Creditor Financial

Summary

Enter

Creditor Number and <RETURN> to see Summary

| Field | Type & Length |

Description |

|---|---|---|

| Creditor Code | N9 | Enter the number and <RETURN> |

Example:

|

Block 6: Creditor Requirements

|

Field |

Type |

Description |

|

Creditor

|

N9 |

Creditor

Code. |

|

Document

Code |

A8 |

Enter

Document Code. |

|

Description |

A30 |

Description

of the Document Code. |

|

Expiry

Date |

D11 |

Date on

which the Document Expires. |

|

Reference |

A30 |

Reference

Code of the Document. |

|

User |

A8 |

Name of

the User updating record. |

|

Date |

D11 |

Date

user updated the record. |

|

Seen |

A1 |

Document

Seen indicator. |

Example:

|

| Processing Rules |

|

|---|---|

| No special processing rules |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 16-Apr-2007 | v01.0.0.0 | Charlene van der Schyff | t134630 | New manual format. |

| 20-May-2008 | v01.0.0.1 | Charlene van der Schyff | t150589 | Update creditor status. by creditor |

| 08-Dec-2008 | v01.0.0.2 | Marchand Hildebrand | t152121 | Manual Corrections |

| 19-Jan-2011 | v01.0.0.3 | Hermien Hartman | t170695 | Added Withholding Tax Parameters to block 1 pg. 3, and updated image. |

| 03-Apr-1012 | v03.0.0.0 | Raymond Schoonraad | t172442 | Remove Creditor Note |

| 11-Feb-2013 |

v03.0.0.1 | Marchand Hildebrand | t185339 |

Add warning to creditor definition to warn if bank account already exists |

| 20-Jun-2014 |

v03.0.0.2 |

Alucia Sabela |

t199665 |

Update manual. |

| 13-Apr-2015 | v03.0.0.3 | Charlene van der Schyff | t206469 | Updated manual with Bank Account Number Suffix |

| 17-Jul-2018 |

v04.1.0.0 |

Ndivhanga Mushando |

t229959 |

Manual Corrections |

| 17-Feb-2020 |

V04.1.0.1 |

Raylene Lapin |

t236830 |

Update Creditor Code with auto generation of creditor numbers and added field for IBAN (International Bank Account Number) Updated Image on page 3 |