|

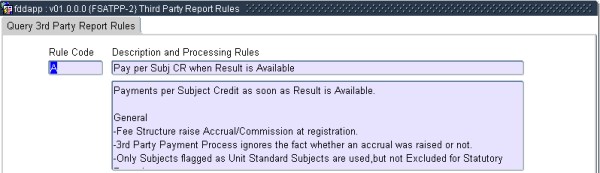

The purpose of the option is to allow the user to view the processing rules, as programed into 3rd Party Payment Calculation Report {FSATPP-5}, when using the defined 3rd Party Report Definitions and its payment rules {FSATPP-3}.

New rules can be develop by ITS.

This is a query only option.

This is a query only option.

| Field | Type & Length |

Description |

|---|---|---|

| Rule Code | A4 | The defined 3rd Party Rule code. |

| Description | A40 | The 3rd Party Rule code description. |

| Processing Rules | A4000 | The processing rules of the 3rd Party Rule code |

|

Rule Codes

| Rule | Description |

|---|---|

| Rule Code A | Once Subject Results are Finalised Payment per Subject Credit |

| Rule Code B | Once Subject Results are Finalised Payment per Subject for Specified Qualification/s |

| Rule Code C | Once Subject Results are Finalised Once Off Payment |

| Rule Code D | Once Subject Refundable Withdrawal Period has Passed:- Payment per Event and Transaction Type |

| Rule Code E | Once Qualification Refundable Withdrawal Period has Passed: - Payment per Event and Transaction Type |

| Rule Code F | Once Subject Service Request Application has a Outcome:-Payment per Event and Transaction Type |

| Rule Code G | Once Qualification Service Request Application has a Outcome Payment per Event and Transaction Type |

| Rule Code H | Once Qualification is Awarded for Certification

Qualification NO 3rd Party Payment |

| Rule Code I | Once Approved Qualification Refundable Withdrawal Period has Passed: - Payment per Event and Transaction Type |

| Rule Code J |

| General | Processing |

||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fee Structure raise Accrual/Commission at registration 3rd Party Payment Process ignores the fact whether an accrual was raised or not. Only Subjects flagged as Unit Standard Subjects are used. May select subjects linked to predefine Exam Types. The predefined Exam Type List is equal to EX1.

Predefine Exam Types is defined in option {GOPS-21} and this rule use only the following fields.

Rules: If no records exist for External Body 3RP External Code Type EX1

then All exam types will be used in this rule.

else

This rule will only use exam types defined.

May In/Exclude Exemption Subjects. As predefine in EY1.

In/Exclude Exemption Subjects is defined in option {GOPS-21} and this rule use only the following fields.

Rules: Only one record must exist for this definition with the value of INCLUDE or EXCLUDE.

If Include Exemption Subjects then Exemption Types may be predefine. The predefined Exemption Type List is equal to EZ1.

Exemption Types is defined in option {GOPS-21} and this rule use only the following fields.

Rules: If Include Exemption Subjects then records must exist for External Body 3RP External Code Type EZ1

Based on a Final Mark the amounts are Payable, using Value per Credit and Subject Credit. Contract Definition may exclude a record. This 3rd Party Rule Code does not use the Related field of the Subject Definition, it only uses the Curriculum Module. Only 3rd Party Audit File records where Record Type is equal to "3P" will be reported to the 3rd Party. |

Select Student with Subject Result Code

Rules: Do not use the start and end date of the selection criteria. Validate the 3rd Party Report Code Definition, Payable Transaction Type and Income Transaction Type. If invalid the 3rd Party Report Code will not be processed. All new records will use Start System Date and Time for the 3rd Party Rule Code. Generate two GL Journal's, Write-Off and 3rd Party Payment in the Year and Cycle of the SD Subsystem. Select Students with Subject Result Codes, where: The Result Code (of Final Mark) is not null.

For pass or fail. Excluding cancelled Subjects. Subject is a Unit Standard Subject. For specific Exam Types. In/Exclude Exemption. If Include Exemption then for specific Exemption Types.

Not yet in the Audit Report.

