Retirement Fund Tax Harmonisation {FPRG-25_Retirement_Fund_Tax_Harmonisation}

Retirement Fund Tax harmonisation was

introduced with effect from 01-Mar-2016 and is applicable to South

African clients only.

General Information:

Retirement

Fund Tax Harmonisation means that the taxation and administration rules

have been standardised and the same rules will be applied to all

Retirement Funds irrespective of whether it is a Pension, Provident or

Retirement Annuity Fund. Prior to the introduction of Retirement

Fund Tax Harmonisation, different taxation rules were applied to the

various types of retirement funding depending on whether the Retirement

Fund was a Pension Fund, Provident Fund or Retirement Annuity.

The effect on Payroll is as follows:

- The employee’s contribution to any registered Retirement

Fund will be deducted at a pre-tax salary level. The includes the

Employee’s current months contribution, arrear contribution,

voluntary additional contributions, buy back contributions and any

individual Retirement Annuity Contributions that are calculated through

the payroll for tax benefit purposes.

- The employer’s contribution to any Retirement Fund and the

contra of the transaction will be calculated at an after-tax salary

level. This includes any arrear contributions.

- There will be a Fringe Benefit to the employee on the

Employer’s Contribution to the Retirement Fund; this salary

transaction will be calculated as a pre-tax salary level.

- As the Employee is liable for a Fringe Benefit on the

Employer’s Contribution, the Fringe Benefit amount will be deemed

to be an Employee Contribution to the Retirement Fund. Therefore

the Employee Deemed Benefit Amount will be a contra to the Fringe

Benefit Amount on the Employer’s Contribution; this salary

transaction will be calculated as a pre-tax deduction.

- The Employee allowed pre-tax deduction (i.e. current, arrear, buy

back, voluntary additional, private RA contributions, employee deemed

amount) is limited to the lessor of a capped amount or capped

percentage calculated on the greater of taxable income or remuneration

(Payrolls will use remuneration before allowable deductions).

Remuneration for the purpose of calculating the percentage cap is

defined by the Fourth Schedule with a few exclusions. Should the

employee’s total contribution into Retirement Funding exceed the

allowed pre-tax amount, an additional salary transaction should be

calculated as a pre-tax Earning with an after-tax contra

Deduction. This calculation is used purely for calculation

purposes to ensure that the PAYE calculation on pre-tax Retirement

Funding Contributions are correct and not for reporting purposes.

For the calculation in the full salary calc {FPRN-2}, single salary calc {FPRN-3} and pro-forma salary calc {FPRI-25},

actual Tax Year-to-date within continuous service period remuneration

is determined and the allowed capping amount /percentage is annualised

to ensure that the employee receives

the maximum pre-tax benefit.

The annual monetary cap and a percentage

based cap are linked to Table Code ‘9998’ on {FPRG-5}.

- Some Retirement Funds provide their members with risk benefits

for death or permanent disability cover. If the additional risk

benefits are included in the fund’s rules and these rules are

approved by SARS, then it is ‘Approved Risk Benefits’ and

the total contribution

(including the risk benefit portion of the contribution) is taxed and

administered as a contribution to a Retirement Fund i.e. on Fringe

Benefit amount calculation on the total Employer’s

Contribution. Therefore, if this is the case and a Fringe Benefit

exists for the Risk portion, it will need to be ended as at 28th

February 2016. Consideration will need to be given as to how the

Fund wants this reported /paid and ED Code setup will need to

accommodate this requirement.

All Retirement Funds will fall into one of

the following categories, the category determines how the Fringe

Benefit on the Employer’s Contribution will be calculated:

- Defined Contribution Fund (DC)

A Defined Contribution Fund (DC) is a fund where the rules of the

fund calculate an employee’s retirement benefit based on the

total contribution made by the Employee and /or the Employer, plus

investment growth, less expenses. The value of the retirement

benefit is directly

linked to the total value of the contributions received, therefore the

Employer’s contribution equals the Fringe Benefit Amount.

- Defined Benefit Fund (DB)

A Defined Benefit Fund (DB) is a fund

where the rules of the fund specify a formula that determines an

employee’s retirement benefit. This usually takes into

account the number of years of service and the employee’s last

/average salary. As the benefit is not based on the actual contributions received for

the member, the Fringe Benefit amount cannot be calculated on the

Employer’s actual contribution, instead a formula is used to

calculate the benefit amount.

