Procurement Management PMIS {FRM-7}

General Information

This is the User Manual for the operation and maintenance of

the

ITS Tertiary Software Procurement Management Information

Subsystem. The abbreviation for

the Subsystem is PM. It is one of a series of user and technical

manuals that is available for the ITS Tertiary Software

systems.

It is assumed that the reader is already familiar with the general

operation of the menus and the keyboard and are fully discussed in

the Operational

Aspects Manual.

The reader is reminded that the copyright of the

Intergrator systems and

documentation remains with ITS Tertiary Software, and that users

thereof are

contractually prohibited from providing information to third

parties, such as other educational institutions.

Overview Of Financial

System

The ITS Financial System

(Menu option {FRM}) consists of the following modules (Menu option in

brackets):

The modules are listed in sequence under {FRM}:

| Option |

Menu |

Description |

| 1 |

{FCCT} |

Counter Subsystem (Receipts/Ad

Hoc Payments / Cash Book) |

| 2 |

{FCMR} |

Mail Recording System |

| 3 |

{FACB} |

ACB System |

| 5 |

{FEBC} |

Electronic Bank Conversion |

| 6 |

{FPME} |

B2B Vendors |

| 7 |

{FPM} |

Procurement

Management (PMIS) |

| 21 |

{FSA} |

Student Accounts |

| 22 |

{FBL} |

Bursaries And Loans |

| 23 |

{FAR} |

Accounts Receivable |

| 24 |

{FSDC} |

Debt Collection Interface |

| 27 |

{FCS} |

Code Structures |

| 28 |

{FGL} |

General Ledger |

| 29 |

{MEB} |

Income And Expense Budgeting |

All these modules are fully integrated with one another,

and other

ITS Systems such as Personnel, Student Information and Asset

Inventory. More detail on the individual modules can be found in the

appropriate User Manuals.

A comprehensive system of access control applies to these modules.

OVERVIEW OF PROCUREMENT

MANAGEMENT INFORMATION SUBSYSTEM

The subsystem consists

of the following components:

Code

Structure {FPM- 3}

These codes are defined by the user

and used by the system.

- Codes used

in the creditor and item

definitions

- Creditor Categories

- Commodities

- Creditor

Types

- Account

Types

- Payment

Terms and

Methods.

- Used on

Creditors and Documents

- Note

Classification Codes and Action Codes

- Used in PM

documents.

- Change/Cancellation/Complete/Retain

Reasons Codes.

- Used by

store and general items,

- Kind

Codes to enhance the Item descriptions.

Maintenance

{FPM-2}

Maintenance

menu options are used to define and maintain the entities in the PM

system for

example creditor biographical information, store definition, item

definition etc.

- Creditor's and Creditor Alias master definitions and

maintenance..

- Stores,

and Sections within Stores definition..

- General and

Store Item

Definitions including detail Creditor Unit Cost with

prioritisation plus

enhanced Item Description using Kind Codes.

- Packages

Item Definition combining Store Items that are not available as a unit

from the Suppliers.

- Accumulation and

deletion of history records. This action cannot be

performed for periods less than 14 months.

- Year-end

close for primary and

secondary ledgers including

- Accruals

on GRV or Order

level,

- Carry

forward Budgets, Standing Orders,

Commitments and Creditor Balances

- Update

Creditor history record

- Incrementing the

fincancial year and cycle of the subsystem..

Operational

Requests {FPMO-1}

- This module

provides for requisition creation, buyer quotation maintenance, overriding of funds,

requisition approval, requisition cancellation and

requisition interrogation (query) of back office Requisitions.

- The

creation, overriding of funds and

approval of iEnabler Requisitions are performed in the web

module however buyer quotation maintenace may

be performed in both the back office or in the iEnabler for these documents.

- Commitments

on back

office Request is optional, and is based on rules as defined

in

the System Operational Definitions BD - REQ Budget Control.

Budget control on iEnabler

requisitions are mandatotory.

- The

Commitment of a Request

will be cancelled as soon as the Request is copied to an Order, Stock

Issue or Payments (for Payment Requests), by means of a

reference

copy. If copied to a Purchase Order the commitment will be carried over to the order.

- The

use of the Request facility is optional, and users may prefer to

process orders directly. If so preferred, required items may

be

entered, leading to the printing of Order Forms and updating of

commitments.