Only for Selection Criteria Academic Year. Validate Subject/Curriculum Module Define

Curriculum Modules as M

If Rule is flagged as SubjectA Subject (Mother) with Curriculum Modules as L A Subject not define as M/L as K Report K as soon as K has a result code

If Rule is flagged as Curriculum ModuleReport M as soon as L has a result code, using the result of L for M Report K as soon as K has a result code

This rule does not report LReport M as soon as M has a result code, using the result of M For each Student,Subject Result do the following: Add to Count.

Write Audit Trail. If last Curriculum Module of a Subject, write-off Subject Accrual if any. Rule Code can be Source of Funding and/or External Body Restricted or Not Restricted: Fail:

Add to Count.

Pass:Accrual will be written-off. Process 3rd Party Payment/Commission using Accrual/Income.

Write Audit Trail. To differentiate between Audit Trail records for this report code: Records can be classified by Record Type and result code (Pass/Fail). The combinations are:

Back to rule codesFunds Restricted Pass Record Type is equal to "FP".

Funds Restricted Fail Record Type is equal to "FF". Ext. Body Restricted Pass Record Type is equal to "EP". Ext. Body Restricted Fail Record Type is equal to "EF". Not Restricted Fail Record Type is equal to "3F". Not Restricted Pass Record Type is equal to "3P". |

| Rule B Code | Exam Types (EX%)

|

Exemption Subjects (EY%)

|

Exemption Type (EZ%)

|

Qualification/s External Type (QU%)

|

| B0 | EX2 | EY2 | EZ2 | QU0 |

| B1 | EX3 | EY3 | EZ3 | QU1 |

| B2 | EX4 | EY4 | EZ4 | QU2 |

| B3 | EX5 | EY5 | EZ6 | QU3 |

| B4 | EX6 | EY6 | EZ6 | QU4 |

| General | Processing |

||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fee Structure raise Accrual/Commission at registration. 3rd Party Payment Process ignores the fact whether an accrual was raised or not. Only Subjects of predefined Qualification/s External Types. May select subjects linked to predefine Exam Types. The predefined Exam Type List is equal to EX%.

Predefine Exam Types is defined in option {GOPS-21} and this rule use only the following fields.

Rules: If no records exist for External Body 3RP External Code Type EX%

then All exam types will be used in this rule.

else

This rule will only use exam types defined.

May In/Exclude Exemption Subjects. As predefine in EY%.

In/Exclude Exemption Subjects is defined in option {GOPS-21} and this rule use only the following fields.

*1 Only values INCLUDE or EXCLUDE is allowed

Rules: Only one record must exist for this definition with the value of INCLUDE or EXCLUDE. If Include Exemption Subjects then Exemption Types may be predefine. The predefined Exemption Type List is equal to EZ%.

Exemption Types is defined in option {GOPS-21} and this rule use only the following fields.

Rules: If Include Exemption Subjects then records must exist for External Body 3RP External Code Type EZ%

Based on a Final Mark the amounts are Payable, using Value per Subject from the Payment Transaction Type. Contract Definition may exclude a record. The predefined Qualification/s External Type is equal to QU%. Qualifications External Type is defined in option {GOPS-21} and this rule use only the following fields.

Rules: Records must exist for External Body 3RP External Code Type QU%

This 3rd Party Rule Code does not use the Related field of the Subject Definition, it uses only the Curriculum Module. |

Do not use the start and end date of the selection criteria. Validate the 3rd Party Report Code Definition, Payable Transaction Type and Income Transaction Type. If invalid the 3rd Party Report Code will not be processed. All new records will use Start System Date and Time for the 3rd Party Rule Code. Generate two GL Journal's, Write-Off and 3rd Party Payment in the Year and Cycle of the SD Subsystem. Select Students with Subject Result Codes where: The Result Code (of Final Mark) is not null.

For pass or fail. Excluding cancelled Subjects, The Subject must be registered under a predefined Qualification/s. For specific Exam Types. In/Exclude Exemption. If Include Exemption then for specific Exemption Types.

Not yet in the Audit Report.Only for Selection Criteria Academic Year. Validate Subject/Curriculum Module Define

Curriculum Modules as M

If Rule is flagged as SubjectA Subject (Mother) with Curriculum Modules as L A Subject not define as M/L as K Report K as soon as K has a result code

If Rule is flagged as Curriculum ModuleReport M as soon as L has a result code, using the result of L for M Report K as soon as K has a result code

This rule does not report LReport M as soon as M has a result code, using the result of M For each Student, Subject Result do the following: Add to Count.

