|

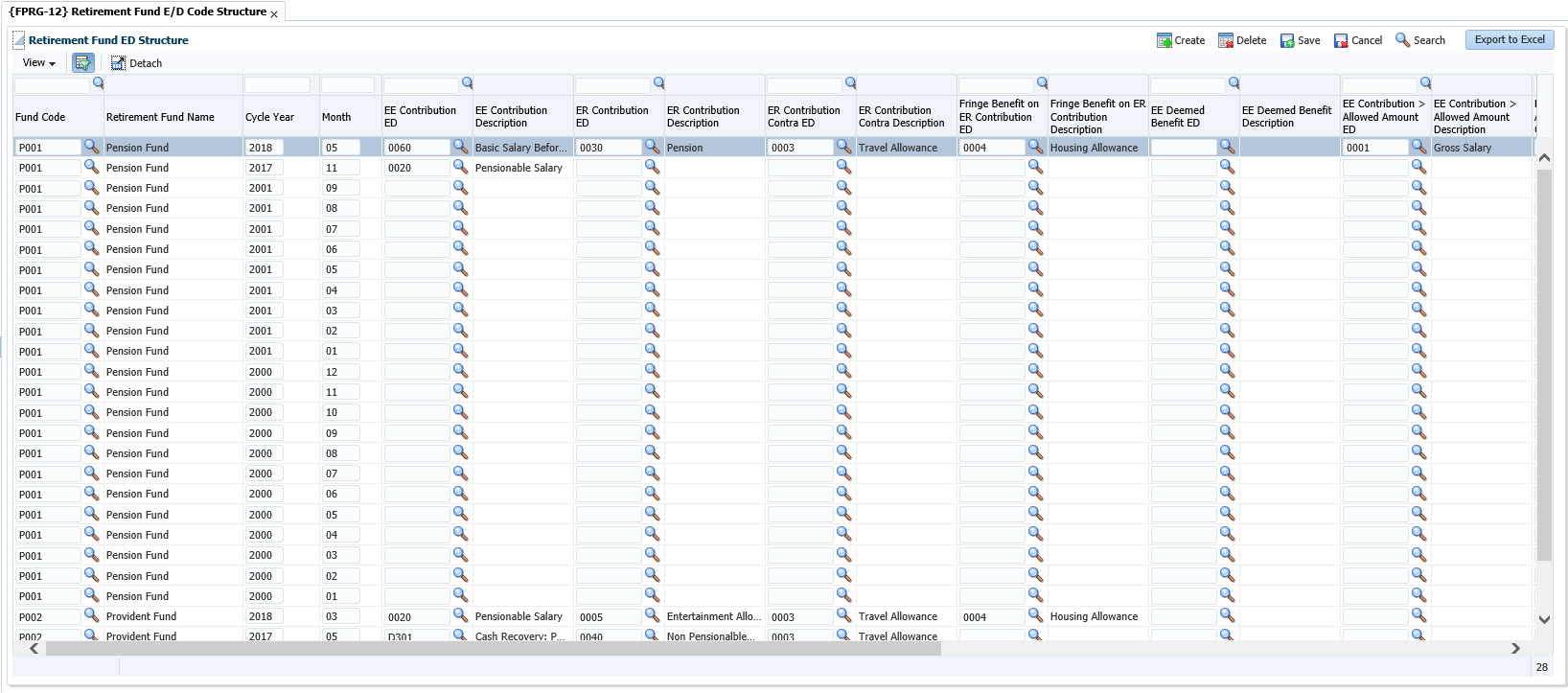

Retirement Fund Tax harmonisation was introduced with effect from 01-Mar-2016 and is applicable to South African clients only.

This option (which is applicable to South

African clients only) is used to link the Earning and Deductions Codes,

per Retirement Fund Code, used for the calculation of the salary

transactions that are applicable to the Retirement Funding Tax Harmonisation Legislation

calculation. Only Funds that have been defined as a Pension

Fund (Fund Type “P”), Provident Fund (Fund Type

‘V’) or Retirement Annuity Fund (Fund Type “R”)

{FPRG-3} may be maintained on this option.

| Field | Type & Length |

Description |

|---|---|---|

| Fund Code | A4 | The Fund Code for the Pension Fund (Fund Type “P”), Provident Fund (Fund Type “V”) or Retirement Annuity Fund (Fund Type “R”) as defined on {FPRG-3}. |

| Cycle Year | (YYYY) | The Year in which this setup becomes effective. |

| Month | N2 | The Month in which this setup becomes effective. |

| Employee Contribution ED Code | A4 | The Deduction Code for the Employee’s current

months’ contribution to the Pension, Provident or Retirement

Annuity Fund.

