|

| User Selection | Prompt Text * an item between square brackets [ ] is the default answer |

Type & Length |

Comments |

|---|---|---|---|

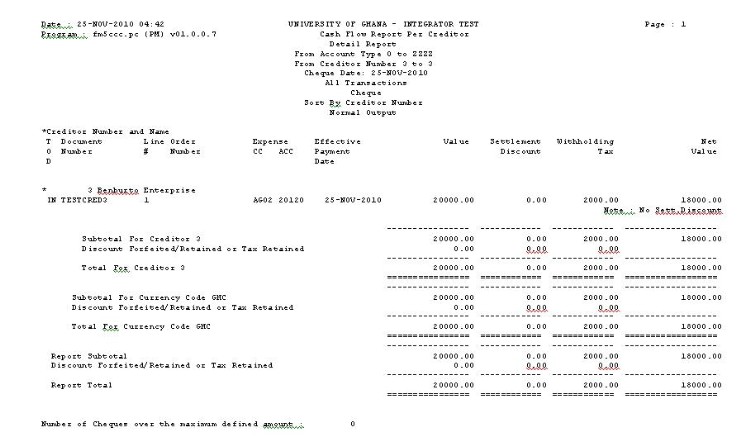

| Run Program For: [C]ash Flow Forecast, Or (P)ayments Your Selection | |||

| If Cash Flow then (S)ummary or (D)etail If Payments | |||

| Cashier ID | |||

| Cashier Password | |||

| Payment Method to Process: 1 - Cheques 2 - National Drafts (Bank Transfers) 3 - International Drafts 4 - Journals 5 - ACB Your Selection (1-5) |

|||

| Start/End Account Type | |||

| First / Last Creditor To Generate For | |||

| Payment Date To Be Printed On (This date must be equal to or greater than system date) |

|||

| Selection: 1. All outstanding invoices 2. Invoices payable before a specified date (If 2., date is requested) IMPORTANT: The system will control that the effective pay date is later than payment date. |

|||

| Lastly the program will display the following message Creditor (N)umber Or N(A)me |

|

| Processing Rules |

|

|---|---|

| No special processing rules. |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 11-Jun-2008 | v01.0.0.0 | Magda van der Westhuizen |

t149068 | New manual format. |

| 14-Jul-2009 | v01.0.0.0 | Magda van der Westhuizen | t160160 | Insert image and links. |

| 22-Jan-2011 | v01.0.0.1 | Hermien Hartman | t170695 | New image to show Withholding Tax info. |