- Requests

can be used to request Stock Items from Stores, Items to be

Purchased or Counter System Payments.

- The back

office requisition maintenance

application alows from the entering of a simple request as well as a

more complex request through numerous drill downs and pop-up

screens.

- Electronic

Requisitions can be routed for authorization and approval.

- Buyer

Requisition Scheduling - requisitions can be allocated to

specific buyers by the department head..

- Buyer

Quotation Maintenance - quotation detail can be recorded on the system.

Purchases

Ordering {FPMO-2}

- This module provides for the creation and printing

of Orders and updating of Commitments.

- Budget control

can be done on Cost Centre, Account or Account Category level.

- Budget and

Commitment carried forward can be done

for the Secondary Ledgers during the cycle end and for the Primary

Ledger during year end of the Subsystem.

- Audit, Management and Cost

reports are produced.

- Override Insufficient Funds

functionality with routing notification is

available..

- Electronic

Order authorisation with routing notification is available.

Deliveries

{FPM0-3}

- This module provides for the creation and printing

of GRVs, Supplier Returns.

- Generating Accrual can be done

for the Secondary Ledgers during the cycle end and for the Primary

Ledger during year end of the Subsystem.

- Audit, Management and Cost

reports are produced.

- Electronic

GRV authorisation with routing notification is available.

Stock {FPMO-4}

- The stock

system supports the Average Cost Price method to

calculate stock values.

- Stock

Orders can be placed and the receipt of goods are recorded.

- The stock

system supports the accounting

entries and physical movement of store items i.e.

transactions are generated by the system and posted to the relevant

accounts.

- The stock

system supports Returns from Departments to the

Store, and Return of deficient stock items to

Suppliers.

- Items can

be sold for cash or on

credit to students and debtors, in which case the amounts are

automatically debited against the student or debtor account.

- Functionality

with

security features

is available to adjust Stock Levels and

the Stock Values.

- The system

can calculate Economic Order Quantities and related statistics on the

basis of actual consumption.

- Item Units

- The Store distinguishes between "Order Units" and "Issue

Units", which

must be defined for each stock item. Stock on hand is stored as "Actual

Units".

- The actual record keeping in the system

will be in terms of individual stock items.

- The stock level in the system, and adjustments to that,

will be in terms of individual items.

- The initial selection of appropriate Issue and Order

Units should be

handled with care, as an inappropriate selection will result in a

clumsy system.

- The following are some possibilities in this

regard:

-

| Item |

Order

Unit Description |

Order

Unit Quantity |

Issue

Unit Description |

Issue

Unit Quantity |

| A4 Paper |

Boxes of 5 reams |

5 |

Reams |

1 |

| Cement |

50 Kg Bag |

1 |

Bag |

1 |

| Paper Clips |

Carton of 100 boxes |

100 |

Box 1000 clips |

1 |

| HB pencils |

Cartons of 1000 pencils |

1000 |

Box of 10 pencils |

10 |

- Items that are returned, either from department to store

or

from store to supplier, are always handled as single items, i.e.

partial issue units will be accepted as returns by the store, and

partial order units can be returned to a supplier.

- In terms of the above structure, individual reams of

paper can be

returned, but half a bag of cement cannot be returned. Only a box of

paper clips rather than an individual paper clip can be returned, but a

single pencil can be returned.

- The units that apply to each aspect of the system are

clearly set out

on the screens when the transactions are entered: - On the screens that

are used for entering requests and issues, all quantities will be

displayed in terms of Issue Units.

- On the screens that are used for Orders and the of Goods

Receiving, quantities will be displayed in terms of Order Units.

- The screens that are used for stock returns or

adjustments to stock

levels will, on the other hand, display the number of Actual Units in

the system.

- Average Cost Pricing

- The system

calculates the cost of items that are issued in terms of the

"Average Cost Pricing"method.

- Within the system the total cost of the stock in respect

of each item

is continuously maintained.

- The issue price of an item is then

calculated by dividing the number of items into this total cost.

