|

These

applications are common to the requisition, order and goods received

input applications although field attributes may differ depending on

the type of document processed. These applications are normally not

directly accessible from a menu but from related Pop Up Menus on fields

in the Requisition, Order or Goods Received options. The ITS philosophy

is that the user should be able to enter a request or order on the

Requisition or Order options; should the user however require

additional functionality the functionality is available and directly

accessible from the record on a second or third level.

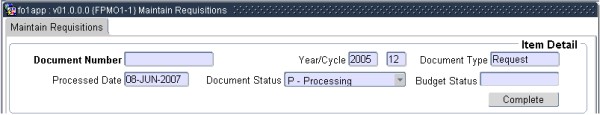

| Field | Type & Length |

Description |

|---|---|---|

| Document Number | A10 | Displays the document number created or queried by the

user in the

Requisition, Order or Goods Received options. If the system operational

definition AR

"Document Numbers set to A or B Auto

Generated Numbers {FCSM-1}

must be set for:

|

| Document Type | A2 | Displays the type of document queried by the user. |

| On Appro | A1 | Valid values are (Y)es or (N)o. If items are ordered on approval, then the user must set this indicator to (Y)es. For these documents, the system will not allow the user to change the status from processing to any other status. If the items are on appro, the user will query the applicable document, change this indicator to (N)o and continue with procedures to change the document status. The document will then be handled in the normal manner. The system defaults to (N)o in this field. |

| Print Indicator | A1 | Valid values are (Y)es or (N)o. The system defaults to (N)o in this field. Documents can only be printed if the document Status is Normal, budget control is Sufficient, Forced or Rejected, approval fields are set to Approved or Rejected and the background printing function has been created {GPRT-3}. The user can force the printout by changing this field value to (Y)es and <COMMIT>, the same rule will be applicable as previous described. |

| Originate from | A1 | This field cannot be accessed by the user but the field

can be

queried. Programs that create the document will assign a

value to the

field. The following is a list of the values. |

| Status | A1 | Displays the document status of the document. Valid

values are

Processing, (Verification), Buyer, Insufficient Funds, Approval 1,

Approval 2 Normal or Change.

In this status

the user can process a document over a period of time using different

session. After creation the user queries the document and can continue

adding items or add changes to the document. A document in

this status

cannot be printed and will not reflect as an outstanding order for the

creditor. If budget control was performed on the a line on the document

and the budget was sufficient the line will reflect as an outstanding

commitment on the General Ledger The document cannot be use in a higher

hierarchy document.

When

a requisition changes status from processing and an item on the

requisition exists where the subsystem of the item is purchase order

(PO), the document will change status to the verification status. In

this status buyers can add item quotations to requested PO items,

update the approve creditor on PO items, accept or reject PO items on a

request and perform budget control on the document {FPMO1-3}.

The

document will not change status to a next status unless all items on

the document including cheque request are accepted or rejected and the

approved creditor on all items and the required number of quotations

have been linked to each PO item. Rejecting an item sets the budget

indicator and all approval fields on the item to rejected.

When

a requisition changes status from processing and an item on the

requisition exists where the subsystem of the item is counter system

(CT), the document will change status to the verification status. In

this status cashiers can add or remove lines on cheques request, update

the cheques amount and perform budget control on the document

{FCTO-11}. The document will not change status to a next status unless

all items on the document including purchase order items are accepted

or rejected. Rejecting an item sets the budget indicator and all

approval fields on the item to reject.

During

this status the user can only force or reject items on the document.

The document will not change status unless the budget indicator on all

lines on the document are set to sufficient, forced or rejected.

Rejecting an line sets the budget indicator and all approval fields on

the line to rejected. If the financing method of the item is percentage

or cost rejecting a line rejects the item.

During

this status approving users can only approve or reject items on the

document. The user cannot add or delete items in this status.

Rejecting a line sets the approval fields on the line to rejected. If

the financing method of the item is percentage or cost rejecting a line

rejects the item.

During this status

approving users can only approve or reject items on the

document. The

user cannot add or delete items in this status. Rejecting a line sets

the second approval fields on the line to rejected. If the financing

method of the item is percentage or cost rejecting a line rejects the

item.

In this status the

document is a

financial document. A document in this status can be printed,

reflected as an outstanding Commitment on the General Ledger if the

budget flag is S or F and is an outstanding order for the creditor and

can be used in a higher hierarchy document. A document in

this status

can be changed as long as the document was not used in a higher

hierarchy document. If the document is changed the system

will force

the user to create a change record in and then the program will reset

the status flag to Change. The change status is the same as

the

processing status.

The program sets the

status

to change when the user makes any change a document which has the the

status of normal. While the status is change, the user can change or

add to a document. The user must query the document and make the

required changes. A document in this status cannot be printed and will

not reflect as an outstanding order for the creditor. If budget control

was performed on the a line on the document and the budget was

sufficient, the line will reflect as an outstanding commitment on the

General Ledger The document cannot be used in a higher hierarchy

document.

|

| Change/Cancel | A1 | Displays Complete, Cancel, Change or Null. This field

is not a data

base field. The Change/Cancel indicators are:

This document was

"Completed". Completing a document means that the

document was used in a higher hierarchy document but not all units of

the document were required and the not used units were cancelled.

Completing a

document updates the units on the document to the total

units used in higher hierarchy documents.

This document was

"Cancelled". Cancelling a document means that the

document was not used in a higher hierarchy document and all the values

were set to zero.

The document has

neither been completed or nor cancelled. After running

the validation program (Complete Button) and setting the

document status to "Normal" for the first time, changes made by users

will be applied to the document.

No changes have been

made to the document after document status was set

to "Normal" for the first time by the validation program.

|

| Document Updateable | A1 | Valid values are (Y)es or (N)o. The field indicates if there are Items of the document that are updateable. This field is not a data base field and is not accessible by the user. The system defaults (N)o in the field if all Items of the document were used in a higher hierarchy document else (Y)es. |

| Budget Control | A1 | The

field indicates the status of the budget control fields on documents

level for document GLA lines. Valid values are Incomplete Information,

Sufficient, Insufficient, Forced, or Rejected. Document Budget Status The following describes the document budget status indicator.

|

| Approved | A1 | The field summarizes the status of the approval fields

of item lines on document level. Valid values are (N)o or (Y)es. This

field is not a data base field, not accessible by the user and it

summaries the approved fields as follows: (N)o If (N)o, records

exist on item detail lines which are rejected.

(Y)esIf (Y)es, at least

one of the records in Block 9 was approved.

|

| B2B | A1 | Indicates if the Creditor is linked to the document is

a "Business To

Business" vendor, the document will automatically be sent to the

"Business To Business" exchange agent as soon as the document status is

"Normal". |

| User | A8 | The default of this field is the User Code of the user who created the document. |

| Year | YYYY | The default of this field is the current PM subsystem year. If the user is linked to the restriction FPFD then he/she is allowed to change the year to the next year. If the document is Send Back Processing, the year is less than the current PM year and the user changed the document, the year will be updated by the program to the current PM year. |

| Cycle | N2 | The default of this field is the current PM subsystem cycle. If the user is linked to the restriction FPFD the user is allowed to change the cycle to any future cycle. If the document status is processing and the cycle is less than the current PM cycle and the user changed the document, the cycle will be updated by the program to the current PM cycle. |

| Process Date | DD-MON-YYYY | The default of this field is the current system

date. The user is not

allowed to change the date but is allowed to query on the

date. If the

document status is processing, and the date is less than the current

system date and the user made changes to the document, the date will be

updated by the program to the current system date. |

| Document Date | DD-MON-YYYY | The default of this field is the current system date. The user is allowed to change the date as long as the date is in the range of 01-JAN-1980 up to the default date. |

| Local Currency | N15.2 | Display the net total of all items on the document after VAT in field local currency. Net total of the document before VAT in local currency. |

| VAT | N15.2 | Display the total VAT of items on the document .

