|

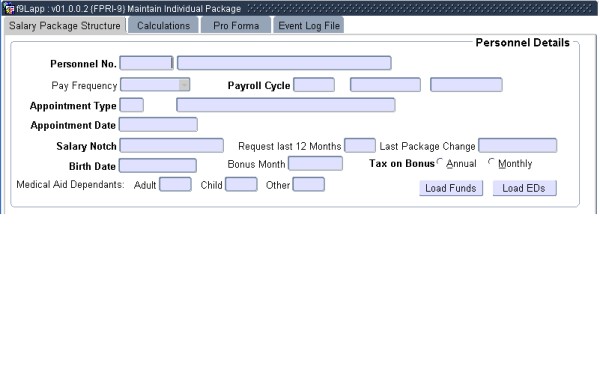

This option may be used to maintain structured salary packages and allows users to view the effect of different package options on the salary of an employee or a prospective employee.

The typical scenario is where a tax structures salary package is offered to an employee, and the employee has the privilege to decide on the components of the package and the size of each component, bearing in mind that the total cost to company amount is fixed. The employee may then liaise with the payroll office, using this option to advise the effect of including or excluding package components or increasing or decreasing the size of each component.

Once satisfied, program allows the user to automatically apply the selected package components and their sizes to the salary of the employee as individual earnings or deductions.

It is also possible to follow a two-step approach whereby one user may use this option to request changes to the package of a personnel member and another user may then approve (apply) the requested changes - refer to the "Request"- and "Apply Pack" - command buttons in Block 4 on the "Calculations" - tab

We advise the following implementation of tax structured salary packages to optimally use this option:

Processing Rules for this Block

| Field | Type & Length |

Description |

|---|---|---|

| Personnel No | N9 | Note: If a salary package is calculated for a personnel number for the first time, the personnel number should be entered here. If a salary package is calculated for the same number again, the personnel number cannot be entered, the record must be queried. Personnel number 0 may be used for dummy package trials, for instance in the case of an potential employee that needs to see what his remuneration package will look like, should he accept an job offer. |

| Name | A40 | The Surname, Title and Initials of the Person will display (For personnel number of 0, the Surname, Title and Initials may be entered here and will be used when a pro-forma payslip is produced by the program) |

| Pay Frequency | A1 | This is fixed on Monthly |

| Payroll Cycle | YYYYMM | The salary will be calculated for the cycle entered here. |

| From date | DD-MON-YYYY | This field displays the start date of the specific payroll cycle. |

| To Date | DD-MON-YYYY | This field displays the end date of the specific payroll cycle. |

| Appointment Type | N4 | For existing

personnel members, the appointment type of the person in the

Payroll Cycle will display, for personnel number 0, the Appointment Type to be used should be entered |

| Appointment type Description |

A40 | This is a display field only. |

| Salary Notch | N11 | For existing personnel

members, the Salary Notch in the Payroll Cycle will display, for

personnel number 0, the Salary Notch to be used should be entered |

| Request last 12 Months | N3 | This is a display field that will display the number of times a request was generated to change the salary package in the last 12 months. Refer to the "Request" - command button in tab-page 2 for more information. |

| Last Package change | DD-M0N-YYYY | This is the last date that changes to the salary package was applied. Refer to the "Apply Pack" - command button in tab-page 2 for more information. |

| Birth Date | DD-MON-YYYY | For existing personnel members, the Birth Date will display, for personnel number 0, the Birth Date to be used should be entered |

| Bonus Month | N2 | For existing personnel members, the Bonus Month will display, for personnel number 0, the Bonus Month to be used should be entered |

| Tax on Bonus | A1 | For existing personnel members, the Tax on Bonus indicator will display, for personnel number 0, the Tax on Bonus value to be used should be indicated. |

| Medical aid Dependants | For existing personnel members, the existing information will be used, for personnel number 0, enter the values to be used. | |

| Adult | N2 | |

| Child | N2 | |

| Other | N2 | |

| Load Funds | Command Button | For existing

Personnel, all Pension Funds {PAOP-5} and Medical Aid / Group Insurance

or Other Funds {PAOP-4} to which the person is linked will be loaded

for use in Block 2 "Exclusion/Inclusion of Membership of Funds". (This is a mandatory step before salaries may be calculated for the person) Command buttons will only execute if the focus is in the same block as the command button. (I.e. the button will not execute if the user worked in block 2, and clicked on the button without navigating back to block 1 using the "Previous Block" command) |

| Load ED's | Command Button | For existing

Personnel, all the Earnings or Deductions, where the Earning- or

Deduction will be used in the calculation of the salary of the person,

and where the Earning or Deduction is linked to the E/D Group

indicated in the System Operational Definition Parameter "PG - E/D

Group for Individual Package" for Subsystem "PR", will be loaded into

Block 3 "Package Specific E/D's". For personnel number 0, this will only include Earnings or Deductions linked to the entered Appointment Type in the Global Earning/Deduction Detail {FPRG-7}. If a request for changes to a package of a personnel member exists, with no record that the request was applied, this button will be disabled in order to display the Earnings or Deductions as per the request. This is to ensure that all changes can be viewed and or changed without being overwritten.. |

|

In this block the user needs to indicate whether specific fund codes that is linked to the person should be excluded in the calculation of the package or not. This will not, however change any of the existing data in the personnel system.

