|

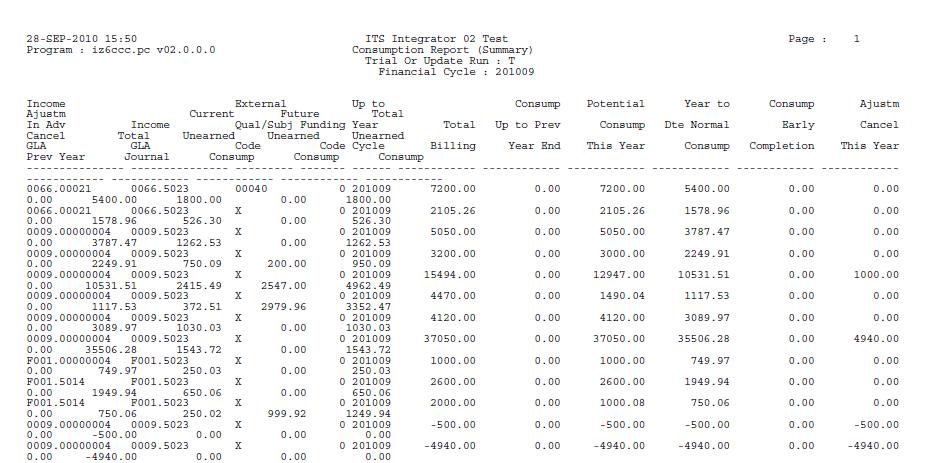

This report is dependent on the setup in {BATCH-7}. For System 'FIN' and Function 'CONSUM', a path where the output should reside must be specified. In {FCSM-1b2}, journals will be created if the SOD 'RA- Apply Student Income Recognition' is set to (Y)es.

When a student registers, revenue is recognized

in the month the registration is processed. This option allows for

income to be recognized over the service period of costs incurred. That

is, enrolment revenue is calculated per service period month and evenly

distributed over the duration of the service period (service period =

enrolment block).

Monthly Income Recognition = Amount charged / Service Period Months

If a student cancels, the effect is in the

cancellation month.

If the start date of the service period is a future date, the transaction is ignored.

If the end date of the service period is in a previous year, the

transaction is ignored if not cancelled. If cancelled and the cancellation date in

the current year, the transaction is reported on.

If a student completes early, outstanding earnings is realized in the month when the qualification / subject is completed (early completion = pass before end date of registration record).

If an enrolment period runs over two months, earnings can either be reflected in the end month or over two months.

If the enrolment period runs over more than one year, the earnings are subsequently reflected in the different years.

This program cannot be run more than once per cycle / month.

Some institutions register students for courses where the start and end date of the registration block is not a true reflection of the actual start and end date of the service period. The actual service period is mostly a much shorter time than the registration block (typically skills courses). All registration, cancellation and programs where registration detail can be changed have start and end registration dates that will be a true reflection of the service period on the qualification registration table and the subject registration table. These dates will default from the registration block {GOPS-1} but can be updated by the user during the registration if indicated as updatable on the qualification / subject definition {SACAD-13 and SACAD-14 respectively}. The user can check start and end registration dates, and update if necessary during registration. This program will use the actual start and end dates as recorded against the registration record to determine the service period.

For residence registrations, the date in and date out (end date of residence block if date out is null) is used. The date out is applied according to the reason code:

Ledger year end month:

If the year end month of the primary ledger is not 12, the program will

convert the financial year and cycle to the equivalent actual year and

cycle to use in calculations. The ‘up to year’ and

‘up to cycle’ input parameters are also converted to the

equivalent actual year and cycle to use in calculations.

Early completion:

If a student completes early, outstanding earnings are realized in the

month when the subject / qualification is completed. Early completion

is established as follows:

Event 07 Subject: if the subject has a pass result recorded before the end registration date.

Event 05 Qualification: if all not cancelled and not exempted subjects for the qualification are completed.

Event 13 Residence: no early completion will be applicable for event ‘13’.

Cancellation:

Cancellations are handled in the financial year and cycle of the cancellation transaction.

A residence registration record will be seen as cancelled where it has

a date out and the reason code is a ‘C’,’V’ or

’H’.