Document total for VAT in local currency. |

| Total | N15.2 | Display the total of items on the document. VAT Inclusive document total in local currency. |

|

The creditor detail page is only available on Order and Goods Received Voucher.

| Field | Type & Length |

Description |

|---|---|---|

| Creditor | N10 | Displays the code, name, currency and preferred language of the creditor linked to the document. |

| Contact Sequence | N2 | The contract sequence number 0 (Zero) will default for the above creditor. The contact type and description will be displayed. The user may change this contact sequence to any valid contact sequence of the creditor code. List function displays the contact sequence plus primary indicator, type code and contact name. |

| Address Type | A2 | The primary order address type will default for the

above creditor and

contact sequence. The four address lines and postal code will

be

displayed. The user may change this address type to any valid

address

type of the creditor code and contact sequence. List function

displays

the address type plus address type description. |

| Telephone Type | A2 | The work telephone type (in other words, the

communication details)

will default for the above creditor and contact sequence. The

telephone type description and telephone number will be

displayed. The

user may change this telephone type to any valid telephone type of the

creditor code and contact sequence. List function displays

the

telephone number plus type description. The list function

will exclude

fax types. |

| Fax Type | A2 | The fax type (in other words, the communication

details) will default

for the above creditor and contact sequence. The fax type

telephone

number will be displayed. The user may change this fax type

to any

valid fax type of the creditor code and contact sequence.

List

function displays the fax type plus telephone number and type

description. The list function will only include fax types. |

|

| Field | Type & Length |

Description |

|---|---|---|

| Note | A160 | A Note field for any relevant information concerning a document. This information will not print on the order and more detail notes per document can entered on the general note application. |

|

The delivery instructions are only available on Order and Goods Received Voucher

| Field | Type & Length |

Description |

|---|---|---|

| Department Code | A4 | Enter the code of the department where the delivery must take place by the supplier. The system will display the description. |

| Person Type | A1 | Valid values are Null, Other, Personnel or

Student. The following describes each value:

If

the user left the field null then the user will not be allowed to

complete the fields Person Number, Person Name and Person Telephone

Type.

The user can only

enter Other Users information

as defined in option {GOPS-3b1 & 2} for the system code FIN in

the

fields Person Number, Person Name and Person Telephone Type.

The

user can only enter Personnel information as defined in option {PBOP-1}

in the fields Person Number, Person Name and Person Telephone Type.

The

user can only enter Student information as defined in option {SREGB-1}

and is registered in the current year in the following fields Person

Number, Person Name and Person Telephone Type.

|

| Person Number | N9 | Enter the Person Number that can be contacted by the supplier or is responsible for the order at the Institution. A list function will display all the valid numbers and their names. The name of the person number will be displayed in the Person Name field. |

| Person Name | A40 | After the user has entered the Person Number, the system will display a name in this field, but if the user wants to change any information in this field, they can do so. This name as committed will be printed on the order document. |

| Telephone Type | A2 | Only valid telephone types of the person number can be used. A list function displays all the valid telephone types and numbers. The telephone number will be displayed. |

| Delivery Date | DD-MON-YYYY hh24mm | This date is an indication to the supplier when the

Institution expects

the delivery. The system will display the delivery date using

the

document date and adding the lead time from the creditor

definition..

The hour and minutes will be displayed as 00:00. The user can

change

the information of this field as long as the date is greater than the

system date. |

| Building Code | A4 | The building code where the supplier must deliver the order. This is not a mandatory field or a prerequisite for the building name field. A list function will display all the valid building codes and description. The building name will be displayed in the Building Name field. |

| Building Name | A30 | The building name where the supplier must deliver the order. The user may change any value that was displayed by the system or if null enter the building name. |

| Floor | N2 | The floor number of the building name where the supplier must deliver the order. A list function will be available only if valid building codes exist. The user may change the valid values to any other value. |

| Room | A7 | The room number of the building name where the supplier

must deliver

the order. A list function will be available only if valid

building

and floor codes exist. The user may change the valid values

to any

other value. |

| Return to Requisitions Return to Orders Return to Goods_Received |

|

Processing Rules for this Block (delete if not applicable).

| Field | Type & Length |

Description |

|---|---|---|

| x | x | x |

|

This application is used to capture internal delivery instruction. Internal delivery instructions are the delivery information given by the item requestor instructing where to deliver the item. Each line can have a delivery instruction.

| Field | Type & Length |

Description |

|---|---|---|

| Document Number | A10 | Displays the document number created or queried by the user in the Requisition, Order or Goods Received options. Documents cannot be created in the applications |

| Document Type | A2 | Displays the document type of the document number created or queried by the user. |

| Item Detail Type | A1 | Displays the item detail type of the line on the document created or queried by the user. |

| Quantity Requested | N6.3 | Displays the requested quantity entered by the user on the item in the requisition or order application. |

| Item Type | A1 | Displays the Item type of the item namely Stock, General, Library or Non-Defined Item. |

| Item Number | N8 | Displays the item number of the item if the item type is Stock, General or Library. |

| Description | A40000 | Displays the item description. |

| Campus Code | N2 | The campus code where internal despatch must deliver the item. This is not a mandatory field. The description of the campus code will be displayed. |

| Department Code | N4 | Enter the code of the department where the delivery

must take place. The system will display the description. |

| Contact Person Type | A1 | Valid values are Null, Other, Personnel or Student. The following describes each value:

If

the user left the field null then the user will not be allowed to

complete the fields Person Number, Person Name and Person Telephone

Type.

The user can only

enter Other Users information

as defined in option {GOPS-3}, TAB -b1 and {GOPS-2} for the system code FIN in

the

fields Person Number, Person Name and Person Telephone Type.

The

user can only enter Personnel information as defined in option {PBOP-1}

in the fields Person Number, Person Name and Person Telephone Type.

The

user can only enter Student information as defined in option {SREGB-1}

and if the student is registered in the current year, in the fields

Person Number, Person Name and Person Telephone Type.

|

| Contact Person Number | N9 | Enter the person's number that can be contacted by the

internal

despatch or is responsible for the requesting of the item. A

list

function will display all the valid numbers and their names.

