|

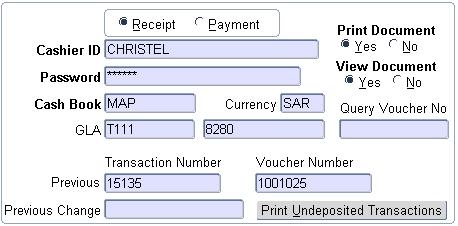

When this option is selected, the

system requests the ID and password of the cashier in block

1. After entering this information, the user proceeds with

<NEXT BLOCK> The program will validate that the user

logged onto the system and the cashier ID entered is the same person by

checking if the cashier ID is linked to the user in {FCTM-2}. The system will also

validate the cashier powers to ensure that the user is allowed to

process receipt transactions. An error message will be displayed if any

of the above is incorrect.

A system operational definition 'C6' for subsystem 'CT' (Receive money for student with action 'S') exists in {FCSM-1} that will determine if the user may accept money for a student with a status with action 'S' linked. If (N)o, the user will not be able to receive money for a student linked to a status with action 'S'. If (Y)es, the user will only receive a warning that the student is linked to a status code with action 'S'.

If the identification is valid, the next three blocks must be entered:

| Block 2 | Receipt/Payment Detail | (One record only) |

| Block 3 | Transaction Detail | (Multiple records) |

| Block 4 | Payment Method Detail | (Multiple records) |

| Field | Type & Length |

Description |

|---|---|---|

| Receipt/Payment | A1 | It is possible for the cashiers to do cash

disbursements in one of two

ways: either by indicating in this screen that the

transaction is a payment, or by processing a cheque payment on {FCTO-6}.

A payment by the debtor or

(R)eceipt on

this screen, will always be a credit to the

debtor/creditor. When the transaction type is entered in

block 4

below, the system will validate that the debit/credit indicator on the

specified transaction type is (C).

The reverse is valid for

(P)ayments.

If a (R)eceipt

is entered with a transaction type

of which

the indicator is set to (D),

and the screen is <SAVED>,

the

system will display an error message: '(R)eceipt should be

credit and

(P)ayment

should be debit for this transaction type'. |

| Cashier ID | A20 | When this option is selected, the system requests the ID and password of the cashier in block 1. After entering this information, the user proceeds with <NEXT BLOCK>. The program will validate that the user logged onto the system and the cashier ID entered is the same person by checking if the cashier ID is linked to the user in {FCTM-2}. The system will also validate the cashier powers to ensure that the user is allowed to process receipt transactions. An error message will be displayed if any of the above is incorrect. |

| Password | A8 | The cashier's password is entered here. |

| Cash Book | A5 | The cash book code to be entered. Pop-up on right click will give the description of the cashbook and a list of valid cashbook codes. |

| Currency | A3 | The currency of the cash book will be displayed from the cash book definition {FCSC-5}. |

| GLA | A4 + A8 | When a receipt is processed the debit GLA will always default from the cash book definition {FCSC-5} for the cash book code. If a payment is processed see credit GLA below. |

| Print Document | A1 | This indicator defaults from {FCTM-2}. Yes will allow the printing of receipts while a no will suppress the printing of receipts. The cashier can change this value for individual transactions. |

| Query Voucher Number | N6 | This field is used to query a receipt. Any receipt can queried regardless of when and by whom it was processed. To query a receipt, enter the voucher/receipt number in this field and <next block>. The cashier ID and password must be entered as well. On <next block> the receipt detail will be displayed. A button 'Duplicate Receipt' will also become available at the bottom of the screen that will allow the user to reprint, view or mail a copy of the document. |

| Previous Transaction Number | N6 | Displays the transaction number of the previous transaction that was processed by the cashier. |

| Previous Voucher Number | N6 | Displays the voucher number of the previous transaction that was processed by the cashier. |

| Previous Change | N6 | Displays the amount of change that was given with the previous transaction if applicable. |

| Print Undeposited Transactions | Button | This button allows for the cashier to do a quick balance check. The button will produce a report per payment method of receipts not yet deposited for the cashier and cashbook without generating a deposit. |

|

|

| Field | Type & Length |

Description |

|---|---|---|

| Person | A1 | Valid values are:

|

| Temp Type | A1 | If a receipt/payment must be processed as a (O)ther person type but biographical detail for the specific person is kept on the ITS system this field can be used to retrieve the name and address detail for the person. |

| Debtor Code | N9 | Completion of this field is

mandatory for debtor types (S)tudent,

(D)ebtor,

(P)ersonnel,

(C)reditor

and

(A)lumnus

and optional for (O)ther.