FB = (Fund Factor x Retirement

Funding Income) – EE contribution excluding Voluntary Additional

Contributions

Some Funds are a combination of

Defined Contribution and Defined Benefits and for these types of Funds,

the Formula as described above is used to calculate the Fringe Benefit

on the Employer’s contribution.

The following Tax Codes are applicable to Retirement Funding Tax Harmonisation (i.e. with effect from 2017 Year of Assessment):

Fringe Benefit Tax Codes

| CODE |

DESCRIPTION |

EXPLANATION |

3817

(3867) |

Employer’s Pension Fund Contributions

(PAYE) |

Value of taxable benefit iro Employer’s Pension Fund Contributions paid for the benefit of Employee.

DC Component: Taxable value = Employer’s Contribution

DB Component: Taxable value = amount calculated ito par 12D(3), Seventh Schedule formula calculation

DC&DB Component: Taxable Value = amount calculated ito par 12D(3), Seventh Schedule formula calculation |

3825

(3875) |

Provident Fund

Contributions

(PAYE) |

Value of taxable benefit iro Employer’s Provident Fund Contributions paid for the benefit of Employee.

DC Component: Taxable value = Employer’s Contribution

DB Component: Taxable value = amount calculated ito par 12D(3), Seventh Schedule formula calculation

DC&DB Component: Taxable Value = amount calculated ito par 12D(3), Seventh Schedule formula calculation |

3828

(3878) |

Retirement Annuity Fund Contributions

(PAYE) |

Value of taxable benefit iro Employer’s Retirement Annuity Fund contributions paid in respect of Employee.

Taxable value = Employer’s Contribution |

Deduction Codes

| CODE |

DESCRIPTION |

EXPLANATION |

| 4001 |

Total Pension Fund Contributions paid or ‘deemed paid’ by Employee |

‘Deemed paid’ by employee is the value of the taxable benefit (Code 3817) included in the income of the Employee.

Prior to the 2017 year of assessment, this Code is only applicable to

‘Current Pension Fund Contributions by Employee’ |

| 4003 |

Total Provident Fund Contributions paid or ‘deemed paid’ by Employee |

‘Deemed paid’ by employee is the value of the taxable benefit (Code 3825) included in the income of the Employee.

Prior to the 2017 year of assessment, this Code is only applicable to

‘Current Provident Fund Contributions by Employee’ |

| 4006 |

Total Retirement Annuity Contributions paid or ‘deemed paid’ by Employee |

‘Deemed paid’ by employee is the value of the Fringe Benefit (Code 3828) included in the income of the Employee.

Prior to the 2017 year of assessment, this Code is only applicable to

‘Current Retirement Annuity Fund Contributions by Employee’ |

| 4472 |

Employer’s Pension Fund Contributions paid for the benefit of the Employee |

This Code was not reported on Tax Certificates from 2010 to

2016 years of assessments. It will once again be reported from

2017 year of assessment. |

| 4473 |

Employer’s Provident Fund Contributions paid for the benefit of the Employee |

This Code was not reported on Tax Certificates from 2010 to

2016 years of assessments. It will once again be reported from

2017 year of assessment |

| 4475 |

Employer’s Retirement Annuity Fund Contributions paid for the benefit of the Employee |

This Code is valid from the 2017 year of assessment. |

Codes not applicable from 2017 year of assessment

| CODE |

DESCRIPTION |

EXPLANATION |

| 4002 |

Arrear Pension Fund Contributions paid by the Employee |

This Code is not applicable from the 2017 year of assessment.

Arrear Pension Fund Contributions paid by the Employee will be reported under Code 4001 from the 2017 year of assessment. |

| 4007 |

Arrear (re-instated) Retirement Annuity Fund Contributions |

‘This Code is not applicable from the 2017 year of assessment.

Arrear Retirement Annuity Contributions paid by the Employee will be reported under Code 4006 from the 2017 year of assessment. |

Additional Code used in the ITS

Integrator system Retirement Tax Harmonisation ED Setup and

programmatically converted to the applicable Retirement Funding Tax

Code when calculated in the salary calculation.

| CODE |

DESCRIPTION |

EXPLANATION |

| 9998 |

Retirement Reform Fund Code to be converted |

Used for Retirement Funding Tax Harmonisation and is

converted programmatically to the applicable Tax Code determined by the

type of Retirement Fund the Employee belongs to, for whom the salary

calculation is being done i.e. Pension Fund, Provident Fund or

Retirement Annuity Fund. |

Setup Requirements:

The details below are in addition to the standard Pension Fund

/Provident Fund setup requirements which currently calculates the

Employer and /or Employee’s Contribution to the Fund.