Provident Fund – Tax Code 4003 Retirement Annuity Fund – Tax Code 4006 |

| Employee Arrear Contribution ED Code | A4 | The Deduction Code for the Employee’s arrear contribution to the Pension, Provident or Retirement Annuity Fund.

Provident Fund – Tax Code 4003 Retirement Annuity Fund – Tax Code 4006 |

| Employee Contribution > Allowed Amount ED Code | A4 | The Earning Code used to calculate the Employee’s total

contribution to Retirement Funding that is greater than the capped

percentage of the Employee’s total remuneration, or greater than

the capped total contribution amount allowed as a pre-tax deduction, as

defined by legislation. To view the allowed capped percentage and

allowed capped total contribution amount, see Table 9998 on {FPRG-5}. The Employee’s contribution used in the calculation, consists of the current month’s contribution, plus Employee’s arrear contribution, plus Employee’s buy back contribution, plus Employee’s voluntary additional contribution, plus Employee’s Deemed Benefit amount (which equals the Fringe Benefit on Employer’s Contribution Amount) plus any additional Retirement Annuity policies (Tax Code 4006) included in the salary calculation of the employee, for tax benefit purposes.

Pension Fund – Tax Code 4001 Provident Fund – Tax Code 4003 Retirement Annuity Fund – Tax Code 4006 The purpose of this calculation is to ensure that the employee doesn’t benefit from a pre-tax Retirement Funding deduction that exceeds the maximum percentage of remuneration allowed or the maximum total amount allowed, as determined by legislation. Cumulative calculation is done on total remuneration to ensure that the maximum pre-tax benefit allowed, is given to the Employee. |

| Employee Contribution > Allowed Amount Contra ED Code | A4 | The Deduction Code which is a contra to the Employee Contribution > Allowed Amount Earning Code.

|

| Employer Contribution ED Code | A4 | The Earning Code for the Employer’s Contribution to the Retirement Fund (Pension, Provident or Retirement Annuity).

|

| Employer Contribution Contra ED Code | A4 | The Deduction Code which is a contra to the Employer Contribution Earning Code.

Provident Fund, Tax Code 4473 Retirement Annuity, Tax Code 4475 |

| Fringe Benefit on Employer Contribution ED Code | A4 | The Earning Code for the Fringe Benefit on the

Employer’s contribution made to the Retirement Fund for the

employee’s benefit.

Pension Fund, DB Component, Tax Code 3818 Pension Fund, DC&DB Component, Tax Code 3819 Provident Fund, DC Component, Tax Code 3825 Provident Fund, DB Component, Tax Code 3826 Provident Fund, DC&DB Component, Tax Code 3827 Retirement Annuity Fund, Tax Code 3828

FB = (Fund Factor X Retirement Funding Income) minus Employee’s contribution to the fund (current, arrear and buyback. Voluntary Additional Contributions are excluded). |

| Employee Deemed Benefit ED Code | A4 | A Deduction Code with which to calculate the Employee Deemed

Benefit Amount. As the employee is paying a Fringe Benefit on the

Employer’s Contribution, the Fringe Benefit Amount is deemed to

be an Employee contribution. Therefore, this ED Code is a contra

to the Fringe Benefit Amount on the Employer’s Contribution

Earning Code.

Provident Fund, Tax Code 4003 Retirement Annuity Fund, Tax Code 4006. |

| Employer Arrear Contribution ED Code | A4 | The Earning Code with which to calculate the Employer’s Arrear Contribution.

|

| Employer Arrear Contribution Contra ED Code | A4 | The Deduction Code which is a contra to the Employer Arrear Contribution Earning Code.

Provident Fund, Tax Code 4473 Retirement Annuity, Tax Code 4475 |

| Employee Buy Back ED Code | A4 | The Deduction Code for the Employee’s Buy Back contribution to the Pension, Provident or Retirement Annuity Fund.

Provident Fund – Tax Code 4003 Retirement Annuity Fund – Tax Code 4006 |

|

| Processing Rules |

|

|---|---|

| No special processing rules. |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 17-Dec-2015 | v03.0.0.0 | Sakhile Ntimane | t209237 | New Manual Format |

| 30-Jan-2017 | v04.0.0.0 | Sakhile Ntimane | t219225 | Change image to Integrator4. |

| 09-Oct-2017 |

v05.0.0.0 |

Sthembile Mdluli |

t220571 |

convert image to the intergrator 5 system version. |

| 13-Nov-2018 |

v04.1.0.0 |

Sthembile Mdluli |

t232368 |

Convert to ADF |