The name

of the contact person's number will be displayed in the Contact Person

Name field as well as the campus, building code and name, floor and

room depending on the existence of this information on the person type

definitions. |

| Contact Person Name | A30 | After the user has entered the contact person's number the system will display a name in this field, but if the user wants to change any information in this field, they can do so. This name as committed will be printed on the delivery document. |

| Contact Person Telephone Type | A2 | Only valid contact telephone type of the person number

can be used. A

list function displays all the valid telephone types and

numbers. The

telephone number will be displayed. |

| Building Code | N4 | The building code where internal despatch must deliver the item. This is not a mandatory field or a prerequisite for the building name field. A list function will display all the valid building codes and description. The building name will be displayed in the Building Name field. |

| Building Description | A30 | The building name where internal despatch must deliver the item. The user may change any value that was displayed by the system or if null enter the building name. |

| Floor | N2 | The floor number of the building code where internal despatch must deliver the item. A list function will be available only if valid building codes exist. The user may change the valid values to any other value. |

| Room | A7 | The room number of the building code where internal

despatch must

deliver the item. A list function will be available only if

valid

building and floor codes exist. The user may change the valid

values

to any other value. |

| Delivery Date | DD-MON-YYYY hh24mm | This date is an indicator for the contact person when he can expect the delivery. The system will display the delivery date using the document date and adding the value of system operational definition code AA. The hour and minute will be displayed as 00:00. The user can change the information of this field as long as the date is greater than the default date. |

| Return to {FPMO1-1} Return to Orders Return to Goods_Received |

|

| Field | Type & Length |

Description |

|---|---|---|

| Item Type | A1 | Displays the Item type of the item namely Stock, General, Library or Non-Defined Item. |

| Item Number | N8 | Displays the item number of the item if the item type is Stock, General or Library. |

| Description | A4000 | Displays the item description. |

| Creditor | N9 | Displays the creditor code, name and currency of the approved creditor. |

| Document Number | A10 | Displays the document number of the document the user is processing. |

| Document Type | A2 | Displays the document type of the document the user is processing. |

| Line Number | N3 | Displays the line number allocated to the item by the system when the line was created. |

| Quantity Requested | N6.3 | Displays the requested quantity enter by the user on the item. |

|

| Field | Type & Length |

Description |

|---|---|---|

| Cost Centre | A4 | Supply the Cost Centre that will pay for the

expense. The

cost centre will populate fields VAT Apportionment Percentage and

Creditor Account Type depending on cost centre definition. Pop Up Menu - available on field Cost Centre

|

| Account | A8 | Supply the account of the cost centre / account

combination that will bear the expense. The account will

populate the

field Asset Indicator. Pop Up Menu - available on account field

|

| Quantity | N9.3 | The number of units that must be supplied.

Unit can

have up to 3 decimals. The sum of quantity for all the lines per item

must always equal the quantity requested in Block 1. Pop Up Menu - available on the quantity field.

|

| Total | N17.2 | Displays the item unit total value in local currency, VAT inclusive for the line item. |

| GL Note | A30 | An optional note to accompany the GL-transaction. The system will insert the first 30 characters of the item description into this field. The user can update the GL Note. |

| Asset Indicator | A1 | Valid values are (Y)es or (N)o. The system will set this indicator to (Y)es, if the expense GLA (in B. above) is linked to the asset account category as defined on the system operational definition code AV and AW, else to (N)o. Asset category values can either be between 410 and 419 or 890 and 899, i.e. expenditure on fixed assets. The user may change the default values. |

| Apportionment Percentage | N6.3 | Value range of this field is 0 to 100.000. The system will default the VAT apportionment of the VAT Rate Code {FCSC-1} link is to the cost centre {FCSO-1b1} of the expense GLA (in A above). |

| Creditor Account Type | A4 | The account type

as defined under option {FCSC-21}.

The system will default an account

type firstly from the cost centre definition, if not found there, then

from the transaction type definition and if not found there, then on

the creditor definition. If this field remains null the user

must

supply a valid account type. Pop Up Menu - available on the account type field.

|

| Budget Control | A1 | The budget control status of a line is displayed in

this

column.

Display values are Incomplete Information, Sufficient, Forced, Rejected

or Insufficient. The displayed budget status of a line is updated when

the user clicks the "Complete_Button" on Block 1 of the requisition or

order application or the user "Forces" or "Rejects" a line by

using

the "Override_Insufficient_Funds" option available on menus or selects

the "Do Budget Control" option. Budget Statuses The following describes each budget status indicator.

|

| Job Number | N8 | Supply a valid job number of the project to link this

item to a

Job number. Job numbers are defined under option

{FJCO-1}. If

entered, the GLA of the job number will be the default for the expense

GLA field of this Block. Pop Up Menu - available on field job number.

|

|

This block is a display only block and is not accessible to the user. The total quantity and VAT inclusive item total in local currency and quantity "Not Distributed" are displayed in this block.

| Field | Type & Length |

Description |

|---|---|---|

| Total | Quantity Displays the sum of all quantity lines on the item. | |

| Total | Total Displays the sum of the VAT inclusive item total in local currency for all lines on the item. | |

| Not Distributed | Displays the difference of the quantity requested in the requisitions or order application and the sum of the quantity lines (see A). The user cannot commit records on this application if the value of the not distributed value is no | |

| Return to {FPMO1-1} Return to Orders Return to Goods_Received |

|

Percentage distribution is

used when an item is funded by a partnership of cost centres and the

basis of funding is percentage. Percentage must always add up to 100%.

This screen differs from the quantity distribution screen in that the

field quantity is replaced with the field percentage. When calculating

the not distributed value the sum of percentages for individual lines

must add up to 100%. The user cannot commit a record in the application

unless the "Not Distributed" percentage is zero (0.000). The rejection

of "Insufficient Funds" or "Approvals" of a line disapproves all other

lines of a item.

Financial Item Detail - Percentage

Distribution Block 1

This block

is a display only block. The document and item detail from which the

user selected to drill down is displayed in this block..

| Field | Type & Length |

Description |

|---|---|---|

| Item Type | A1 | Displays the Item Type of the item namely Stock, General, Library or Non-Defined Item. |

| Item Number | N8 | Displays the Item Number of the item if the Item Type is Stock, General or Library. |

| Description | A4000 | Displays the item description. |

| Creditor | N9 | Displays the Creditor Code, name and currency of the approved creditor. |

| Document Number | A10 | Displays the Document Number of the document the user is processing. |

| Document Type | A2 | Displays the Document Type of the document the user is processing. |

| Line Number | N3 | Displays the line number allocated to the item by the system when the line was created. |

| Percentage | N6.3 | Always displays 100 referring to 100 %. |

|

| Field | Type & Length |

Description |

|---|---|---|

| Cost Centre | A4 | Supply the Cost Centre that will pay for the expense.

The cost centre

will populate fields VAT Apportionment Percentage and Creditor Account

Type depending on cost centre definition. Pop Up Menu - available on field Cost Centre.

|

| Account | A8 | Supply the account of the cost centre / account

combination that will bear the expense. The account will

populate the

field Asset Indicator. Pop Up Menu - available on the account field.

|

| Percentage | N6.3 | This percentage indicates the partners' contribution

to the partnership. The value range is between .001 and 100.000. The

sum of percentage for all lines on the item must equal 100.000. Pop Up Menu - available on field percentage.

|

| Total | N17.2 | Displays the item unit total value in local currency VAT inclusive for the line in. |

| GL Note | A30 | An optional note to accompany the GL-transaction. The system will insert the first 30 characters of the item description into this field. The user can update the GL Note. |

| Asset Indicator | A1 | Valid values are (Y)es or (N)o. The system will set this indicator to (Y)es, if the expense GLA (in B. above) is linked to the asset account category as defined on the system operational definition code AV and AW, else to (N)o. Asset category values can either be between 410 and 419 or 890 and 899, i.e. expenditure on fixed assets. The user may change the default values. |

| Apportionment Percentage | N6.3 | Value range of this field is 0 to 100.000.