Enrollment over 2 months

If an enrolment period runs over two months, the program will reflect

the income according to the system operational definition ‘RC

– Latest Reg. Day of Month for Student Income Recognition over 2 Months‘ for subsystem SD on {FCSM-1}.

If the day of the start registration date is less than the day recorded

against the SOD, revenue is reflected over the 2 month period.

If the day of the start registration date is after or equal to the day

recorded against the SOD, income is reflected in the 2nd month.

Enrollment over multiple years

If the enrolment period runs over more than one year, the earnings are subsequently reflected in the different years

{FSAO-29} must be

completed to define an income GLA for every income in advance GLA. The

look up process to find the corresponding income GLA for every income

in advance GLA, is as follow:

Contra and Create General Ledger Journals:

If the SOD ‘RB’ for subsystem 'SD' on {FCSM-1} indicates that journals should be generated

by this program, the previous months’ journal will be reversed in

the current month and a new journal generated.

Journals will only be created when the student debtor subsystem is

posted to the general ledger. If the report is requested from the menu,

a trial run will be enforced.

Contra GL journals:

The GL journals created with the previous run of this report will be

cancelled by creating a contra transaction for each journal created.

If these journals were created for the previous financial

year, contra journals will not be created. Journals for the

previous year may not be

cancelled.

Generate GL Journals:

The program uses the year and cycle of SD subsystem – NOTE: THIS ONLY WORKS IF SD SUBSYSTEM IS POSTED CORRECTLY.

A GL journal will be created for each income in advance GLA,

irrespective of the income GLA. If more than one income in

advance GLA maps to the same income GLA, a separate GL journal will

still be created for each income in advance GLA. Therefore, each total

line printed for the income in advance GLA will map to one GL Journal.

If the user selected to sort per faculty and department, a GL journal

must be created per GLA within the faculty and department, therefore,

if the same GLA is linked to different faculties and departments,

different GL journals will be created for each faculty / department

combination.

All journals created will be generated with the same journal number.

| User Selection | Prompt Text * an item between square brackets [ ] is the default answer |

Type & Length |

Comments |

|---|---|---|---|

| [Trial Run] Update Run will only be Performed with SD Period End | A1 | Update run is only allowed when the report is run from the SD post to GL report and the system is set to generate GL journals. If the report is run from the menu, update run is not allowed. | |

|

N1 |

||

| If 1 or 2 | |||

| Enter the Financial Cycle upto - Year - Cycle |

N4 N2 |

||

| If 3 | |||

| Faculty or All | N4 | ||

| Department or All | N4 | ||

| Internal or External Qualification (I/E) | A1 | ||

| Qualification or All | A7 | ||

| Internal or External Subject (I/E) | A1 | ||

| Subject Code or All | A21 | ||

| Contract Code or All | A4 | ||

| Use Internal or External GLA's (I/E) | A1 | Only for OPNZ | |

| Enter the Financial Cycle upto - Year - Cycle |

N4 N2 |

||

| If 4 | |||

| Enter the Financial Cycle upto - Year - Cycle |

N4 N2 |

||

| Sort by (C)ontract or (F)aculty and Department | A1 | ||

| Sort Order | Per | Comments |

|---|---|---|

| The report sorts by the ‘Income in Advance GLA’, for options 1, 2 and

3, and by contract and ‘Income in Advance GLA’ for option 4. For option 4 (‘Summary Consumption - Financial Year/Cycle with Contract/Dept/Fact’), the user can choose to either sort by faculty and department or by contract. If the user chooses ‘F’, the data will be sorted by faculty, department, and then 'Income in Advance GLA'. Residence fees do not have a faculty or department - this will result in a null faculty and department sorting and printing at the top of the report, for event 13. If the user chooses 'C', the data is sorted by contract and 'Income in Advance GLA'. |

| System Select | |

|---|---|

| No special system selection. |

|

| Processing Rules |

|

|---|---|

| No special processing rules. |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 17-Sep-2010 | v02.0.0.0 | Christel van Staden | t169772 | New manual. |

| 19-May-2014 | v03.0.0.0 | Oteng Mooke | f199250 | Manual Update. |