Write Audit Trail. If last Curriculum Module of a Subject, write-off Subject Accrual if any. Rule Code can be Source of Funding and/or External Body Restricted or Not Restricted: Fail:

Add to Count.

Pass:Accrual will be written-off. Process 3rd Party Payment/Commission using Accrual/Income.

Write Audit Trail. To differentiate between Audit Trail records for this report code: Records can be classified by Record Type and Result Code (Pass/Fail). The combinations are:

Back to rule codesFunds Restricted Pass Record Type is equal to "FP".

Funds Restricted Fail Record Type is equal to "FF". Ext. Body Restricted Pass Record Type is equal to "EP". Ext. Body Restricted Fail Record Type is equal to "EF". Not Restricted Fail Record Type is equal to "3F". Not Restricted Pass Record Type is equal to "3P". |

| Rule C Code | 3rd Party Report Code

(RC%)

|

Certificate Seen Code

(CS%)

|

| C0 | RC0 | CS0 |

| C1 | RC1 | CS1 |

| C2 | RC2 | CS2 |

| C3 | RC3 | CS3 |

| C4 | RC4 | CS4 |

| General | Processing |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| No Fee is raised for the student from this action. Based on a Final Mark and the Student not linked to a specific Certificate Seen Code, amounts are Payable. Contract Definition may exclude a record. This 3rd party Rule Code will use a selection that is based on a 3rd Party Report that has a 3rd Party Report Rule Code of "A" and the Student has a Report Type of "3P". The predefined 3rd Party Report External Type is equal to RC%. 3rd Party Report External Type is defined in option {GOPS-21} and this rule use only the following fields.

Rules: Records must exist for External Body 3RP External Code Type RC%

The predefined Certificate Seen Code External Type is equal to CS%. Certificate Seen Code External Type is defined in option {GOPS-21} and this rule use only the following fields.

Rules: Records must exist for External Body 3RP External Code Type CS%

|

This process will not use the start and end date of the selection criteria. No further validation necessary of the 3rd Party Report Code Definition. All new records will use Start System Date and Time for the 3rd Party Rule Code. Generate one GL Journal, 3rd Party Payment, in the Year and Cycle of the SD Subsystem. Select distinct Student Number from the 3rd Party Payment Audit Trail where: The Audit Trail Academic Year is equal to the Selection Criteria Academic Year.

The Audit Trail Report Type is equal to "3P". The Audit Trail 3rd Party Report Code has a 3rd Party Report Rule Code of A. The Student do not have a Predefine Certificate Seen Record. For each Student selected do the following: Count Each Student Selected.

Linked the Student to the Certificate Seen Record and set the Certificate Seen flag to N. Write to the Audit Trail. Do the following after the last student was processed. Processed the GL Journals. This is a Summary Debit and Credit Journal.

All Audit Trail records for this report code is classified by Record Type 3A |

| Rule D Code | Exam Types (EX%)

|

Exemption Subjects (EY%)

|

Exemption Type (EZ%)

|

Subjects (SU%)

|

| D1 | EX7 | EY7 | EZ7 | SU1 |

| D2 | EX8 | EY8 | EZ8 | SU2 |

| D3 | EX9 | EY9 | EZ9 | SU3 |

| D4 | EXA | EYA | EZA | SU4 |

| D5 | EXB | EYB | EZB | SU5 |

| D6 | EXC | EYC | EZC | SU6 |

| D7 | EXD | EYD | EZD | SU7 |

| D8 | EXE | EYE | EZE | SU8 |

| D9 | EXF | EYF | EZF | SU9 |

| General | Processing |

||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fee Structure raise Accrual/Commission at registration. 3rd Party Payment Process ignores the fact whether an accrual was raised or not. Only Subjects of a predefined Subject List. May select subjects linked to predefine Exam Types. The predefined Exam Type List is equal to EX%.

Predefine Exam Types is defined in option {GOPS-21} and this rule use only the following fields.