- The

calculations done by the system can be illustrated by the following

example based on an Order Unit and Issue Unit of 1:

| Issue

/ Receipt |

Quantity |

Unit

Price |

VAT % |

Stock

level |

Stock

Value |

Average

Price |

| Receive |

100 |

12-50 |

13 % |

100

|

1421.50 |

14.13 |

| Issue |

2 |

14.13 |

0% |

98 |

1384.24 |

14.13 |

| Receive |

20 |

15.00 |

13 % |

118 |

1723-24 |

14.60 |

| Issue |

50 |

14.60 |

0 |

68 |

993.24 |

14.60 |

| Supplier Return |

2 |

12.50 |

13 % |

66 |

964-98 |

14.62 |

| Return |

1 |

14.60 |

0 |

67 |

979-58 |

14.62 |

| Issue |

10 |

14.62 |

0 |

57 |

833-38 |

14.62 |

- Note that Issue Prices are rounded off to the nearest

cent. If items of

very low value (say less than 5 cents each) are issued, the rounding

errors can, in the long run, become significant. It may be better to

issue such items in units of 5 and 10 only.

Creditors {FPMO-5}

- This module

supports the processing of invoices, credit notes and

adjustments in

respect of Creditor's

with or without orders..

- Invoices

can be allocated to multiple GL

accounts.

- Commitments

are adjusted when invoices are processed or

when budget control is done on invoices not linked to orders.

- Payments to creditors can be

generated as cheques, ACB, transfers and/or journals and in the

interim, cheques can be made out on the Counter Subsystem.

- Cheques can

be generated for all outstanding invoices, or payments can

be made for invoice items, which qualify on the basis of the most

"effective payment date" only.

- Control totals are kept and

audit reports are available.

- Electronic

Invoice authorization is available.

Correspondence

{FPM4}

The Correspondence Subsystem allows for the defintion of

letters and the generartion of letters,

creditor lists, address labels

and ASCII files for selected Creditors.

LINKING WITH OTHER ITS

SYSTEMS

The integration of the ITS systems result in the interdependence of

systems. The extent to which this applies to the Procurement Management

Information Subsystem is discussed in this section.

- The PM subsystem use the values defined in the Financial

Code Structure Subsystem, these include

- System Operation

Definitions - Rules set up

in the system which the institution can set to apply operational

policies. These rules are defined by ITS with default values

- Subsystem Financial Year and Cycle

- Indicates the current financial period in which

transaction in the subsystem are recorded.

- The approval rules linked to the subsystem

- The retain rules for balances and transactions (How

long records must be kept on the system).

- General Ledger Allocations - Financial managers are able

to

control the ledger allocation of transactions originating from the

subsystem

- Transaction Types for the events of the Subsystem - The

subsystem is totally event driven which means that all actions, i.e.

capturing an invoice, that results in financial transactions

in

the

system are linked to a code (event). When a program

executes the

program attempts to find a transaction type for the event

which is

used to

process financial transaction.

- Foreign Currency Codes and Rates - Foreign currency

definition and exchange rate maintenance

- Document Types - Documents to be used in the PM system

have been pre-fined by ITS i.e. Orders, GRV's Invoices

- Auto Generated Numbers - Documents number are

automatically allocated to a documents in some application

- User

Restrictions / Access Control - the area in which a user may operate

in the subsystem may be controlled through access and user

restrictions

The

existence of these code

structures are a prerequisite for the operation of the subsystem.

- The update or view access to menu options for the

subsystem is done in the General

Support System, and is described in detail in General

System User Manual {GMAIN-3}.

- Address Maintenance.

- Printers Maintenance and Dedicated to Functions for

automatic printing.

- Routing.

- Use the SQL Generator in the Technical Subsystem to

generate additional reports

- All cheques and other payments are numbered when generated,

and the

value of this control file can be queried and updated in the Counter

Subsystem {option FCTM-1}.

- Creditor Payments from {FCTO-6} link

the payment to the Creditor Account and taking settlement discount is

optional.

- Any bank statement transaction for a Creditor, not yet on

the

Creditor Account, can be processed in the Cash Book.

- All transactions in this subsystem are

validated against the GL-Allocations. Such transactions can be queried

on the General Ledger transaction file, and are logically posted to the

GL via a separate menu option in the GL Subsystem (option {FGLP-3}).

The GL-Allocations used within this subsystem can also be

queried.

- Also interfaces with the Student Accounts- and Accounts

Receivable

Subsystems (since credit sales to currently registered students and to

Debtors are debited directly to their accounts via direct purchases or

stock issues)

- The Student Distance Education and Health Management

Subsystems can

issue prescribed Items from the stock. This is either free or not.

- Debtors debit (Accounts Receivable Subsystem) balance can

be deducted

before payment to the Creditor if it is the same person or company.