The system will default the

VAT apportionment of the VAT Rate Code {FCSC-1}

link is to the cost

centre {FCSO-1b1} of the expense GLA (in A. above). |

| Creditor Account Type | A4 | The Account Type as defined under option {FCSC-21}. The system will

default an Account Type firstly from the cost centre definition, if not

found there, then from the transaction type definition and if not found

there, then on the creditor definition. If this field remains

null the

user must supply a valid account type. Pop Up Menu - available on field Creditor Account Type.

|

| Budget Control | A1 | The Budget_Status of a line is displayed in this column. Display values are Incomplete Information, Sufficient, Forced, Rejected or Insufficient. The displayed budget status of a line is updated when the user clicks the "Complete_Button" on Block 1 of the requisition or order application or the user "Forces" or "Rejects" a line by using the "Override_Insufficient_Funds" option available on menus or selects the "Do Budget Control" option. |

| Job Number | N8 | Supply a valid job number of the project to link this

item to a Job

number. Job numbers are defined under option {FJCO-1}. If entered,

the GLA of the job number will be the default for the expense GLA field

of this Block. Pop Up Menu - available on field job number.

|

|

This block is a display only block and is not accessible to the user The total quantity and VAT inclusive item total in local currency and quantity "Not Distributed" are displayed in this block.

| Field | Type & Length |

Description |

|---|---|---|

| Total | Quantity Displays the sum of all percentage fields on the item. | |

| Total | Total Displays the sum of the VAT inclusive item total in local currency for all lines on the item. | |

| Not Distributed | Displays the difference of the 100% the sum of the line percentages (see A). The user cannot commit records on this application if the value of the not distributed value is not zero. | |

| Return to Requisitions Return to Orders Return to Goods_Received |

|

Cost distribution is used when an item is funded by a partnership and the basis on which the partners contribute to funding the item is cost. Cost is the total VAT inclusive cost value before trade discount in creditor currency. This application differs from the quantity distribution application in that the field quantity is replaced with the field cost. When calculating the not distributed value the sum of cost for individual lines is subtracted from to the total item cost. The user cannot commit a record in the application unless not distributed cost is zero (0.0000) The rejection of "Insufficient Funds" or "Approvals" of a line disapproves all the other item lines.

Financial Item Detail - Cost Distribution Block 1

| Field | Type & Length |

Description |

|---|---|---|

| Item Type | A1 | Displays the Item type of the item namely Stock, General, Library or Non-Defined Item. |

| Item Number | N8 | Displays the Item Number of the item if the Item Type

is Stock, General or Library. |

| Description | A4000 | Displays the item description. |

| Creditor | N9 | Displays the Creditor Code, name and currency of the approved creditor. |

| Document Number | A10 | Displays the Document Number of the document the user is processing. |

| Document Type | A2 | Displays the Document Type of the document the user is processing. |

| Line Number | N3 | Displays the Line Number allocated to the item by the system when the line was created. |

| Item Total | N17.2 | Displays the total VAT inclusive cost value before trade discount for this item detail type in foreign currency. |

|

The user enters the application with the cursor in the cost centre field. Entering the application automatically queries the document and item from which the user selected to drill down. The first lines always displays the expense GLA as entered by the user on the requisitions or order application and acts as the senior partner of the funding partnership, regardless of the cost born by the financing partner. The user will only be able to access this application if the financing method entered on the order or requisition application is "C" Cost. On this block the GLA, quantity and total fields column widths are fixed where as all other fields can be dragged to enlarge or reduce the displayed size.

| Field | Type & Length |

Description |

|---|---|---|

| Cost Centre | A4 | Supply the Cost Centre that will pay for the expense.

The cost centre

will populate fields VAT Apportionment Percentage and Creditor Account

Type depending on cost centre definition. Pop Up Menu - available on field Cost Centre.

|

| Account | A8 | Supply the account of the cost centre / account

combination that will bear the expense. The account will populate the

field Asset Indicator. Pop Up Menu - available on the account field.

|

| Cost | N15.2 | The cost value entered indicates the amount a partner's

contribution to the partnership. Pop Up Menu - available on the cost field.

|

| Total | N17.2 | Displays the item unit total value in local currency, VAT inclusive for the line item. |

| GL Note | A30 | An optional note to accompany the GL-transaction. The system will insert the first 30 characters of the item description into this field. The user can update the GL Note. |

| Asset Indicator | A1 | Valid values are (Y)es or (N)o. The system will set this indicator to (Y)es if the expense GLA (in B. above) is linked to the asset account category as defined on the system operational definition code AV and AW, else to (N)o. Asset category values can either be between 410 and 419 or 890 and 899, i.e. expenditure on fixed assets. The user may change the default values. |

| Apportionment Percentage | N6.3 | Value range of this field is 0 to 100.000.

The system will default the

VAT apportionment of the VAT Rate Code {FCSC-1}

link is to the cost

centre {FCSO-1b1} of the expense GLA (in A above). |

| Creditor Account Type | A4 | The account type as defined under option

{FCSC-21}. The system

will default an account type firstly from the

cost centre definition, if not found there, then from the transaction

type definitionand if not found there, then on the creditor

definition. If this field remains null the user must supply a

valid

account type. Pop Up Menu - available on the creditor account type field.

|

| Budget Control | A1 | The budget Budget_Status of a line is displayed in this column. Display values are Incomplete Information, Sufficient, Forced, Rejected or Insufficient. The displayed budget status of a line is updated when the user clicks the "Complete_Button" on Block 1 of the requisition or order application or the user "Forces" or "Rejects" a line by using the "Override_Insufficient_Funds" option available on menus or selects the "Do Budget Control" option. |

| Job Number | N8 | Supply a valid job number of the project to link this

item to a Job number. Job numbers are defined under option {FJCO-1}.

If entered, the GLA of the job number will be the default for the

expense GLA field of this Block. Pop Up Menu - available on field job number.

|

|

This block is a display only block and is not accessible to the user The total quantity and VAT inclusive item total in local currency and quantity "Not Distributed" are displayed in this block.

| Field | Type & Length |

Description |

|---|---|---|

| Total | Quantity Displays the sum of all quantity lines on the item. | |

| Total | Total Displays the sum of the VAT inclusive item total in local currency for all lines on the item. | |

| Not Distributed | Displays the difference of the quantity requested in

the requisitions

or order application and the sum of the quantity lines (see A). The

user cannot commit records on this application if the value of the not

distributed value is not zero. |

|

| Return to Requisitions Return to Orders Return to Goods_Received |

|

| Field | Type & Length |

Description |

|---|---|---|

| Item Type |

A1 | Displays the Item Type of the item namely Stock, General, Library or Non-Defined Item. |

| Item Number | N8 | Displays the Item Number of the item if the Item Type is Stock, General or Library. |

| Description | A4000 | Displays the item description. |

| Creditor | N9 | Displays the Creditor

Code, name and currency of the approved creditor. |

| Document Number | A10 | Displays the Document Number of the document the user is processing. |

| Document Type | A2 | Displays the Document Type of the document the user is processing. |

| Line Number | N3 | Displays the Line

Number allocated to the item by the system when the line was created. |

| Quantity Requested | Displays the requested quantity entered by the user on the item in the requisition or order application. |

|

The user enters the application with the cursor in the store code field. On entering the application the application automatically queries the document/item from which the user selected to drill down. The first line always displays the expense GLA as entered by the user on the requisitions or order application. On this block the GLA, quantity and total fields column widths are fixed where as all other fields can be dragged to enlarge or reduce the displayed size.

| Field | Type & Length |

Description |

|---|---|---|

| Store Code | A2 | Supply a valid store code for this item. Store codes

are defined under

option {FPMM-22}. Different store codes per item may be linked. Pop Up Menu - available on field store code.

|

| Cost Centre | A4 | Supply the Cost Centre that will pay for the expense.

