| System Select |

|

| 1 |

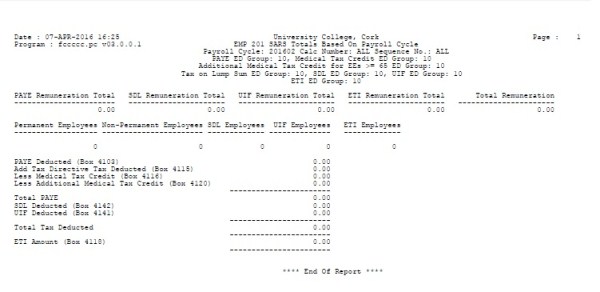

If the totals are

determined by the Payroll Cycle, salary transactions for the

selected cycle, calculation number and - sequence are used

|

| 2 |

If the totals are determined by Posting Dates, salary transactions posted to the General Ledger {FGLP-5}

between the Start - and End Posting Date and Time as well as "Late

Rollback" transactions (Refer to "Rollback Single Calculation {FPRN-23}) posted between the Start - and End Posting Date and Time are used.. |

| 3 |

The PAYE Remuneration Total is a total of transactions where the Salary Level is below 50 |

| 4 |

The SDL Remuneration Total is a total of transactions

where "Skills Levy" is set to (Y)es for the Earning / Deduction

Type {FPRG-6} |

| 5 |

The UIF Remuneration Total is a total of transactions

where "Include for UIF" is set to (Y)es for the Earning /

Deduction Type {FPRG-6}.

In this case, for each transaction, the maximum of the transaction

value and the "High Limit Amount" of the Earning / Deduction as set-up

in the Global Earning / Deduction Detail {FPRG-7} or the Individual Earnings / Deductions {FPRI-2} is used. |

| 6 |

The PAYE Deducted is a total of transactions where the

Earning / Deduction is part of the Earning / Deduction Group

for PAYE Deductions |

| 7 |

The SDL Deducted is a total of transactions where the

Earning / Deduction is part of the Earning / Deduction Group

for SDL Deductions |

| 8 |

The UIF Deducted is a total of transactions where the

Earning / Deduction is part of the Earning / Deduction Group for

UIF Deductions |

| 9 |

Permanent Employees is the number of Employees with Service Records {PBOP-2} where

- the Nature of Person is (A) Person with ID- or Passport Number, (B)

Person without ID- or Passport Number or (C) Director of a Private

Company / Member of a CC and

- the Appointment Type {FPRG-10} is indicated as (P)ermanent.

- with at least one salary transaction in the period indicated in the user selection parameters.

Note that for personnel members with more than one Service Record for

the payroll cycle, the last Service Record for the relevant payroll

cycle is used. |

| 10 |

The rule for Non-permanent Employees is the same as for Permanent Employees, except that the Appointment Type {FPRG-10} is indicated as (T)emporary. |

| 11 |

SDL Employees is the number of Personnel Members with at

least one Salary Transaction according to rules 1 and 2 where "Skills

Levy" is set to (Y)es for the Earning / Deduction Type {FPRG-6} |

| 12 |

UIF Employees is the number of Personnel Members with Salary Transactions according to rules 1 and 2 where

- "Include for UIF" is set to (Y)es for at least one Earning- or Deduction in Earning / Deduction Type {FPRG-6} and

- the Nature of Person is (A) Person with ID- or Passport

Number, (B) Person without ID- or Passport Number or (C)

Director of a Private Company / Member of a CC and

- the UIF Employment Status is not (EX) - Natural Person Excluded

Refer to Service Records {PBOP-2} for more

information about Nature of Person and UIF Employment Status. Note

that for personnel members with more than one Service Record for

the payroll cycle, the last Service Record for the relevant

payroll cycle is used. |