Rules: If no records exist for External Body 3RP External Code Type EX%

then All exam types will be used in this rule.

else

This rule will only use exam types defined.

May In/Exclude Exemption Subjects. As predefine in EY%.

In/Exclude Exemption Subjects is defined in option {GOPS-21} and this rule use only the following fields.

*1 Only values INCLUDE or EXCLUDE is allowed

Rules: Only one record must exist for this definition with the value of INCLUDE or EXCLUDE. If Include Exemption Subjects then Exemption Types may be predefine. The predefined Exemption Type List is equal to EZ%.

If Include Exemption Subjects then records must exist for External Body 3RP External Code Type EZ%

Based on "Once Subject Refundable Withdrawal Period has Passed" the amounts are Payable, using Value per Subject from the Payment Transaction Type. Contract Definition may Exclude a record. The predefined Subject List is equal to SU%.

*1 The Subject Code as define in option {SACAD-14}

Rules:

Records must exist for External Body 3RP External Code Type SU%

This 3rd Party Rule Code does not use the Related field of the Subject Definition, it only uses the Curriculum Module. |

Do not use the start and end date of the selection criteria. Validate the 3rd Party Report Code Definition, Event 07, Payable Transaction Type and Income Transaction Type. If invalid the 3rd Party Report Code will not be processed. All new records will use Start System Date and Time for the 3rd Party Rule Code. Generate two GL Journal's, Write-Off and 3rd Party Payment in the Year and Cycle of the SD Subsystem. Select Students with Subjects where: The subject is in the 100% Cancellation Credit Liability Period.

Excluding cancelled Subjects. The Subject must be registered under a predefined Subject List. For specific Exam Types. In/Exclude Exemption. If Include Exemption then for specific Exemption Types.

Not yet in the Audit Report.Only for Selection Criteria Academic Year. Validate Subject/Curriculum Module Define

Curriculum Modules as M

If Rule is flagged as SubjectA Subject (Mother) with Curriculum Modules as L A Subject not define as M/L as K Report K as soon as K has a result code

If Rule is flagged as Curriculum ModuleReport M as soon as L has a result code, using the result of L for M Report K as soon as K has a result code

This rule does not report LReport M as soon as M has a result code, using the result of M For each Student where the Subject Refundable Withdrawal Period has Passed do the following: Add to Count.

Write Audit Trail. Rule Code can be Source of Funding and/or External Body Restricted or Not Restricted:

Restricted

Accrual will be written-off.

Not Restricted:

Process 3rd Party Payment/Commission using Accrual/Income.

To differentiate between Audit Trail records for this report code: Records can be classified by Record Type. The combinations are:

Subject/Curriculum Module Exclusions Record Type is equal to "S1".

Funds Restricted Record Type is equal to "F1". External Body Restricted Record Type is equal to "E1". Not Restricted Record Type is equal to "31". Back to rule codes |

| Rule E Code | Qualification List

(RC%)

|

| E0 | EQ1 |

| E1 | EQ2 |

| E2 | EQ3 |

| E3 | EQ4 |

| E4 | EQ5 |

| General | Processing |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fee Structure raise Accrual/Commission at registration. 3rd Party Payment Process ignores the fact whether an accrual was raised or not.

If Include Exemption Subjects then records must exist for External Body 3RP External Code Type EZ%

Only Qualifications of a predefined Qualification List. Based on "Once Qualification Refundable Withdrawal Period has Passed" the amounts are Payable, using Value per Qualification from the Payment Transaction Type. Contract Definition may Exclude a record. The predefined Qualification List is equal to EQ1. Qualifications External Type is defined in option {GOPS-21} and this rule use only the following fields.

Records must exist for External Body 3RP External Code Type EQ%

This 3rd Party Rule Code will not use the value of field Subject/ Curriculum Module. |

Do not use the start and end date of the selection criteria. Validate the 3rd Party Report Code Definition, Event 05, Payable Transaction Type and Income Transaction Type. If invalid the 3rd Party Report Code will not be processed. All new records will use Start System Date and Time for the 3rd Party Rule Code. Generate two GL Journal's, Write-Off and 3rd Party Payment in the Year and Cycle of the SD Subsystem. Select Student with Qualification, Where: The Qualification is in the 100% Cancellation Credit Liability Period.