The cost centre

will populate fields VAT Apportionment Percentage and Creditor Account

Type depending on cost centre definition. Pop Up Menu - available on field Cost Centre.

|

| Account | A8 | Supply the account of the cost centre / account

combination that will

bear the expense. The account will populate the field Asset

Indicator. Pop Up Menu - available on the account field.

|

| Quantity | N9.3 | The number of units that must be supplied. Unit can

have up to 3

decimals. The sum of quantity for all the lines per item must always

equal the quantity requested in Block 1. Pop Up Menu - available on the quantity field.

|

| Total | N17.2 | Displays the item unit total value in local currency, VAT inclusive for the line in. |

| GL Note | A30 | An optional note to accompany the GL-transaction. The system will insert the first 30 characters of the item description into this field. The user can update the GL Note. |

| Asset Indicato | A1 | Valid values are (Y)es or (N)o. The system will set this indicator to (Y)es if the expense GLA (in B. above) is linked to the asset account category as defined on the system operational definition code AV and AW, else to (N)o. Asset category values can either be between 410 and 419 or 890 and 899, i.e. expenditure on fixed assets. The user may change the default values. |

| Apportionment Percentage | N6.3 | Value range of this field is from 0 to 100.000. The system will default the VAT apportionment of the VAT Rate Code {FCSC-1} link to the cost centre {FCSO-1b1} of the expense GLA (in A above). |

| Creditor Account Type | A4 | The Account Type as defined under option {FCSC-21}. The

system will

default an account type firstly from the cost centre definition, if not

found there then from the transaction type definition and if not found

there, then on the creditor definition. If this field remains

null the

user must supply a valid account type. Pop Up Menu - available on creditor account type field

|

| Budget Control | A1 | The budget Budget_Status of a line is displayed in this column. Display values are Incomplete Information, Sufficient, Forced, Rejected or Insufficient. The displayed budget status of a line is updated when the user clicks the "Complete_Button" on Block 1 of the requisition or order application or the user "Forces" or "Rejects" a line by using the "Override_Insufficient_Funds" option available on menus or selects the "Do Budget Control" option. |

| Job Number | N8 | Supply a valid job number of the project to link this

item to a Job number. Job numbers are defined under option

{FJCO-1}.

If entered, the GLA of the job number will be the default for the

expense GLA field of this Block. Pop Up Menu - available on field job number.

|

|

This block is a display only block and is not accessible to the user The total quantity and VAT inclusive item total in local currency and quantity "Not Distributed" are displayed in this block.

| Field | Type & Length |

Description |

|---|---|---|

| Total | Quantity Displays the sum of all quantity lines on the item. | |

| Total | Total Displays the sum of the VAT inclusive item total in local currency for all lines on the item. | |

| Not Distributed | Displays the difference of the quantity requested in

the requisitions

or order application and the sum of the quantity lines (see A). The

user cannot commit records on this application if the value of the not

distributed value is not zero. |

|

| Return to Requisitions Return to {FPMO3-1} Return to Goods_Received |

|

| Field | Type & Length |

Description |

|---|---|---|

| Item Type | A1 | Displays the Item type of the item namely Stock, General, Library or Non-Defined Item. |

| Item Number | N8 | Displays the item number of the item if the Item Type is Stock, General or Library. |

| Description | A4000 | Displays the item description. |

| Creditor | N9 | Displays the Creditor Code, name and currency of the approved creditor. |

| Document Number | A10 | Displays the document number of the document the user is processing. |

| Document Type | A2 | Displays the document type of the document the user is processing. |

| Line Number | N3 | Displays the line number allocated to the item by the system when the line was created. |

| Quantity | Requested Displays the requested quantity entered by the user on the item in the requisition or order application. |

|

The user enters the application with the cursor in the branch code field. On entering the application the application automatically queries the document/item from which the user selected to drill down. The first line always displays the expense GLA as entered by the user on the requisitions or order application. On this block the GLA, quantity and total fields column widths are fixed where as all other fields can be dragged to enlarge or reduce the displayed size.

| Field | Type & Length |

Description |

|---|---|---|

| Branch Code | A2 | Supply a valid library branch code for this item. Pop Up Menu - available on field branch code.

|

| Cost Centre | A4 | Supply the Cost Centre that will pay for the expense.

The cost centre will populate fields VAT Apportionment Percentage and

Creditor Account Type depending on cost centre definition. Pop Up Menu - available on field cost centre.

|

| Account | A8 | Supply the account of the cost centre / account

combination that will bear the expense. The account will

populate the

field Asset Indicator. Pop Up Menu - available on the account field.

|

| Quantity | N9.3 | The number of units that must be supplied. Unit can

have up to 3 decimals. The sum of quantity for all the lines per item

must always equal the quantity requested in Block1. Pop Up Menu - available on the quantity field.

|

| Total | N17.2 | Displays the item unit total value in local currency VAT inclusive for the line. |

| GL Note | A30 | An optional note to accompany the GL-transaction. The system will insert the first 30 characters of the item description into this field. The user can update the GL Note. |

| Asset Indicator | A1 | Valid values are (Y)es or (N)o. The system will set this indicator to (Y)es if the expense GLA (in B. above) is linked to the Asset Account Category as defined on the system operational definition code AV and AW, else to (N)o. Asset category values can either be between 410 and 419 or 890 and 899, i.e. expenditure on fixed assets. The user may change the default values. |

| Apportionment Percentage | N6.3 | Value range of this field is 0 to 100.000. The system will default the VAT apportionment of the VAT Rate Code {FCSC-1} link is to the cost centre {FCSO-1b1} of the expense GLA (in A above). |

| Creditor Account Type | A4 | The account type as defined under option {FCSC-21}. The

system will

default an account type firstly from the cost centre definition, if not

found there, then from the transaction type definition and if not found

there then on the creditor definition. If this field remains

null the

user must supply a valid account type. Pop Up Menu - available on the creditor account type field.

|

| Budget Control | A1 | The budget Budget_Status of a line is displayed in this column. Display values are Incomplete Information, Sufficient, Forced, Rejected or Insufficient. The displayed budget status of a line is updated when the user clicks the "Complete_Button" on Block 1 of the requisition or order application or the user "Forces" or "Rejects" a line by using the "Override_Insufficient_Funds" option available on menus or selects the "Do Budget Control" option. |

|

This block is a display only block and is not accessible to the user The total quantity and VAT inclusive item total in local currency and quantity "Not Distributed" are displayed in this block.

| Field | Type & Length |

Description |

|---|---|---|

| Total | Quantity Displays the sum of all quantity lines on the item. | |

| Total | Total Displays the sum of the VAT inclusive item total in local currency for all lines on the item. | |

| Not Distributed | Displays the difference of the quantity requested in

the requisitions

or order application and the sum of the quantity lines (see A). The

user cannot commit records on this application if the value of the not

distributed value is not zero. |

|

| Return to {FPMO1-1} Return to {FPMO3-1} Return to Goods_Received |

|

This block is used to enter the payment detail of a cheque request.

| Field | Type & Length |

Description |

|---|---|---|

| Creditor Type | A1 | The user must enter the type of creditor for which the cheque is requested. If the person is not defined on the system, the user must use the person type Other. If the person type (S)tudent, (C)reditor or (D)ebtor is selected the issue of the cheque will result in a transaction on the account of the student or debtor / creditor in the subsystem of the person type. If the person type is (S)tudent, (P)ersonnel and (O)ther and a meal account type is entered on the financial item detail block the issue of the cheque will result in a transaction in the meal system. Any person type (O)ther / Person Type will default the name and address of the person type and number into the cheque request. |

| Creditor Number | N9 | Completion of this field is mandatory for all person types except person type (O)ther. The system will check that the code is valid and defaults the name and address into the request. The system checks the validity of the code on entering of this field, displaying "Invalid number while debtor = Student, Personnel, Creditor, Debtor, Alumnus or Other Payments" if code is invalid. |

| Creditor Name | A36 | The creditor's name will default in this field,

but the name on the cheque may differ from the "creditor's" name. Pop Up Menu - available on field creditor name.