The system will check that the number is valid, and display the

name and address of the person from the relevant biographical data. If

the number is invalid, the system will display an error message:

'Invalid Number'. If the student has a financial status linked to the action code 'S' (Stop Statements) against his record, the system will block the cashier from accepting funds from such a student. |

| Date | DD-MON-YYYY | System date. Not updateable |

| Transaction Number | N6 | This number is allocated by the system on commit. A unique number is allocated per transaction. |

| Currency | A3 | The currency code of the person defaults into this field. |

| Balance | N15.2 | The account balance of the person if applicable |

| Name | A20 | For debtor types (S)tudent, (D)ebtor, (P)ersonnel, (C)reditor and (A)lumnus, the name and address will be retrieved from the biographical record. For (O)ther, the name and address of the person must be entered if a number from the system is not used. |

| Address | 4 x A20 | For debtor types (S)tudent, (D)ebtor, (P)ersonnel, (C)reditor and (A)lumnus, the name and address will be retrieved from the biographical record. For (O)ther, the name and address of the person must be entered if a number from the system is not used. |

| Email Document | A1 | Indicate if the receipt

must be mailed. If yes, the cashier will be presented with a pop-up

menu where the mail address can be entered. The cashier will not be able to mail documents from this screen if indicated on {FCTM-2} that mail not allowed. The following record needs to be defined on {GOPS-21} External Body = EML External Code Type = EMS Internal Code = CT External Code = RECEIPT (used in subject line) Description = message to accompany the mail External Body = EML External Code Type = EMF Internal Code = CT External Code = NULL Description = mail address to be used as from address |

|

| Field | Type & Length |

Description |

|---|---|---|

| Contact Sequence | N2 |

A list of the primary contact sequence numbers is available to choose from. |

| Communication Type | A2 |

The primary communication type where the address reference is 'E' |

| Email Address | A80 |

Email address as on biographical information. The cashier can also skip the contact detail and only enter an email address. |

|

The user may enter multiple records in this block.

| Field | Type & Length |

Description |

|---|---|---|

| Transaction Number | N6 | This field is not updateable. The next

transaction number will be allocated by the system and displayed upon

<SAVE>ing the transaction. |

| Voucher Number | N6 | This field is not updateable. The next

receipt number will be allocated by the system and displayed upon

<SAVE>ing the transaction. |

| Total Amount | N15.2 | If multiple lines, a running total is displayed. |

| Transaction Type | N4 | Transaction

types

are defined in {FCSO-7}. Only

active transaction types for subsystem CT can be used. The system

will validate that the person type and sign of the transaction type is

in accordance with the person type and type of transaction used in the

previous two blocks. If multiple lines are processed in this block, the system will validate that all lines are in respect of the same person. The system will however, if a receipt is processed for a (S)tudent, allow lines for person type (O)ther as well. |

| Person Type | A1 | The type of debtor will default from the

Transaction Type and it cannot be updated here. One of the

following values will be displayed:

|

| Trans Ind | A1 | For person types (S)tudent, (O)ther and (P)ersonnel, receipts can be processed for meals. This value will default from the transaction type definition {FCSO-7}, indicating if the transaction will be generated in the meal subsystem.. |

| Person | A1 | The person number defaults from block 2. |

| Account Type | A4 | The account type will default from the transaction

type, but will be updateable by the user if so defined on the

transaction type definition. The account type field is mandatory if the

person type of the transaction is (S) tudent, (D)ebtor or (C)reditor.

For (P)ersonnel and (O)ther, this field is also mandatory if the card

indicator in the transaction type definition is (Y)es. If this

indicator on the transaction type definition is (N)o, an account type

is not needed. If the person type is (S)tudent, (C)reditor or

(D)ebtor, a list of valid account types for the person type will be

available that will also show the balance for the account type. The user will only be able to process a

transaction on one of these valid account types. The program will

validate that the subsystem / account type combination is valid and

active. |

| Agreement Code | A4 | Whenever a transaction is processed for person type (S)tudent, the user will have to enter a payment agreement for the transaction. A list of valid values for the specific student will be available to choose from. This is a mandatory field for person type (S)tudent unless the transaction is processed against the default account type, or for the meal subsystem, when this field will be null. |