Please refer to {FPRG-25}, Calc Method ‘A’ for more details.

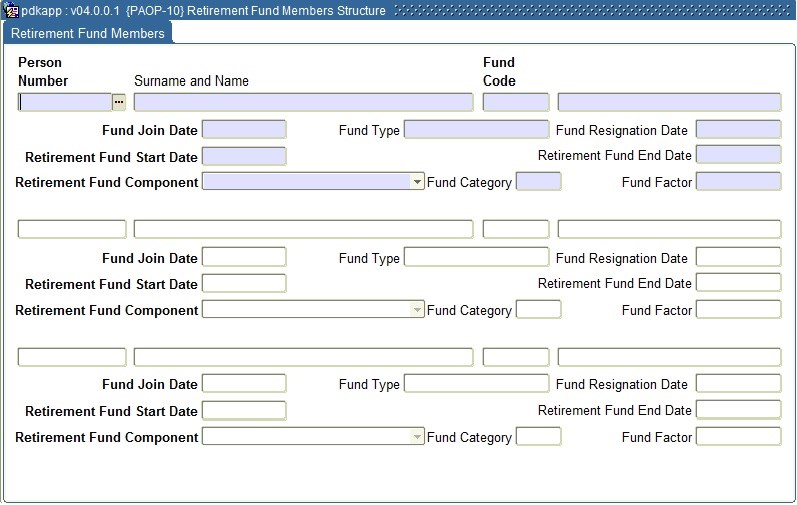

- Retirement Fund Member’s Structure {PAOP-10} /{FPRI-15}

Member’s Retirement Fund details as captured on {PAOP-4} or {PAOP-5}

will be displayed on this Menu Option. Users must add the Fund

Component (i.e. ‘DC’, ‘DB’ or

‘DC&DB’) and as applicable the Fund Category, Fund

Factor and the date that this detail is effective, to the existing details. This additional information

will be supplied by the Fund Provider, for each member on a

Member’s Certificate. This information is expected to

change annually.

Please note that this information is used

in the salary calculation and is therefore mandatory to ensure the

correct calculation of the Fringe Benefit on the Employer’s

Contribution, the Employee Deemed Benefit Amount and the Employee

Contribution to Retirement Funding greater than the allowed Capped Amount

/Capped Percentage

Example:

2. Export Retirement Fund Member’s Structure {PAOP-11} /{FPRI-16}

Import Retirement Fund member’s Structure {PAOP-12} /{FPRI-17}

To ease the burden of manually capturing the additional Retirement Funding information on {PAOP-10} /{FPRI-15}

there is an Export /Import functionality to assist. The

member’s details can be export into excel, the information

updated and then import back into the structure.

3. Earning /Deduction Types {FPRG-6}

The following new ED Codes must be defined:

(i) Fringe Benefit on Employer’s Contribution

- one ED Code per Retirement Fund where there is an Employer’s Contribution

- Tax Code ‘9998’

This is an internal Tax Code which will be programtically updated when

running a salary calculation to the correct SARS Tax Code, determined

by the Fund Type (i.e. Pension, Provident or RA)

- Calc Method ‘X’

Used for Retirement Funding Tax Harmonisation calculations

- This is a taxable Fringe Benefit and therefore will always be

defined at a salary level <50 (assuming PAYE is calculated at salary

level 50)

- The program will determine the Fund Component for the member and

then will calculate the Fringe Benefit amount using this

information.

Component ‘DC’ means that

the Employer Contribution will be the Fringe Benefit Amount.

Component ‘DB’ or

‘DC&DB’ means the formula will be used for the

calculation i.e. Retirement Funding Income (i.e. income used to

calculate the Retirement Funding Contribution) x Retirement Funding

Factor (as defined for the member on {PAOP-10} /{FPRI-15} minus Employee Contribution

(current, arrear, buy back but excluding voluntary additional

contribution).

See example below of a typical example

(ii) Employee Deemed Benefit

- one ED Code per Retirement Fund where there is an Employer’s Contribution

- Tax Code ‘9998’

This is an internal Tax Code which will be programtically updated when

running a salary calculation to the correct SARS Tax Code, determined

by the Fund Type (i.e. Pension, Provident or RA)

- Calc Method ‘6’

- As there is Fringe Benefit being calculated on the

Employer’s Contribution, the Fringe Benefit amount is deemed to

be an Employee Contribution and is reported on the Tax certificate as

an Employee Contribution.

