|

Retirement Fund Tax harmonisation was introduced with effect from 01-Mar-2016 and is applicable to South African clients only.

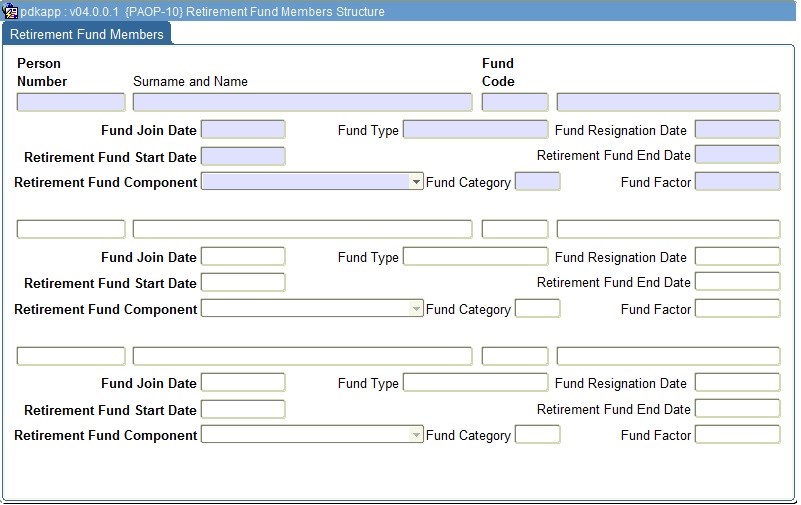

Retirement Fund Membership details for each employee (i.e. where the Fund Code has been defined as a Pension, Provident or Retirement Annuity Type Fund on {FPRG-3}) is maintained on {PAOP-4} and /or {PAOP-5} and those Retirement Fund Membership details, per employee, are displayed on this Menu Option.

The Retirement Fund Component, Fund Category, Fund Factor and Start Date of this information, for each record, must be entered on this Menu Option. This information is used by Calculation Method ‘X’ in the salary calculation, providing the relevant Earning /Deduction Codes have been defined on {FPRG-6}, linked to each Retirement Fund Code on {FPRG-12} and are linked to the applicable Appointment Types on {FPRG-7}.

| Field | Type & Length |

Description |

|---|---|---|

| Person | N9 | When a personnel number is linked to a Retirement Fund on {PAOP-4} or {PAOP-5} (i.e. where the Fund Type has been defined as Pension, Provident or Retirement Annuity on {FPRG-3}), the Personnel Number, Surname and First Names are displayed here. When a new record is created, the details of the Person Number, Fund Code will be validated to {PAOP-4} or {PAOP-5} where a valid record must exist. If a valid record does not exist, an error message will be displayed. |

| Fund Code | A4 | The Retirement Fund Code linked to the personnel number on {PAOP-4} or {PAOP-5} is displayed, in addition to the Fund Description. When a new record is created, allowed Fund Codes may be viewed via the <LIST FIELD VALUES> command. Only Fund Codes that have been defined as a Pension, Provident or Retirement Annuity on {FPRG-3} will display. The details of the Person, Fund Code will be validated to {PAOP-4} or {PAOP-5} where a valid record must exist. If a valid record does not exist, an error message will be displayed |

| Fund Join Date | (DD-MM-YYYY) | The Retirement Fund Start Date /Join Date as defined on {PAOP-4} or {PAOP-5} is displayed. |

| Fund Resignation Date | (DD-MM-YYYY) | The Retirement Fund Resignation Date /End Date as defined on {PAOP-4} or {PAOP-5} is displayed. |

| Retirement Fund Start Date | (DD-MM-YYYY) | The date from which the Retirement Fund Component, Fund Category and Fund Factor is effective. When entering this date, it is validated to the Start and End Dates of the Retirement Fund Membership and must fall within these two dates. |

| Retirement Fund End Date | (DD-MM-YYYY) | The last date for which the Retirement Fund Component, Fund Category, Fund Factor is effective. When entering this date, it is validated to the Start and End Dates of the Retirement Fund Membership and must fall within these two dates. |

| Retirement Fund Component | A5 | The List of Values for this field displays hard-coded values. They are as follows: DC – Defined Contribution Fund DB – Defined Benefit Fund DC&DB – Combination of Defined Contribution and Defined Benefit Fund (sometimes referred to as a Hybrid Fund) This information will be supplied annually by the Retirement Fund provider to the Employer for each member belonging to the Retirement Fund on a Membership Certificate. Please see notes below for additional information |

| Fund Category | A5 | The Fund Member Category is allocated per group of members of

the Fund, whose Employer and Employee Contributions have the same

percentage of Retirement Funding Income and for whom the determination

of the retirement benefit is calculated according to the same method. This information will be supplied annually by the Retirement Fund provider to the Employer for each member belonging to the Retirement Fund, on a Membership Certificate. |

| Fund Factor | A5 | The Fund Member Category Factor is the factor calculated by the Retirement Fund provider for members, per Fund Category and is a mandatory field where the Retirement Fund Component is either ‘DB’ or ‘DC&DB’ This information will be supplied annually by the Retirement Fund provider to the Employer for each member belonging to the Retirement Fund on a Membership Certificate. |

|

|

| Processing Rules |

|

|---|---|

| No special processing rules. |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 07-Jan-2016 | v03.0.0.0 | Sakhile Ntimane | t209237 | New manual format. |

| 01-Feb-2017 | v04.0.0.0 | Sakhile Ntimane | t219225 | Change image to Integrator4. |

| 07-Mar-2017 | v04.0.0.1 | Sakhile Ntimane | t219560 | Validation of Data |