| Loan Code | N5 | The staff loan code or student loan code, if

applicable, can be entered here. For staff debtors the cumulative principal repayment and the reducing principal (outstanding amount) {FARS-2b2}, - will then be updated with the amount of the payment. It is essential that the debtor code be linked to an account type of which the category is 'S' (staff loans) or else the user will not be allowed to enter a loan code. For student loans, the real payment amount, as indicated on the amortization schedule {FBLO-22b4}, - will be updated with the payment amount when the next amortization calculation is run. Again it is essential that the debtor code be linked to an account type of which the category is 'L' (student loans) or else the system will not allow the user to enter a loan code. The system validates that the loan code exists for the specific debtor code for both staff and student loans. |

| Cost Centre & Account | A4 + A8 | In the case of a receipt the credit GLA will default from the account type definition {FCSC-21} if an account type is applicable. That is transactions where the debtor type is (S)tudent, (D)ebtor, (C)reditor and (S)tudent, (O)ther, (P)ersonnel where the card system indicator on the transaction type definition is (Y)es. In this case the credit GLA is not updateable by the user. If the debtor type is (A)lumni and (P)ersonnel, (O)ther where the card system indicator on the transaction type is (N)o the credit GLA will default from the transaction type definition {FCSO-7} and will be updateable by the user if so indicated on the transaction type definition. If a payment is processed see debit GLA above. |

| VAT Code | A2 | For receipts the credit cost centre determines

whether any VAT is applicable (debit cost centre in the case of

payments). The VAT code is stored with the Cost Centre on

option

{FCSO-1}. The

VAT code also determines whether any VAT apportionment

is applicable. The VAT code from the applicable cost centre

is

displayed in this field but can be updated. The VAT rate of

the cost

centres used must all have the same value, or a specific value and

zero-rated. The system will use the percentage as displayed

on the

screen, to calculate the amount for the VAT transaction, which will

automatically be generated. |

| VAT Rate | N5 | The VAT percentage of the corresponding VAT code is displayed. It can be updated. |

| Apportionment % | N5 | For a receipt the VAT apportionment always defaults to 1, meaning that no apportionment is applicable. For payments the percentage apportionment associated with the VAT code above is displayed. This field can be updated. |

| Currency | A3 | The currency code of the

cash book defaults into

this field but is updateable by the user if the payment is made in any

other currency. |

| Exchange | N5.3 | The currency rate as defined on {FCSC-21}. |

| Given Currency Value | N15.2 | The value of the currency of the payment |

| Receipt Note | A30 | Any note to appear on the receipt. For students this note defaults, according to the student's preferred language, from the transaction type note or alternative note as entered on {FCSO-7}. If the payment method as entered in Block 4 is a 'Q' then this note will be overwritten with the cheque drawer's name. This note can only then be changed manually by going back to block 3 and changing it prior to committing the transaction. |

| GL Note | A30 | Any special note to be transferred to the general ledger. On entering the person number above, the system will default the person name and number into this field. The user is allowed to update this field. |

| Sponsorship Funds | A1 | Access to this field can only be

obtained when the card

system field on the transaction type used is a

'Y'. This field indicates whether the money deposited into the card account is the student's own money or a sponsor's money. Different rules apply to the withdrawal of funds from the card account depending on the type of money deposited. Enter (Y)es to indicate sponsor money and (N)o to indicate own money. |

| Tax Certificate | A1 | Must a tax exemption certificate be

generated for the receipt (Yes/No). The system default is

'No'.

If

the account type of the debtor code is linked to category (C)ontact

then the system will default to the indicator as set up in

{FCTM-1}

The tax certificate indicator can only be updated to

'Yes'

if the

debtor type is (O)ther,

(A)lumnus, (P)ersonnel or (D)ebtor where the

category is (C)ontact.

These certificates can then be printed

from

option {FTXO-1}. |

| Bursary Year | YYYY | Enter the bursary year. |

| Bursary Code | A7 | A valid bursary code. |

| Cancellation Reason | A4 | Enter a cancellation reason to query on. |

|

| Field | Type & Length |

Description |

|---|---|---|

| Deposit Number | N6 | This field will be populated when a deposit listing is generated. |

| Change | N15.2 |

After saving the transactions, the program will display change to be

given to the person if the cash tendered was more than the payable

amount. |

| Total | N15.2 | If multiple lines, a running total will be displayed. |

| Rounding Write-Off |

N15.2 |

A ‘Denomination Rounding Factor’ per currency can be set on the currency definition {FCSO-21}

to allow the system to handle a situation where denominations of that

currency are discontinued, or where an institution prefer not to accept

specific denominations of a currency when cash payments are received

through the counter system.