- Asset Inventory, Costing and Central Reservation Subsystems

by means of request, orders and/or issues.

IMPLEMENTATION SEQUENCE

The existence of the complete General Systems and Financial Code

Structure Subsystems are prerequisites for the operation of this

subsystem.

A logical sequence of implementation events would be the following, the

relevant menu options being indicated in brackets:

{FCSO-21} Maintain Foreign Currencies

{GCS-1} Set currency of institution

{GCS-2} Institution Codes

{GCS-3}

Faculty/School Codes

{GCS-4} Department Codes

{GCS-24}

Contact/Address/Tel Types

{GCS-25} Address Reference Type Menu

{GCS-26}

Address Maintenance

{GCS-27} Address System Maintenance

{GCS-28}

Relationship Maintenance

{GOPS-5} Printers Menu

{GOPS-6} User Access Menu - Assign Usernames,

Passwords and Privileges

{GOPS-7} Batch Processing Menu

{GOPS-22}

Validation Control

{FCSC-1} Maintain VAT Rates

{FCSC-2} Maintain VAT Registration Numbers

{FCSC-3} Create Ledgers {FCSC-4} Maintain Bank Detail

{FCSC-5} Maintain

Cash Book Definitions

{FCSC-6} Maintain Fund Groups

{FCSC-7} Maintain

Account Categories

{FCSC-21} Maintain Acct Type Definition

{FCSM-1} Define system operation and create set-up rules

{FCSM-2}

Define subsystem {FCSM-3} Maintain Auto Generated Numbers

{FCSM-4}

Maintain User Restrictions

{FCSM-5} Finance User Access Control

{FCSM-6} Maintain Cheque Authorisation

{FCSO-1/2} Create/validate cost centre definition

{FCSO-3/4}

Create/validate account definitions, structure

{FCSO-6} Create

GL-Allocations

{FCSO-7} Create transaction types and the combination of

transaction types and transaction events.

{FCSO-23} Query Types of Documents

{FCSP-7} Maintain Functions and Group Functions

{FCSP-6} Maintain Rule Definitions

{FCSP-4} Link Functions to Rules

{FCSP-3} Maintain Action Groups and Users

{FCSP-5}Link Users to Functions and Rules

{FCTM-1} Maintain Cheque/Payment number (Counter Subsystem)

{FCTM-2} Maintain Cashier ID and Password

After completion of the above, the Procurement Management Information

Subsystem can be set up, maintained and operated, as follows:

{FPMC-1} Creditor Categories

{FPMC-2} Commodity Codes

{FPMC-3} Creditor

Types

{FPMC-4} Payment Terms

{FPMC-5} Note Classification Codes

{FPMC-6} Action Codes

{FPMC-7} Query Payment Methods

{FPMC-8}

Change/Cancellation Reasons

{FPMC-9} Maintain Item Units

{FPMC-21} Kind

Codes

{FPMM-2} Maintain Creditor's Fixed Detail

{FPMM-1} Maintain Creditor's

Alias Names

{FPMM-21} Store System Defaults

{FPMM-22} Store &

Section Definitions

{FPMM-23} Store Item Definitions

{FPMM-24} Maintain

Packages Item Definitions

{FPMM-3} General Item Definitions

After the above have been created, the Procurement Management

Information Subsystem can become operational.

CREDITORS BALANCING

PROCEDURES

General

The reconciliation process can be divided into separate phases, of

which the most important ones are:

Phase

1 Balancing of Inputs

On installation of this subsystem, the total debit and credit and

therefore the balance on creditors' records will be zero. By

entering historical balances, invoices, credit notes, payments and

receipts on individual creditors records, the total debit, credit and

thus balance of this subsystem will be affected. It could

even happen that different users on different campuses are entering

transactions. Supporting documentation can be added on a

calculator and the totals from the tally slips can be entered on a

register. This register can be compared to the User Work

Summary Report from the system.

This phase does not use debit and credit, just the value of the

supporting document.

Phase

2 Balancing of Transaction Types

Use the phase 1 register values and validate them against the

Transaction Type Report for the same period. The objective of

the phase is:

- Linking the supporting documents to the SLGL-transactions.

- Convert supporting document values to debits and credits.

- Accumulate data for phase 3.

Phases 1 and 2 should be

done daily for the previous working day.

