|

This option is also available as {FARO-26}, {FSAO1-4} and {SALUM-9}.

With this option individual ACB receipts that have been

generated in {FACO-1},{FACO-2},{FACO-3}, {SALUM-8}, {FARO-25} and {FSAO1-3} or maintained under

options {SALUM-9}, {FARO-26} and {FSAO1-4} can be maintained

(i.e. information corrected or deleted or new receipts

inserted). If this option is executed from the AR, SD or AL

subsystems, receipts can only be maintained for that specific

subsystem. These records cannot be updated once the ACB tape

has been created.

This option differs from CT in the sense that a CT receipt is not

created nor is a record written to the other subsystem

immediately. The CT receipt is only generated and the other

subsystem involved updated, on the action date, when option {FACO-6} is executed.

A corresponding deposit journal is then also created in the cash

book. (Note that individual payments can be generated from

option {FCTO-6}.

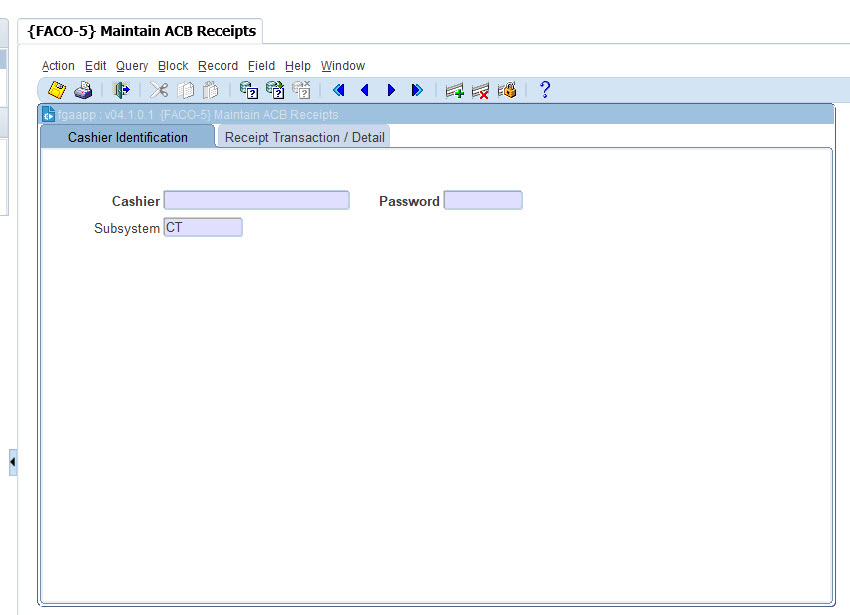

Before a cashier can start entering transactions, the cashier

must sign on as a user of the subsystem via option {FCTO-1}. Similarly,

before leaving the pay point, even temporarily, the cashier

should sign-off via option {FCTO-2}

to prevent unauthorised use of the pay point whilst unattended.

The system administrator will create a password under option {FCTM-2} and notify the cashier

of the password. The casier needs to change this

password immediately through option {FCTO-1}

to a password that will only be known to the cashier. This

password is encrypted and can thus not be seen on any report or screen.

| Field | Type & Length |

Description |

|---|---|---|

| Cashier/Password | A20/A6 | The system requests the ID

and password of the cashier. The program will validate that the user

logged onto the system and the cashier ID entered represent the same

person by checking if the cashier ID is linked to the user in {FCTM-2}. The subsystem from

which this option is executed is also displayed and cannot be

changed. After entering this information, the user proceeds

with <NEXT BLOCK> or <RETURN>.