|

| Cheque Note | A30 | The note entered here will be displayed on the cheque. |

| Creditor Currency Code | A3 | The currency code of the cashbook defaults into this field but is updateable by the user if the persons currency is not local currency. |

| VAT Code | A2 | The VAT code may be entered for this transaction. Pop Up Menu - available on the field VAT Code.

|

| VAT Rate | N3.2 | If the cheque payment is subject to VAT, the rate to be applied to the payment. A default VAT rate defaults from the VAT code if the VAT code is entered. VAT rate is mandatory. |

| Creditor Currency Value | N15.2 | The cheque value in the creditor's currency. |

| VAT Amount | N15.2 | The calculated VAT amount. |

| Value in Local Currency | N15.2 | The amount to be printed on the cheque. This amount should balance with the amounts debited to different GL-Allocations in Block 2. |

| Net After VAT | N16.2 | The amount after VAT will be displayed and is not updateable by the user. |

|

Block 2 to is used to enter the item detail of the cheque request.

| Field | Type & Length |

Description |

|---|---|---|

| Account Type | A1 | If the person type of the record is Student, Debtor or

Creditor the

account type is mandatory. If the person type of the record is Person,

Student or Other the user can enter a meal account type. The Account

Type must be valid for the person type and subsystem of the person or

if a meal account type the person type and number must exist on the

meal system. If the account type is complete the GLA defaults from the

account type and the GLA is not updateable by the user. Pop Up Menu - available on field account type.

|

| Cost Centre | A4 | Supply the Cost Centre that will pay for the expense.

The cost centre will populate fields VAT Apportionment Percentage and

Creditor Account Type depending on cost centre definition. Pop Up Menu - available on field Cost Centre.

|

| Account | A8 | Supply the account of the cost centre / account

combination that will bear the expense. The account will populate the

field Asset Indicator. Pop Up Menu - available on the field Account.

|

| Cost | N15.2 | The value in creditors currency allocated to the GLA. Pop Up Menu - available on the cost field.

|

| Apportionment Percentage | N6.3 | Value range of this field is 0 to 100.000. The system will default the VAT apportionment of the VAT Rate Code {FCSC-1} link is to the cost centre {FCSO-1b1} of the expense GLA (in A above). |

| Payment Agreement | A4 | This field can only be entered if the debtor type is

Student. The value

defaults from the account type <List of Values>. The user

can

only enter agreement codes that are linked to the student and account

type as defined in option {FSAO-4b3}. Pop Up Menu - available on the field Payment Agreement.

|

| Loan Code | A4 | This field can only be entered if the Debtor Type is

Debtor and the

account type's AR category is S. The user can enter any Loan

Code as

defined in option {FARS-1} as long as the Loan Code was not previously

used for the debtor or the loan is not fully paid. Pop Up Menu - available on the field Loan Code.

|

| GL Note | A30 | An optional note to accompany the GL-transaction. The system will insert the first 30 characters of the item description into this field. The user can update the GL Note. |

| Budget Control | A1 | The budget control status of the line is displayed in this column. Display values are Incomplete Information, Sufficient, Forced, Rejected or Insufficient. The displayed budget status of a line is updated when the user clicks the "Complete_Button" on Block 1 of the requisition or order application or the user "Forces" or "Rejects" a line by using the "Override_Insufficient" application. The user can only change value Insufficient to Forced or Rejected if he/she has a (Y)es in Override Insufficient Rule field of option {FCSM-5} and the document is not yet used in a higher hierarchy document. |

| Creditor Currency Value | N15.2 | Displays the sum of the cost column. If the total creditors currency in Block 2 does not correspond to the total creditor currency in Block 1 the user will not be able to commit the Block 2 records. |

| Return to {FPMO1-1} | ||

|

| Field | Type & Length |

Description |

|---|---|---|

| Item Type | A1 | Displays the item type currently being processed from

which the user

drilled down from. Item types are Stock, General, Library or

Non-Defined Items. |

| Item Number | N8 | Displays the item number of the item type currently being processed from which the user drilled down from if the item type is Stock, General or Library. |

| Description | A4000 | Displays the item description |

| Document Number | A10 | The document number currently being processed from which the user drilled down from in the requisition or buyer screens. The field is not accessible to the user. |

| Document Type | A2 | The type of document currently being processed from which the user drilled down from in the requisition or buyer screens. |

| Line Number | N5 | Displays the line number being processed from which the user drilled down from in the requisition or buyer screens. The field is not accessible to the user. |

| Sort Order | A1 | The user can order the quotes entered according to any of the following in ascending order Creditor Code, Item Unit Total, Unit Price and Lead Time |

|

| Field | Type & Length |

Description |

|---|---|---|

| Creditor Code | N9 | Enter the creditor code for whom the quotation was

received. Pop Up Menu - available on field creditor code.

|

| Currency Code | A3 | Displays the currency code of the creditor code

definition. The field is not accessible to the user. |

| Currency Fix | A1 | Valid values are (Y)es or (N)o. The default is (N)o. If the currency code is local currency this field is not accessible to the user. Only items assigned to PO where the currency code is foreign currency can be (Y)es. The user must supply the currency rate as received from the bank when they purchased the forward cover. |

| Exchange Rate | N7.3 | The system will default the exchange rate depending on

the following criteria:

|

| Unit Price | N17.2 | The currency value of one unit. The value

supplied

here must correspond to a value of the currency code. The

system will

default this value if available either from options {FPMM-3b2},

{FPMM-23b3} if item is stock or general and assigned to PO. Pop Up Menu - available on field unit price.

VAT

Inclusive/Exclusive Indicator is I:

The value of Unit

Price field.

VAT Inclusive/Exclusive Indicator is E:The value of Unit

Price field multiply by (1 plus VAT rate).

The value of

Price/Cost multiplied by

Trade Discount Percentage divided by 100.

The value

of Cost minus Trade Discount.

The value

of Item Unit Total minus VAT..

The value of Item

Unit Total multiplied by the VAT Rate divided by (1

plus VAT Rate).

The value of Given

Currency multiplied by the Currency Rate.

|

| Trade Discount Percentage | N5.2 | The trade discount percentage. The system will default a value from the creditor, options {FPMM-2b1}, the general item definition, option {FPMM-3b2} or the stock item definition {FPMM-23b3} for trade discount percentage. This value is updateable by the user. |

| VAT Code | A2 | Enter the VAT code as defined in option {FCSC-1} and

the

VAT rate of this code will be displayed in the next field.

This is not

a mandatory field. The system will default the value of

system

operational definition code AY subsystem PM into this field and the

user is allowed to change the value. Pop Up Menu - available on the VAT code field.

|

| VAT Rate | N8.3 | The VAT rate for the unit price; The valid range is from 0 up to 1.000. The system will default the VAT rate of the previous field VAT code. The system will allow the user to use different VAT rates for each creditor of the item and items of the document. |

| VAT Inclusive/Exclusive Indicator | A1 | Is VAT included/excluded in the unit price of this item? Reply Included or Excluded. The system will default an I into this field and the user is allowed to change the value to an E. The unit price entered will remain unchanged. |

| Expiring Days | N4 | Enter the number of days that this unit price information is valid. The system will calculate the expiry date, using the document date plus the expiring days. This is not a mandatory field and this information will not influence the item in any way. |

| Expiring Date | DD-MON-YYYY | Enter the date that this unit price information expired. The system will default a date into the field if the user has completed the expiring date field. This is not a mandatory field and this information will not influence the item in any way. |

| Lead Time | N3 | The normal order to delivery time lapse, in days. The system uses this period to calculate the default delivery date when an order is placed. |

| Payment Terms | A3 | Enter the payment term code as defined in option

{FPMC-4} and the description of the payment term will be

displayed.