Phase

3 Balancing of Subsystem Creditors and

General Ledger - Summary

The reconciliation of subsystem creditors is firstly between the SLGL-

and SL transaction and using the Audit report as an additional

control. Then lastly reconcile the SLGL transactions with the

GL Creditor Control Accounts.

Invoices from creditors will create a credit, and credit notes and

payments to the creditor will create a debit to creditors.

The difference between the two will thus be equal to the total balance

on all the statements (amount due) or to the difference between

"Creditors in Debit" and "Creditors in Credit". The user can

thus confirm the outstanding total of the sub-ledger, before generating

payments and executing "Post to General Ledger". After the

posting has been done the user will normally run the "Period End"

program, and the resulting report will confirm the totals to date.

All transactions, excluding Transaction Types that are defined as post

to GL, will affect the General Ledger. Normally, institutions

will have two or three creditor control accounts which will be

representative of the outstanding balance. The net total of

the creditors' register would thus be in balance with the total of the

mentioned control accounts. By confirming this, the user

ensures that all transactions in the subsystem were indeed posted to

the General Ledger.

Warning: When the users decide that balancing procedures and

the generation of creditors payments must take place, it is vital that

the following events do not take place during this period:

AP SUBSYSTEM

No transactions must be entered in the AP Subsystem, since this will

change report totals as well as the balances on the creditors' accounts.

CT SUBSYSTEM

There are four ways in which a creditor's balance can be influenced by

payments, and the user should take care NOT to mix the

methods. The methods are:

- The generation of cheques in which the system will:

calculate the balance of the creditor,

generate a cheque,

debit the creditor and

debit creditors control and

credit Bank.

- Issue cheque on the CT Subsystem with the "Creditor Type"

field set to (C) and the "Post to GL" indicator on the transaction type

set to (Y)es. On entering the creditor's code, the system

will display the creditor information and:

debit the cheque to the creditor and

debit creditors' control and

credit Bank.

| NOTE:

This option will not mark transactions as being paid compared to the

generation of cheque method. |

- In some cases the user will require payments to creditors

for whom master records have not yet been created. He/she

will then issue cheques on the CT Subsystem with the "Creditor Type"

set to (O) and creditor's code to "NULL". The same

Transaction Type will be used, and the system will:

debit creditors control and credit Bank, and

create NO transaction to

creditor.

In order to update the

creditor, option {FPMO-4}, type of document PP, will be used.

- Lastly, some users may use a manual system of making out

cheques to creditors. To update these cheques to the creditor

and the General Ledger, the user can:

use option {FPMO5-1}, type of document PP.

Phase

4 Balancing of Subsystem Creditors and

General Ledger - Detail

If there is an imbalance between the reconciliation of the SLGL

transactions and GL Creditor Control Accounts, then this phase is

designed to assist in the solving of the imbalance.

The phase also assists in the carry forward of previous imbalances,

reminding of unsolved and pointing out when it was solved.

Phase

5 Balancing of Multiple Control GLA's

If the institution uses multiple creditor control GLA's then this phase

will reconcile the each control account with a SL-total and

will point out any inter control account corrections if this exist.

Phase 3, 4 and 5 should be done monthly.

Hereafter more detail will be discussed.

Reports Required For

Daily and/or Monthly Balancing

All reports that can be of use in the balancing procedures are listed

and discussed, but users can select a subset as required.

| NOTE: Always run the reports the

day after the interval and/or period end close. |

Definitions

| A1. Start date: |

The day after the last reconciliation. |

| A2. End date: |

The last day of this reconciliation period. This date

cannot be greater than or equal to the system date.

|

| A3. Year: |

Year of PM for creditor reconciliations. |

| A4.1. Start Cycle |

The next cycle after the last reconciliation. |

| A4.2. End Cycle: |

The cycle up to this recon. This cycle cannot

be the current PM cycle or greater than.

|

User Work Summary

Report {FPMMR1-23}

- This report reflects totals per User per transaction type

of the transactions that have been entered into this subsystem for a

specified period.

- There are two selection options available, namely:

- For a single user

- the system will list totals for all transaction types used by the

specified user;

- For all users -

the report will include ALL transactions that were updated into this

subsystem, including transactions, which

were created on the CT

Subsystem. Only transactions with a "C" as (C)reditor Type

will update this subsystem.

- The report is very important to institutions where a number

of people are working on this subsystem, even more so when they are

geographically separated.