|

|

| Field | Type & Length |

Description |

|---|---|---|

| Action Date | DD-MON-YYYY | This is the only field that can be updated on this screen. The ACB action date can be entered in this field. |

| The rest of the fields are displayed for information purposes only. | ||

| Date | DD-MON-YYYY | The system date is displayed. |

| Cash Book | A5 | The cash book as defined on the transaction type when entered on the next block. All the transaction types used in block 3 must have the same cash book code. |

| Transaction Number | N6 | The ACB transaction number is automatically generated by the system on commit. The next number is displayed and maintained on {FCTM-1}. |

| ACB User code | N4 | The ACB user code associated with the cash book code is displayed. |

| Tape Created | DD-MON-YYYY | The date on which the ACB tape was created for this receipt. |

| Generation No. | N4 | Once the ACB tape has been created, the tape generation number is displayed for each transaction generated to that specific tape. |

|

| Field | Type & Length |

Description | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Transaction Number | N6 | Same as Block 2. | ||||||||||||

| Transaction Type | N4 | Enter the transaction type for the transaction. Normal CT transaction types can be used. A <LIST> function is available. Defaults that exist on the transaction type are displayed, e.g. transaction type description, default amount, debit and credit GLA's, debtor type and the VAT code of the Cost Centre. | ||||||||||||

| Debtor | A1 | The type of debtor will

default from the Transaction Type and it cannot be updated

here. One of the following values will be displayed:

|

||||||||||||

| Debtor Number | N9 | The debtor number for

which a transaction was generated by using one of the following options

will display.

The debtor number must be entered if the generation programmes were not used. The system validates the number and displays the name of the debtor. |

||||||||||||

| Account Type | A4 | The account type that was used when the transaction was generated will display, but is updateable by the user. The account type field is mandatory if the person type of the transaction is (S)tudent, (D)ebtor or (C)reditor. For (P)ersonnel, (A)lumni and (O)ther this field must be null. If person type is (S)tudent, a list of valid account types for that student will be available and the user will only be able to process a transaction on one of these valid account types or the default account type defined for the student debtor subsystem. | ||||||||||||

| Debit GLA | A4+A8 | The descriptions of the Cost Centre and Account are displayed. | ||||||||||||

| Credit GLA | A4+A8 | The descriptions of the Cost Centre and Account are displayed. | ||||||||||||

| Tax Certificate | A1 | The user must indicate if a tax certificate must be generated for this transaction. Tax certificates can only be generated for person type (O)ther, (P)ersonnel, (A)lumni and (D)ebtor where the transaction being processed is processed against an Account Type linked to the AR category (C)ontact Debtor. If the user indicated that a tax certificate must be generated, a record will be inserted in {FTXM-2}. When this record is copied via {FACO-6} the certificates can be printed from {FTXO-1}. | ||||||||||||

| Amount | N8.2 | The transaction amount. | ||||||||||||

| VAT Code | A2 | The default VAT code associated with the Credit Cost Centre is displayed. it can be updated by the user. The VAT rate associated with the VAT code is displayed and can not be changed on this screen. | ||||||||||||

| Note | A30 | The transaction type note is displayed if the debtor type is a (S)tudent. This note can be updated by the user. If the debtor type is not (S)tudent; the note must be entered by the user. | ||||||||||||

| Payment Agreement | A4 | The payment agreement that was used when the transaction was generated will display, but is updateable by the user. | ||||||||||||

| G/L Note | A30 | The name of the debtor and the debtor number is displayed in this field and will accompany the transaction to the general ledger. It can be updated by the user. | ||||||||||||

| Loan Code | N5 | The loan code (staff- or student loan) that is being repaid by this receipt, if any. |

|

| Processing Rules |

|

|---|---|

| No special processing rules |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 30-Nov-2006 | v01.0.0.0 | Amanda Nell | t133568 | New manual format. |

| 31-Jul-2007 | v01.0.0.0 | Charlene van der Schyff | t133568 | Added correct image after alterations were done to Combo Boxes. |

| 07-Jun-2013 | v02.0.0.0 | Kenneth Bovula | f191325 | (“S&rdquo changed to (S)tudent). |

| 2-Mar-2022 |

v04.1.0.0 |

Precious Matshaya |

t249837 |

Replace IMAGES INT 4.1 |

| 01-Nov-2022 |

v04.1.0.1 |

Elmarie Roos |

T249837 |

Replace images with INT4.1 images. |