The receipting program will on cash payments only round the

payment received according to the denomination rounding factor linked to the

currency and automatically generate a write-off transaction as part of the

receipt for all person types. This action will be done for cash payments

only (Payment Method = ‘C’). The program will test if the amount

contains attributes of the denomination smaller than the factor

indicated on the currency definition, and round the amount accordingly

(will always round down). The given value and amount tendered will

automatically display the rounded value and the remainder will display

in this field. |

| Imbalance | N15.2 | The total amount from block 3 is compared with the total amount from block 4. These values must always be in balance. If not, the system will display the imbalance and not allow the transaction to be saved. |

| Pay Method | A1 | The method of payment may be one of the following:

|

| Currency | A3 | The currency code will default from block 3 and cannot be changed to a different currency. |

| Exch Rate | N5.3 | The currency rate as defined on {FCSO-21}. |

| Given Currency Value | N15.2 | The total amount payable and thus the amount of the

receipt that was

entered in the previous block. This amount may be paid by a

combination of means, for instance:

The sum of the amounts entered in this block should be equal to the value of the receipt. The system will allow the user to pass this field but when the transaction is <SAVED>, the system will display: 'Total receipt amounts do not equal total payments amount'. |

| Cash Amount Tendered | N15.2 | The amount cash received by the cashier. If this amount is more than the actual amount tendered, the system will display the amount of change the cashier must pay. |

| Expiry

Date or Cheque Date |

MMYYYY DDMMYYYY |

Cheque Date (DDMMYYYY) for a cheque and Expiry Date (MMYYYY) for a credit card. Enter the cheque date if a cheque is offered. The system will not accept a post dated or expired (i.e. older than six months) cheque. If a credit card, enter the expiry date on the credit card. If a postal or money order, this field will ask for the Issued Date of the order. A postal order will not be accepted if the issue date is older than 3 months and a money order may not be older than 1 year. This field is mandatory if the payment method is Che(Q)ue, C(R)edit Card, (P)ostal Order or (M)oney Order. |

| Reference Number | A16 | Enter the number of the cheque, postal order, credit card or debit card etc. |

| Drawer Name | A18 | If the payment is made by cheque or money order, the name of the drawer is entered. |

| Bank Guarantee | A1 | Indicate by Yes or No whether the cheque is guaranteed. |

| Branch Number | N2-N2-N2-N2 | Enter the Bank IT-number. This field is mandatory, since the commercial banks require that the IT-number be displayed on the bank deposit list. |

| Budget | N2 | Enter the budget term of credit card, if any. This field is not mandatory. |

| Print Summary Receipt | Button | This button is only available if the cashier is linked to printer choice 7 or 8 on {FCTM-2}. It will allow the user to print a summary of the receipt detail on a separate document e.g. the back of a cheque received. |

| Print Duplicate Receipt | Button | This button will always be available if the cashier is linked to printer choice 7 and 8 on {FCTM-2}. For all other printer choices, the button will be available when a receipt is queried by using the query field on block 1. In these cases, the duplicate receipt button will allow the cashier to reprint, view or mail a copy of the document. |

| Next Transaction | Button | This button will clear the screen to allow the process of the next transaction in cases where necessary. When a record is queried in block-2 and the next transaction button is pressed, the screen will be cleared to allow the processing of the next transaction. Should the cursor be in block-3, the next record button will be greyed out and next record will not be allowed. |

|

|

| Processing Rules |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

NB: The only printer choice that will use

the style sheet for view, print and mail is printer choice 9. All other

printer choices will use the style sheet for view and mail only.

|

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 07-May-2007 | v01.0.0.0 | Amanda Nell | t12345 | New manual format. (Still busy with manual) |

| 23-Sep-2009 | v01.0.0.1 | Charlene van der Schyff | t161944 | Complete manual with New screen dumps. |

| 30-Jul-2010 | v02.0.0.0 | Christel van Staden | t168728 | Add view and mail |

| 06-Dec-2010 | v02.0.0.1 | Christel van Staden | t168830 | Correct spelling errors |

| 23-Jan-2012 | v02.0.0.2 | Macfarlane Thipe | f179172 | More information added on the use of Next Transaction Button |

| 07-Mar-2013 |

v03.0.0.0 |

Christel van Staden |

t186723 |

Add denomination rounding |

| 28-Jun-2013 |

v03.0.0.1 |

Nokuthula Mafenuka |

t191705 |

Add debit card payment method |

| 03-Sep-2013 |

v03.0.0.2 |

Christel van Staden |

t189862 |

Add SOD C6 for subsystem CT |

| 02-Dec-2016 | V04.0.0.0 | Ntshabele Morgan | T208911 | Removed Investment Number Field. |