Transactions per Type

(Local

Currency) {FPMOR3- 3}

- The SLGL-transactions of the Creditors.

- This report reflects summary or detail

of transaction types for a specified range and for a specified period.

- Subtotals per type for debits and

credits are calculated.

- The report can be requested in Detail

or in Summary

- Transactions which were created in the

PM Subsystem with a Creditor Type = "C", will also be listed.

| NOTE:

Use only the local currency columns of the above report. |

Print Audit Trail {FPMMR1-1}

The report lists the creditor, store and purchase or SL-transactions on

the left-hand side, and the applicable SLGL-transactions on the right,

store is only SLGL-transactions. If the matching transactions

are not in balance, the difference can be seen in the totals at the end

of the report.

Only Audit Trail totals form part of the PM monthly reconciliation

process phase 3.

Creditor

Balances

{FPMOR3-23}.

- The SL-transactions of the Creditors.

- This report gives details of selected

creditors with balances and is sorted per Account type, payment method

and currency.

- The report reflects the local currency

value and the foreign currency value for foreign creditors.

Cost Centre Cost Summary

Report {FGLOR1-4}

- A summary report for each control

account must be printed for each GL year up to PM year, where the

balance is not yet carried forward to the next year.

- If there is more than one control

account use Specific Account selection or Account Exception Indicator

to reduce the period of time this report will run.

- The total of the actual column will be

used to reconcile with the SLGL-transaction of the subsystem.

- Remember that un-posted transactions of

subsystems that are not PM or AR will not form part of this report.

- The report reflects the local currency

value.

Transaction per Type

Report {FGLOR1-21}

- A summary report for each control

account must be printed for each GL year not yet closed up to PM

year. Previous years have a different user selection.

- This report will be used to find the

imbalance between the SLGL-transaction of the subsystem and GL of phase

3.

- Remember that un-posted transactions

will not form part of this report.

- The report reflects the local currency

value.

Reports Required For

Statement

and/or Payment Balancing

- This report can be printed for single,

multiple or all creditors with balances or zero.

- If statements are requested immediately

before the generation of payments and payment advices, the report will

reflect the amount for which a payment will be generated if all invoice

parameter is used excluding the settlement discount transaction that

may be generated during payment generation.

Transactions - International

Draft Application {FPMOR3-26}

- Transactions can be selected for a

specified period.

- The net total will be equal to the

"Application for Draft", if requested for the same period via option

{FPMOPD-30}.

Daily and Monthly

Reconciliation

The Microsoft Excel Spreadsheets are available from ITS. E-mail a

financial support person and asks for the SS-MAS.XLS and it will be

forwarded. This file has the examples as displayed below as

well as a master sheet. The master sheet can be used for your

reconciliation.

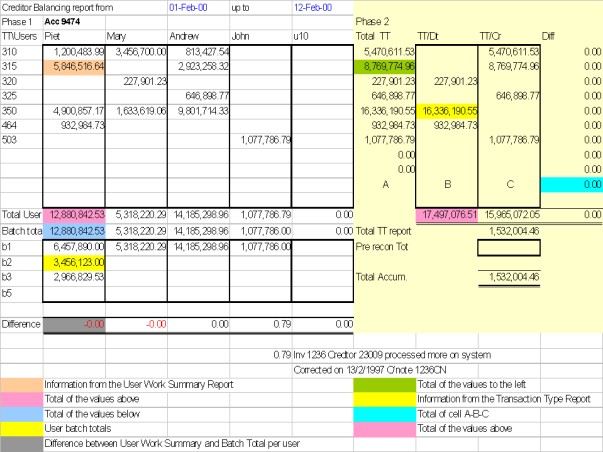

Phase 1 and 2 reconciliation

Set up a sheet as illustrated below.

Example:

- Collect your users batch totals of the

previous day.

- Run the User Work Summary and

Transaction type report.

- Complete the sheet.

- Solve any errors. In some

cases a User Work Detail report for a specific user will help solve the

imbalance between the batches of the user and the data on the system.

- During the month the previous day Total

Accumulated must be carried to the next day Previous Recon

Total. Start the first day of a new cycle with zero in

Previous Recon Total.

Phase 3 reconciliation

Set up a sheet as illustrated below.

Example:

Run the Transaction Type report for the

cycle, Audit, Creditor Balance, GL Control Summary and GL Transaction

Type Reports.