Excluding cancelled Qualification. The Qualification must be registered under a predefined Qualification List. Not yet in the Audit Report. Only for Selection Criteria Academic Year. For each Student with Qualification Refundable Withdrawal Period has Passed do the following: Add to Count.

Write Audit Trail. Rule Code can be Source of Funding and/or External Body Restricted or Not Restricted: Restricted Accrual will be written-off.

Not Restricted:Process 3rd Party Payment/Commission using Accrual/Income.

To differentiate between Audit Trail records for this report code: Records can be classified by Record Type. The combinations are:

Funds Restricted Record Type is equal to "F1".

External Body Restricted Record Type is equal to "E1". Not Restricted Record Type is equal to "31". Back to rule codes |

| Rule F Code | Exam Types (EX%)

|

Exemption Type (EZ%)

|

Subjects (SF%)

|

| F1 | EXG | EZG | SF1 |

| F2 | EXH | EZH | SF2 |

| F3 | EXJ | EZJ | SF3 |

| F4 | EXK | EZK | SF4 |

| F5 | EXL | EZL | SF5 |

| F6 | EXM | EZM | SF6 |

| General | Processing |

||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Service Request Fee Structure may raise Accrual/Commission at application of the Service Request. 3rd Party Payment Process ignores the fact whether an accrual was raised or not. Only Subjects as per Service Request and predefined Subject List. Based on Service Request Application Outcome the amounts are Payable, using Value per Subject Credit or Payment Transaction Type. May select subjects linked to predefine Exam Types.

The predefined Exam Type List is equal to EX%.

Predefine Exam Types is defined in option {GOPS-21} and this rule use only the following fields.

Rules: If no records exist for External Body 3RP External Code Type EX%

then All exam types will be used in this rule.

else

This rule will only use exam types defined.

Exemption must be equal to Yes on the Subject Registration Table. May select subjects linked to predefine Exemption Types.

The predefined Exemption Type List is equal to EZ%.

If Include Exemption Subjects then records must exist for External Body 3RP External Code Type EZ%

The predefined Subject List is equal to SF%.

*1 The Subject Code as define in option {SACAD-14}

Rules:

Records must exist for External Body 3RP External Code Type SF%

This 3rd Party Rule Code will not use the value of field Subject/ Curriculum Module. |

Do not use the start and end date of the selection criteria. Validate the 3rd Party Report Code Definition, Service Request Code, Event 98, Payable Transaction Type and Income Transaction Type. If invalid the 3rd Party Report Code will not be processed. All new records will use Start System Date and Time for the 3rd Party Rule Code. Generate two GL Journal's, Write-Off and 3rd Party Payment in the Year and Cycle of the SD Subsystem. Select Students with Service Request Outcomes, Where:

The Result Outcome Code not null.

Service Code is equal to the Service code of the 3rd Party Report Definition. Not yet in the Audit Report. Only for Selection Criteria Academic Year. For each Student with Service Request Outcomes do the following:

*Add to Count.

*Write Audit Trail. Service Request outcomes Not Eligible, Subject Excluded or Subject without a exempt academic record will reverse the Accrual.

Rule Code can be Source of Funding and/or External Body Restricted or Not Restricted:

Accrual will be written-off.

Service Request Eligible and Not Restricted:

Process 3rd Party Payment/Commission using Accrual/Income.

-Record Type differentiates between Audit Trail records for this report code. The combinations are:

Not Eligible Record Type is equal to "NS".

Subject Excluded Record Type is equal to "QS". Subject does not have Exempt Record Type is equal to "DS". Funds Restricted Record Type is equal to "FS". External Body Restricted Record Type is equal to "ES". Service Request Eligible and Not Restricted Record Type is equal to "3S". Back to rule codes |

| Rule G Code | Qualification List

(SQ%)

|

| G1 | SQ1 |

| G2 | SQ2 |

| G3 | SQ3 |

| G4 | SQ4 |

| G5 | SQ5 |

| G6 | SQ6 |

| General | Processing |

|---|---|

| Service Request Fee Structure may raise Accrual/Commission at application of the Service Request. 3rd Party Payment Process ignores the fact whether an accrual was raised or not. Only Qualifications as per Service Request and predefined Qualification List. Based on Service Request Application Outcome the amounts are Payable, using Payment Transaction Type. The Qualification was awarded. Contract Definition may Exclude a record. The predefined Qualification List is equal to SQ%. This 3rd Party Rule Code will not use the value of field Subject/ Curriculum Module. |