The system will default this value either from options {FPMM-2b1},

{FPMM-3b2} or {FPMM-23b3}. The payment term will ensure that

the

invoice calculated the correct effective payment date and if the

invoice is paid before or on the effective payment date that the

correct settlement discount is deducted from the invoice. Pop Up Menu - available on the field payment terms.

|

| Reference Number | A15 | The ID Code or name by which this contract or quotation is known. In other words this number is an external supporting document for the unit price information. |

| Item Unit Total | N17.2 | Displays the item unit total value for this record of the unit price information, in local currency. The user cannot access this field. |

| Update Approved Creditor | Button | When requesting an item to be purchased, the requestor or buyer will obtain the required number of quotations. Quotation will be entered by the user on the maintain item quotation screen. After entering the quotes the user / buyer should consider all relevant information i.e. price, quality, delivery date etc and make a decision as from which supplier the item should be purchased. This done by flagging the selected creditor in the tick box above the creditor code. On clicking the Update Approved Creditor Button the flagged creditor is set as the approved creditor on the requisition and the requisition unit price is updated with the quote price information. |

| Return to Requisitions Return to Orders Return to Goods_Received |

|

General

The purpose of the screen is to update item quotations

on general items where unit price information on general items is

maintained. Institutions using general items can maintain item unit

prices per item and creditors in the option {FPMM-3b2}. If the field

Require Quotations on the general item is set to = 'N' the creditor

unit price information on a general item may be used and the unit price

information will default if the item is requested on a requisition. The

number of quotes defaulting on a general item request may be limited by

the system operational definition code AU "Maximum Priority" {FCSM-1b2}

as only item/creditor unit price records will default where the

priority on the item/creditor unit price record is less than or equal

to the maximum priority system operational definition. If the price

information has changed between the time the unit price defaulted and

the date the buyer checks the quotations on the requisition, the

user/buyer can use this option to update the prices from the item

definition. If the creditor quote did not default because the priority

on the creditor item record was greater than the maximum priority code,

the user can add the item/creditor unit price information as a quote on

the requisition.

| Field | Type & Length |

Description |

|---|---|---|

| Item Type | A1 | Displays the Item Type currently being processed. |

| Item Number | N8 | Displays the Item Number of the Item Type currently being processed. |

| Description | A4000 | Displays the Item Description. |

| Document Number | A10 | The Document Number currently processed. |

| Document Type | A2 | The type of document currently processed. |

| Line Number | N5 | Displays the Line Number processed. |

| Sort Order | A1 | The user can order the quotes entered according to any

of the following

in ascending order Creditor Code, Item Unit Total, Unit Price and Lead

Time. |

|

Processing Rules for this Block (delete if not applicable).

| Field | Type & Length |

Description |

|---|---|---|

| Creditor Code | N9 | Displays the Creditor Code of the creditor linked to

the item {FPMM3-b2}. Pop Up Menu - available on field Creditor Code.

|

| Currency Code | A3 | Displays the Currency Code of the Creditor Code

definition. Pop Up Menu - available on field Currency Code.

|

| Creditor Active | N9 | Displays the creditors active non-active status. Pop Up Menu - available on field Creditor Active.

|

| Exchange Rate | N7.3 | The system will default a currency rate from option {FCSO-21}. Also see paragraph "Maintain Foreign Currency" for more details. |

| Priority Code | N2 | Displays the priority linked to the creditor on the item. |

| Unit Price (N17.2) Displays the Unit Price

linked to the creditor for the item. " Pop Up Menu - available on field Unit Price. " Item Unit Total - Selecting the Unit Price field. o Creditor Code (N9) Display the Creditor Code of the quotation record. o Cost (N17.2) Displays the total VAT inclusive unit price/cost value before trade discount of the unit price information for this record, in foreign currency. The user cannot access this field. The system calculations are as follows: VAT Inclusive/Exclusive Indicator is "I": The value of Unit Price field. VAT Inclusive/Exclusive Indicator is "E": The value of Unit Price field multiply by (1 plus VAT rate). o Trade Discount (N17.2) Displays the total trade discount value of the unit price information for this record, in foreign currency. The user cannot access this field. The system calculations are as follows: The value of Price/Cost multiplied by Trade Discount Percentage divided by 100. o Given Currency (N17.2) Displays the total given currency value of the unit price information for this record, in foreign currency. The user cannot access this field. The system calculations are as follows: The value of Cost minus Trade Discount. o Local Currency (N17.2) Displays the local currency value of the unit price information for this record, in local currency. The user cannot access this field. The system calculations are as follows: The value of Item Unit Total minus VAT. o VAT (N17.2) Displays the total VAT value of the unit price information for this record, in local currency. The user cannot access this field. The system calculations are as follows: The value of Item Unit Total multiplied by VAT Rate divided by (1 plus VAT Rate). o Item Unit Total (N17.2) Displays the item unit total value of the unit price information for this record, in local currency. The user cannot access this field. The system calculations are as follows: The value of Given Currency multiplied by the Currency Rate. |

||

| Trade Discount Percentage | N5.2 | Displays the trade discount percentage linked to creditor for this item. |

| VAT Rate | N8.3 | Displays the VAT rate linked to the creditor for this item. |

| VAT Inclusive/Exclusive Indicator | A1 | Displays the VAT Included / Excluded indicator linked to the creditor for this item. |

| Lead Time | N3 | Displays the lead time linked to the creditor for this item. |

| Payment Terms | A3 | Displays the payment terms linked to the creditor for

this item. Pop Up Menu - available on field payment terms.

|

| Item Unit Total | N17.2 | Displays the item unit total value for this record, of the unit price information in local currency. The user cannot access this field. |

| Add / Renew Quotations | Button | All unit price information of creditor

quotations linked to the item will be displayed in the screen. The user

will flag a creditor to be updated in the tick box above the creditor

records. On clicking the Add / Renew Button the creditor is updated. If

the creditor exists on the quotation, screen the unit price information

will be updated otherwise, if the creditor does not exist on the

quotation screen a quotation will be inserted for the creditor. |

|

This is the unit price

information of an item.