Carry forward the Totals of the

previous phase 3 recon columns Transaction Type and Audit Report into

Accumulation Totals. Excluding corrections that are not

accumulative corrections. No Accumulative

Corrections are corrections that are not in the PM system at the time

of the recon. The above example will carry forward 23425.10

to period 2000 03 recon because the 3 corrections in the transaction

type column and the one in the audit report are accumulative.

Complete the following values as

printed on the above report, only Subsystem cells: Total

Diff. T/Type this report, Total Audit Report and Total Creditor

Balance. "Total Diff. T/Type this report" must also be equal

to the last phase 2 recon for this period value "Total Accum.".

If the four column totals of the

subsystem reconciliation are not equal, find the problems before

continuing to the GL column. If SL and SLGL do not balance

use {FPMMR1-10} to help find the fault or any other {FPMOR3} report.

After the above balances, add the GL

Creditor Control Account Information. Do phase 4 if the

transaction type total is not equal to GL creditor control account

total.

Phase 4 reconciliation

Set up a sheet as illustrated below.

Example:

- Carry forward the Totals of the

previous phase 4 recon columns GL Transaction Type and Corrections as

well as PM Transaction Type and Correction into Balance Brought

Forward. The Accumulative corrections must be added to PM

Transaction Type value. Only the values that are not accumulative

corrections must be entered into the PM Correction cell. Not

Accumulative Corrections are corrections that are not in the PM system

at the time of the recon.

- Firstly enter the GL transaction type

values from the GL Transaction Type Summary report. The total

of the column must be equal to Phase 3, Sub Total column Control

Account. If in balance, do the next paragraph.

- Enter the PM transaction type values

from the PM Transaction Type Summary report. The total of the

column must be equal to Phase 3, Sub Total column Transaction

Type. If in balance, do the next paragraph.

- Brought forward corrections of Phase 3,

encountered during the Subsystem reconciliation.

- The cell total of column Total PM must

be equal to Phase 3 cell total column Transaction Type.

- Investigate the values of column Total

Difference and enter the correction or contra values in the appropriate

column.

- After the above your spreadsheet will be as followed.

Example:

- All the difference values were

investigated, entered into the GL Correction or Contra columns and each

correction has a label number. The Contra column must always

add-up to zero.

- Each label must have a reason under the

headings "No action corrections" or "Corrections for GL". The

user must process the GL Journals as soon as possible for the

corrections under the heading "Corrections for GL".

- The above example will carry forward

the following to period 2000 03 recon. The 3 corrections in

the PM transaction type correction column are accumulative.

Example:

Phase 5 reconciliation

Set up a sheet as illustrated below.

Example:

- Complete the following values as

printed on the above report, GL Balances for each GL Control Account

from the Summary Cost Centre report, Subsystem Balance per Account Type

from Creditor Balance report and Values from phase 3 namely subtotals

for columns Subsystem Balance and Control Account

- After the above the difference column

must zero, all three values, and the Difference between GL and Account

Type columns Total and Total Phase 3 must be equal and the value must

be equal to the total GL Correction of Phase 3.

- Enter all the corrections of Phase 4

into the appropriate column.

- If all the GL allocations were correct

during the cycle the total of row Transfers between Controls should be

zero. But if incorrect, process a GL Journal to correct the

Transfer between Control Accounts.

The above GL Journal will be

| F998 |

9474 38, |

495.63 C |

| F997 |

9474 1, |

267.00 C |

| F996 |

9474 110, |

317.59 C |

| F995 |

9474 150, |

080.22 D |

History of Changes

| Date |

System Version |

By Whom |

Job |

Description |

| 15-May-2007 |

v01.0.0.0 |

Charlene van der Schyf |

t137175 |

New manual format. |

| 29-Jan-2009 |

v01.0.0.1 |

Marchand Hildebrand |

t152121 |

Proof Read System Owner |

| 10-Jul-2009 |

v01.0.0.1 |

Charlene van der Schyff |

t158351 |

Added additional information pertaining to the Creditors Balancing. |

18-Dec-2012

|

v02.0.0.0

|

Marchand Hildebrand

|

t183060

|

Add menu options {FCSP}

|

| 07-Dec-2016 |

V04.0.0.0 |

Morgan Ntshabele |

T208911 |

Removed any reference to discontinued "Investment" and "Long Term " Subsystems

|