Do not use the start and end date of the selection criteria. Validate the 3rd Party Report Code Definition, Service Request Code, Event 98, Payable Transaction Type and Income Transaction Type. If invalid the 3rd Party Report Code will not be processed. All new records will use Start System Date and Time for the 3rd Party Rule Code. Generate two GL Journal's, Write-Off and 3rd Party Payment in the Year and Cycle of the SD Subsystem. Select Students with Service Request Outcomes, Where: The Result Outcome Code must be not null.

Service Code must be equal to the Service code of the 3rd Party Report Definition. Not yet in the Audit Report. Only for Selection Criteria Academic Year. For each Student with Service Request Outcomes do the following: Add to Count.

Write Audit Trail.

Service

Request outcomes Not Eligible, Qualification Excluded or Qualification

without a awarded academic record will reverse the Accrual

Rule Code can be Source of Funding and/or External Body Restricted or Not Restricted:

Accrual will be written-off.

Service Request Eligible and Not Restricted:*Process 3rd Party Payment/Commission using Accrual/Income.

Record Type differentiates between Audit Trail records for this report code. The combinations are: Not Eligible Record Type is equal to "NS".

Qualification Excluded Record Type is equal to "QS". Qualification was not awarded Record Type is equal to "DS". Funds Restricted Record Type is equal to "FS". External Body Restricted Record Type is equal to "ES". Service Request Eligible and Not Restricted Record Type is equal to "3S". Back to rule codes |

| General | Processing |

||||||

|---|---|---|---|---|---|---|---|

| No 3rd Party Payments. Only Awarded Qualification if define for Certification. Contract Definition may Exclude a record. The 3rd Party Report Definition will only use report definition parameters: Report Code, 3rd Party Code and Rule Codes. |

Do not use the start and end date of the selection criteria. Validate rest of the 3rd Party Report Code Definition, Service Request Code, Event 98, Payable Transaction Type and Income Transaction Type. If invalid the 3rd Party Report Code will not be processed All new records will use Start System Date and Time for the 3rd Party Rule Code Generate NO GL Journal for 3rd Party Audit Report Get and validate the Note Type to be used in this Report Rule. External Body is "3RP" and External Type is "HNT"

*1 The Note Type as define in option {GCS2-10}

Rules:

Records must exist for External Body 3RP External Code Type HNT

Select Student with Awarded Qualification, Where: The Qualification is flag for Certification.

When the endorsement is received, the user will update each note with CompleteNot yet in the Audit Report Only for Selection Criteria Academic Year For each Student with Awarded Qualification do the following: Add to Count

Write Audit Trail. For Not Restricted Record Type, validate the Student Note Type, If it does not exist, then insert a note for the student and note type. Record Type differentiates between Audit Trail records for this report code. The combinations are: Funds Restricted Record Type is equal to "FQ"

External Body Restricted Record Type is equal to "EQ" Not Restricted Record Type is equal to "3Q" Back to rule codes |

| Rule I Code | Approved Qualification List

(IQ%)

|

| I1 | IQ1 |

| I2 | IQ2 |

| I3 | IQ3 |

| I4 | IQ4 |

| I5 | IQ5 |

| General | Processing |

||||||

|---|---|---|---|---|---|---|---|

| Fee Structure raise Accrual/Commission at registration. 3rd Party Payment Process ignores the fact whether an accrual was raised or not. Only Approved Qualifications of a predefined Qualification List. Based on "Once Qualification Refundable Withdrawal Period has Passed" the amounts are Payable, using Value per Qualification from the Payment Transaction Type. Contract Definition may Exclude a record. The predefined Qualification List is equal to IQ% Approved Qualifications List External Type is defined in option {GOPS-21} and this rule use only the following fields.