New fund records may be created here and it will only be used by this program for calculation purposes.

| Field | Type & Length |

Description |

|---|---|---|

| Fund | A4 | Fund codes that is linked to a person, or that must be taken into account when calculating package values. |

| Fund Description | A40 | This is a display field only. |

| Fund Type | A1 | This is a display field only, that displays the type and description |

| MSA Level | N5.2 | This field must be used to indicate the correct savings levels for new age medical aid funds. |

| Include | A1 | (Y)es or (N)o, this indicator determines whether a fund is taken into account when a package calculation is done. |

|

| Field | Type & Length |

Description |

|---|---|---|

| ED Code | A4 | Only Earning- or Deduction codes that is linked to the specific

appointment type of the person and that is linked to the package

maintenance group will be loaded

here. The field is not updateable |

| E/D | A1 | This field indicates whether it is an Earning or a Deduction. The field is not updateable |

| Method | A1 | This field displays the specific calculation method of the Earning or Deduction. The field is not updateable |

| Level | N2 | This field indicate the salary level (order) in which the specific Earning or Deduction will be used in the salary calculation. The field is not updateable |

| E/D Description | A40 | This field display the description of the ED code. The field is not updateable |

| Amount | N15.2 | This field only contains amount values for calculation method "3 - Advised Amount" If the calculation method is "3 - Advised Amount", the advised amount may be updated here. |

| Calc % | N3.3 | This field contains percentage values for calculation methods "1 - Percentage of Salary Level" and "6 - Percentage of E/D" If the calculation method is "1 - Percentage of Salary Level" or "6 - Percentage of E/D", the percentage may be updated here |

| Changed | A1 | (Y/N), As soon as an amount or a percentage changes this field will change from "N" to "Y". The field is not updateable |

|

Processing Rules for this Block (delete if not applicable).

| Field | Type & Length |

Description |

|---|---|---|

| Calculate | Command Button | If this button is selected, the

program

will perform a pro-forma salary calculation for the cycle entered in

Tab Page 1, Block 1, incorporating

the changes that was done in the "Exclusion/Inclusion of

Membership of Funds" and "Package Specific Earnings/Deductions". The

proforma may

then be

viewed. Apart from the pro-forma, the program will also perform a "dummy" salary calculation for the person for the next 11 months to obtain yearly salary figures with the difference that any future notch record for the person entered in the Fixed Salary Detail {FPRI-1} will be ignored. Note that details like Earnings/Deductions, Funds Membership or Dependents for the personnel member with a start date later than the end of the cycle in block 1 will be included in the figures calculated for the next 11 months and the figure may be influenced by a resignation for the personnel member during the next 11 months. Command buttons will only execute if the focus is in the same block as the command button. |

| Nett Pay | N17.2 | This field will display the nett pay calculated in the proforma (after calculate was executed) The value in this field applies only to the cycle entered in Tab Page 1, Block 1 |

| Cost to Company | N17.2 | This field will display

the total value of Earnings and Deductions for the person, where

Include in Stats Gross is set to "Y"es for the Earning or Deduction in "Earning /Deduction Types {FPRG-6}} (after calculate was executed) The value in this field applies only to the cycle entered in Tab Page 1, Block 1 |

| Request | Command Button | If this button is selected

|

| Apply Pack | Command Button | If this button is

selected

|

| Annual Notch | N17.2 | For existing personnel member, the field will

display the annual notch as it exists in the "Salary Notch Record" - tab of the Fixed Salary Detail {FPRI-1}. For personnel number 0, the salary notch as entered in Page 1, Block 1 will display. |

| Annual Cost to Company |

N17.2 | This field displays the sum

of Earnings and Deductions for the pro-forma calculation as well

as the calculated values for the next 11 months.

|

| Under/Over | N17.2 | This field

displays the difference between the Annual Notch and the

Annual Cost to Company.

|

| Annual Bonus | N17.2 | This field will display the value of any Earning with Calculation Method "2 - Bonus" for the pro-forma or the following 11 months.. |

| Resignation Date | DD-MON-YYYY | The resignation of the person will be displayed here. |

|

This block display all payroll transactions calculated by the proforma.

| Field | Type & Length |

Description |

|---|---|---|

| Level | N2 | This field display the salary level of the transaction. |

| Calc | N12 | This field will display the calculation method used for the calculation of the transaction. |

| Method | A40 | This field displays calculation method description. |

| Earning/Deduction | A4 | This field display the E/D Code used for the transaction. |

| A1 | This field will indicate whether the E/D code is an Earning or a Deduction. | |

| A40 | This field will display the E/D Code description | |

| Inc Cost to comp | A1 | This field will indicate whether the specific ED code was included for the calculation of the annual cost to company. |

| Amount | N17.2 | This field will display the amount calculated for the transaction. |

|

Only types "D - Package Requests" and "E - Package Changes applied" for the personnel member in Tab page 1 - Block 1 will be displayed in this screen.

No records may be created manually on this screen.

| Field | Type & Length |

Description |

|---|---|---|

| Event Type | A1 | Event Type. |

| Event Description | A30 | Event Description. |

| Cycle | (YYYYMM) | Pay cycle for which event occurred. |

| Calc No | N1 | Calculation number for which event occurred. |

| Calc Seq | N2 | Calculation sequence for which event occurred. |

| Pay Date | N1 | Pay date number, using ACB's "One day Service". |

| Personnel Number | N9 | Personnel number of the person for whom the event occurred. |

| Pay Freq | A1 | Pay Frequency Indicator. |

| Date and Time | (DD-MON-YYYY HH24MISS) | Date and time when event occurred. |

| User | A8 | The user who Executed the event. |

|

| Processing Rules |

|

|---|---|

| No special processing rules |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 21-Sep-2007 | v01.0.0.0 | Allie de Nysschen | t138228 | New Development. |

| 18-Aug-2009 | v01.0.0.1 | Allie de Nysschen | t159532 | Calculate annual cost to company and compare with annual notch values. |