- The amount of this transaction equals the Fringe Benefit Amount,

is calculated at a salary level <50 and essentially is the contra

for the Fringe Benefit transaction.

See example below of a typical example

(iii) Employee Contribution greater than the Allowed Amount

- The same ED Code may be used for all Retirement Funds and must be

defined if there is any type of Retirement Funding calculations in the

salary calculation irrespective of whether it is an Employee and /or

Employer Contribution or Employee’s private Retirement Annuity

policies.

- Tax Code ‘9998’

This is an internal Tax Code which will be programtically updated when

running a salary calculation to the correct SARS Tax Code, determined

by the Fund Type (i.e. Pension, Provident or RA)

- Calc Method ‘X’

Used for Retirement Funding Tax Harmonisation calculations

- There is a limit to the total amount that the Employee is allowed

as a Retirement Funding Contribution as a pre-tax deduction. This

transaction is used to adjust the pre-tax contribution greater than the

allowed amount /allowed percentage by calculating an ‘adjustment

transaction’ and is for calculation purposes only, not reporting

purposes. Therefore it will only calculate when applicable and

although defined as an Earning, it may also be calculated as a negative

Earning.

- The allowed amount /allowed percentage is linked to Table ‘9998’ on table Details {FPRG-5}

See below, for an example of what this transaction is determining:

Amounts are calculated as follows:

Determine YTD Remuneration

- Sum YTD amounts for following Tax Codes

’36—‘, ’37—‘,

’38—‘, ’39—‘ (always salary level

0-48)

- The following exceptions apply:

- Exclude

Tax Code ‘3616’ Independent Contractors

Tax Code ‘3901’ Severance Benefits

- Only 80% of the following Tax Codes are included

(i.e. only Remuneration value not Income value)

Tax Code ‘3701’ Travel Allowance

Tax Code ‘3702’ Reimbursive Travel

Tax Code ‘3802’ FB on Company Car purchased

Tax Code ‘3816’ FB on Company Car that is rented

- Tax Code ‘3703’ Reimbursive Travel

If Tax Code ‘3703’ will be converted to

‘3702’ on generation of the Tax Certificates, then 80% on

this Tax Code must also be included. An additional calculation is

done in resignation month and February to determine this. Tax Code

‘3703’ is converted under the

following conditions:

If Tax Code ‘3701’ exists

If Tax Code ‘3702’ exists

If rate per km paid is > rate per km as per table ‘9999’

If km travelled is > than max km allowed as per table ‘9999’

If total amount reported is > rate per km x max km

Determine Allowed Amount

The employee is allowed the lessor of the capped percentage or the capped amount as defined in Table ‘9998’.

The YTD Remuneration as determined above is then applied to this

calculation and the lessor of the two is then used as the maximum

Allowed amount. If an employee is in service for an incomplete

cycle, days are used in the calculation.

Determine YTD EE Contribution to Retirement Funding

YTD Tax Codes ‘4001’, ‘4003’, ‘4006’ are summed, including the current months calculation

Determine YTD EE Contribution > Allowed Amount

This is the difference between what the employee is allowed as per the

above calculation and the employee’s actual Retirement Funding

YTD amounts are used and should an employee have an additional earning

in a particular month, the previously dis-allowed amount would be

adjusted in the current month.

See example below of a typical example

(iv) Employee Contribution greater than the Allowed Amount Contra

- The same ED Code may be used for all Retirement Funds and is a

contra to the Employee Contribution greater than Allowed Amount ED Code.

- Tax Code ‘9998’

This is an internal Tax Code which will be programtically updated when

running a salary calculation to the correct SARS Tax Code, determined

by the Fund Type (i.e. Pension, Provident or RA)

- Calc Method ‘6’

See example below of a typical example

4. Earning /Deduction Detail {FPRG-7}

All new ED Codes that have been defined on {FPRG-6} must be linked to the applicable Appointment Types on {FPRG-7}

5. Retirement Fund ED Structure {FPRG-12}

All ED Codes relating to each Retirement Fund must be linked to the Retirement Fund ED Structure on {FPRG-12}.

A typical Example would be:

See Also:

History of Changes

| Date |

System Version |

By Whom |

Job |

Description |

| 05-Feb-2016 |

v03.0.0.0 |

Sakhile Ntimane |

t209237 |

New manual format. |

| 30-Jan-2017 |

v04.0.0.0 |

Sakhile Ntimane |

t219225 |

Change Images to Integrator4. |