On a requisition to the unit price is update when the approved creditor

is linked to the a item

In the screen the user can see the how the calculation of the item

total is performed.

| Field | Type & Length |

Description |

|---|---|---|

| Item Type | A1 | Displays the Item type of the item namely Stock, General, Library or Non-Defined Item. |

| Item Number | N8 | Displays the item number of the item if the item type is Stock, General or Library. |

| Description | A4000 | Displays the item description. |

| Document Number | A10 | Displays the document number of the document that the user is processing. |

| Document Type | A2 | Displays the document type of the document that the user is processing. |

| Line Number | N3 | Displays the line number allocated to the item by the system when the line was created. |

| Creditor Code | N9 | Enter the creditor code. Pop Up Menu - available on field creditor.

|

| Unit Price | N17.2 | The currency value of one unit. The value

supplied

here must correspond to a value of the currency code. The

system will

default this value if available from option {FPMM-3b2} or {FPMM-23b3}

if the item is stock or general and assigned to PO. Pop Up Menu - available on field unit price. |

| Trade Discount Percentage | N5.2 | The trade discount percentage. The system will default a value from the creditor, options {FPMM-2b1}, the general item definition, option {FPMM-3b2} or the stock item definition {FPMM-23b3} for trade discount percentage. This value is updateable by the user. |

| Exchange Rate Fixed | A1 | Valid values are (Y)es or (N)o. The default is (N)o. If the currency code is local currency this field is not accessible to the user. Only items assigned to PO and the currency code is foreign currency code then this can be (Y)es and the user must supply the currency rate as received from the bank when they purchased the forward cover. |

| Exchange Rate | N7.3 | The system will default the exchange rate depending on

the following criteria: Currency Code equal to local currency then the default is (N)o and this field is not accessible to the user. Currency code is a foreign currency: Currency fix equal to "Y" The user must supply the currency rate as received from the bank when they purchased the forward cover. If this item is copied to higher hierarchy document then this currency rate will be carried forward and cannot be changed. Currency fix equal to "N" The system will default a currency rate from option {FCSO-21}. Also see paragraph "Maintain Foreign Currency" for more details. The user may update the default value if the field Updateable (Y/N) is (Y)es for the subsystem PM in option {FCSO-21b1}. To update the outstanding commitments to the latest currency rate the user can run option {FCSO-21 sequence 2}. |

| VAT Rate | N8.3 | Enter the VAT rate for the unit price. The valid range is 0.000 to 1.000. The system will default the VAT rate of the previous field's VAT code. The system will allow the user to use different VAT rates for each creditor of the item and items of the document. |

| VAT Inclusive/Exclusive Indicator | A1 | Is VAT included/excluded in the unit price of this item? Reply (I)ncluded or (E)xcluded. The system will default "I" into this field and the user is allowed to change the value to "E". The unit price entered will remain unchanged. |

| Quote / Contract | A15 | The ID Code or name by which this contract or quotation is known. In other words this number refers to an external supporting document for the unit price information. |

| Payment Terms | A3 | Enter the payment term code as defined in option {FPMC-4} and the description of the payment term will be displayed. The system will default this value from option {FPMM-2b1}, {FPMM-3b2} or {FPMM-23b3}. The payment term will ensure that the invoice calculated the correct effective payment date and if the invoice is paid before or on the effective payment date that the correct settlement discount is deducted from the invoice. The <List of Values> available on the field will list the payment terms, description, discount percentage and number of days from statement or invoice. |

| Quantity Requested | N15.2 | Displays the quantity requested on the item by the user |

| Cost | N17.2 | Displays the total VAT inclusive unit price/cost value

before trade

discount for this record, of the unit price information in foreign

currency. The user cannot access this field. The

system calculations

are as follows: VAT Inclusive/Exclusive Indicator is I: The value of Unit Price field. VAT Inclusive/Exclusive Indicator is E: The value of Unit Price field multiply by (1 plus VAT rate). |

| Trade Discount | N17.2 | Displays the total trade discount value of the unit

price information

for this record, in foreign currency. The user cannot access

this

field. The system calculations are as follows: The value of Price/Cost multiply by Trade Discount Percentage divided by 100. |

| Given Currency | N17.2 | Displays the total given currency value of the

unit price information for this record, in foreign currency.

The user

cannot access this field. The system calculations are as

follows: The value of Cost minus Trade Discount. |

| Local Currency | N17.2 | Displays the local currency value of the unit

price information for this record, in local currency. The

user cannot

access this field. The system calculations are as follows: The value of Item Unit Total minus VAT. |

| VAT | N17.2 | Displays the total VAT value for this record of the

unit

price information, in local currency. The user cannot access

this

field. The system calculations are as follows: The value of Item Unit Total multiply by VAT Rate divided by (1 plus VAT Rate). |

| Item Total | N17.2 | Displays the item unit total value for this record

of the unit price information, in local currency. The user

cannot

access this field. The system calculations are as follows: The value of Given Currency multiplied by the Currency Rate. |

| Return to Requisitions Return to Orders Return to Goods_Received |

|

| Field | Type & Length |

Description |

|---|---|---|

| Document Number | A10 | The Document Number of the document. The field is not accessible to the user. |

| Document type | A2 | The Document Type of the document. The field is not accessible to the user. |

| Line Number | N5 | The Line Number from Block 8 will be displayed. The field is not accessible to the user. |

| Item Type | A1 | Displays the Item Type of the item namely Stock. |

| Item Number | N8 | Displays the Item Number of the item if the Item Type is Stock, General or Library. |

| Description | A4000 | Displays the item description. |

| Unit Price | N17.2 | The value of one unit. The system will default this value from {FPMM-23b3}. |

| Mark Up % | N5.2 | Mark-up percentage. The system will default a value from option {FPMM23b2} mark-up percentage. This value is updateable by the user. |

| VAT Rate | N8.3 | Enter the VAT rate for the Unit Price and the valid range is from 0 to 1.000. |

| Quantity Requested | N15.2 | Displays the requested quantity enter by the user on the item. |

| Cost | N17.2 | Displays the total VAT inclusive cost value before mark

up for this

record. The user cannot access this field. The system

calculations are

as follows: Quantity Requested multiply by the Unit Price. |

| Mark Up | N15.2 | Displays the mark up for this record. The user cannot

access this field. The system calculations are as follows; Quantity Requested multiply by the Unit Price multiply by Mark Up % |

| Local Currency | N17.2 | Displays the local currency value for this

record, of the unit price information in local currency. The

user

cannot access this field. The system calculations are as

follows: The value of Item Unit Total minus VAT. |

| VAT | N17.2 | Displays the total VAT value for this record, of the

unit

price information in local currency. The user cannot access

this

field. The system calculations are as followed: The value of Item Unit Total multiply by VAT Rate divided by (1 plus VAT Rate). |

| Item Unit Total | N17.2 | Displays the item unit total value of the

unit price information for this record, in local currency.

The user

cannot access this field. The system calculations are as

follows: The value of Cost plus Mark-Up |

|

| Field | Type & Length |

Description |

|---|---|---|

| Document Type | A2 | The Document Type the user wishes to cancel. The documents available to be cancelled are determined by the menu option i.e. if called from the requisition option only requisitions can be cancelled. |

| Document Number | A10 | The Document Number that the user wishes to

cancel. The <List of

Values> on the field will list the Document Number, Document

Type,

Process Date and Creditor Code (only orders and GRVs) of documents with

status Normal and with items not copied or partially copied to a higher

document in the hierarchy. The user can select a document from the

<List of Values> or enter a document number if known to

the user.

Only valid documents will be accepted. |

| Type Code | A1 | Valid values are Change, Complete or Cancel.

The following describes each value:

Cancel Type Code - Usage is to cancel a document that was not

used in a higher hierarchy document.

Complete Type Code - If the user wants to cancel a document but the document was used in a higher hierarchy document. Change Type Code - Usage is to make changes to the document if status Normal. If a document is cancelled or completed on selecting the Document Type and Number, the program will automatically set the value of the field to the action allowed for the document i.e. cancel or complete. The user is not allowed to update the action. If the user must enter a change reason the program will automatically pop up in the option in which the user is busy with the value of the field as change and force the user to enter a change reason. The rest of the fields are mandatory as soon as the type code is not null. |

| Date and Time | DD-MON-YYYY hh24mm | The system will complete this field with the system date and time. The user can only query this field. |

| Reason Code | A6 | Enter a valid reason code for the Type Code as defined on option {FPMC-8}. The description of the Reason Code will be displayed. A list function will display all the valid reason codes for the type code plus the reason code description. |