*1 The Approved Qualification Code as define in option {SACAD-13} TAB - Approved Qualifications

Rules: Records must exist for External Body 3RP External Code Type IQ%

This 3rd Party Rule Code will not use the value of field Subject/Curriculum Module. |

Do not use the start and end date of the selection criteria. Validate the 3rd Party Report Code Definition, Event 05, Payable Transaction Type and Income Transaction Type. If invalid the 3rd Party Report Code will not be processed. All new records will use Start System Date and Time for the 3rd Party Rule Code. Generate two GL Journal's, Write-Off and 3rd Party Payment in the Year and Cycle of the SD Subsystem. Select Students with Approved Qualification, Where: The Approved Qualification is in the 100% Cancellation Credit Liability Period.

Excluding cancelled Approved Qualification. The Approved Qualification must be registered under a predefined Qualification List. Not yet in the Audit Report. Only for Selection Criteria Academic Year. For each Student with Qualification Refundable Withdrawal Period has Passed do the following: Add to Count.

Write Audit Trail. Rule Code can be Source of Funding and/or External Body Restricted or Not Restricated: Accrual will be written-off.

Not Restricted:Process 3rd Party Payment/Commission using Accrual/Income.

To differentiate between Audit Trail Record Type the combinations are: Records can be classified by Record Type is equal to "F1".

External Body Restricted Record Type is equal to "E1". Not Restricted Record Type is equal to "31". Back to rule codes |

| Rule C Code | Qualification List

(QQ%)

|

| J1 | QQ1 |

| J2 | QQ2 |

| J3 | QQ3 |

| J4 | QQ4 |

| J5 | QQ5 |

| J6 | QQ6 |

| General | Processing |

||||||

|---|---|---|---|---|---|---|---|

| Service Request Fee Structure may raise Accrual/Commission at application of the Service Request. 3rd Party Payment Process ignores the fact whether an accrual was raised or not. Only Qualifications as per Service Request and predefined Qualification List. Based on Service Request Application Outcome the amounts are Payable, using Payment Transaction Type. Service Request for a Qualification before Qualification was awarded. Contract Definition may Exclude a record. The predefined Qualification List is equal to QQ%. Qualifications External Type is defined in option {GOPS-21} and this rule use only the following fields.

Records must exist for External Body 3RP External Code Type QQ%

This 3rd Party Rule Code will not use the value of field Subject/ Curriculum Module. |

Do not use the start and end date of the selection criteria. Validate the 3rd Party Report Code Definition, Service Request Code, Event 98, Payable Transaction Type and Income Transaction Type. If invalid the 3rd Party Report Code will not be processed. All new records will use Start System Date and Time for the 3rd Party Rule Code. Generate two GL Journal's, Write-Off and 3rd Party Payment in the Year and Cycle of the SD Subsystem. Select Students with Service Request Outcomes, Where: The Result Outcome Code must be not null.

Service Code must be equal to the Service code of the 3rd Party Report Definition. Not yet in the Audit Report. Only for Selection Criteria Academic Year. For each Student with Service Request Outcomes do the following: Add to Count.

Write Audit Trail. Service Request outcomes Not Eligible or Qualification Excluded will reverse the Accrual Rule Code can be Source of Funding and/or External Body Restricted or Not Restricted: If restricted, accrual will be written-off.

Service Request Eligible and Not Restricted:Process 3rd Party Payment/Commission using Accrual/Income.

Record Type differentiates between Audit Trail records for this report code. The combinations are: Not Eligible: Record Type is equal to "NS".

Qualification Excluded: Record Type is equal to "QS". Funds Restricted: Record Type is equal to "FS". External Body Restricted: Record Type is equal to "ES". Service Request Eligible and Not Restricted Record: Type is equal to "3S". Contract does not Exist/not linked to Registration: Type is equal to "DS". Back to rule codes |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 08-Aug-2006 | v01.0.0.0 | Marchand Hildebrand | t135029 | New manual format. |

| 28-Jan-2007 | v01.0.0.0 | Charlene van der Schyff | t134766 | New Manual Format Updated. inserted Pic and more Columns. |

| 22-Jun-2009 | v01.0.0.1 | Ernie van den Berg | t157364 | Review the manual. |