|

| Code | Sub System | Description Action |

| AK | PM | GRV Approval is Invoice approval |

| AO | PM | Use GRV |

| AP | PM | GRV/INV Variance amount |

| AQ | PM | GRV/INV Variance % |

| AS | PM | Allow Deduction of AR Balanace on PM |

| AV | PM | Start Asset Account Category |

| AW | PM | End Asset Account Category |

| BA | CS | Budget Control |

| BB | CS | Override Insufficient Funds |

| BH | CS | Allow Insufficient Funds |

| BI | CS | Include / Exclude Un-Approved Credits Budget Control |

| EF | PM | Invoice or Credit Note Approvals Syste(M) / Us(E)r |

| Event | Description | Type of Document |

| AI | PM - Invoice Transaction | IN |

| AN | PM - Credit Note Transaction | CN |

| AJ | PM - Invoice Transaction to SD | IN |

| AK | PM - Invoice Transaction to AR | IN |

| AA | PM - Credit Note Transaction to SD | CN |

| AB | PM - Credit Note Transaction to AR | CN |

| AV | PM - Payment (Not Generated Normally) | PP |

| Field | Type & Length |

Description |

|---|---|---|

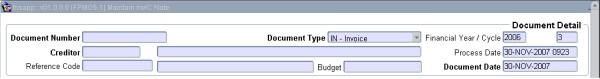

| Document Number | A15 | The document number as received

from the supplier.Document number is unique per supplier and

the

user will not be allowed to enter a number that already exists.If the

invoice was

entered to be tracked through option {FPMO5-2},

the

system will remove the invoice from the option on commit of this document. Pop up Menu - available on field Document Number.

|

| Document Type | A2 | The document type of the document maintained. The

following document types can be maintained in the option.

The document types allowed in the option and dipslayed on the list of value are controlled by the sequence (Range 21 to 60) in Type of Document option {FCSO-23}. |

| Creditor | N9 | The creditor code of the supplier of the document received.Creditor codes are defined in option {FPMM-2}, TAB - Crediotor Detail. The List Of Value function will display the Creditor Code, Name, Currency Code, Lead Time and Payment Term. Depending on the Creditor Status the user will not be allowed to use a creditor or will be warned or no action taken. The warning will further allow the user to view any documentation relating to the status stored in the DSR and linked to the status. |

| Financial Year/Cycle |

YYYY/MM | The year and cycle of the document. When a document is created the year and cycle defaults from the current PM subsystem year and cycle. If the user is linked to the restriction FPFD then the user is allowed to change the year to the next year using the "Document Detail" application. |

| Process Date |

DD-MON-YYYY HHMM | The default of this field is system date. The field is not updateable. |

| Document Date | DD-MON-YYYY | The default of this field is system date. The user is allowed to change the date as long as the date is in the range of 01-JAN-1980 up to the default date. |

| Reference Code | A15 | A reference for any relevant information concerning a document. |

|

| Field | Type & Length |

Description | ||||

|---|---|---|---|---|---|---|

| Originating Documents | ||||||

| ToD | A2 | Valid values are (O)rder/(G)RV if the Document Type is (IN)voice or (IN)voice/(S)upplier Return if (CN) - Credit Note. | ||||

| Document # | A15 | The document number for the Document Type specified in the previous field from which information was copied. | ||||

| ToD | A2 | Valid values are (O)rder/(G)RV if the Document Type is (IN)voice or (IN)voice/(S)upplier Return if (CN) - Credit Note. | ||||

| Document # | A15 | The document number for the Document Type specified in the previous field from which information was copied. | ||||

| Quote/Contract | A12 | The ID Code or name by which this contract or quotation is known. In other words this number is an external supporting document for the unit price information. | ||||

| Version | N4 | The Quote/Contract version number. | ||||

| Original | N10.3 / N15.2 |

|

||||

| Available | N10.3 / N15.2 |

|

||||

| Description | A4000 | The

item description.

|

||||

| Unit | A8 | A standard measure of quantity. The fields allows any eight-character unit, e.g. Kg, Litre, etc

|

||||

| Unit Price | N15.4 | The price per unit for the service or product in the currecny defined on the creditors definition for the creditor.

|

||||

| Financing | A1 |

Financing indicates the basis used to split the expense per item between the entities financing the item. The system supports the following relationships:

|

||||

| Paid/Received | A1 | Paid / Received indicates the basis used to

recognise

the receipt of an item. The recognition of an item is important, if the

item originates from an order, as it determines the commitment

cancelled and the quantity or cost available to be invoiced on

future invoices. The system supports the following:

From an originating document

|

||||

| Quantity | N10.3 | Quantity represents the number of units

received from (Invoice) or returned to (Credit Note) a supplier.

If the Paid / Received method of the item is Quantity, a quantity value

must be entered by the user matching the quantity on the document

received from the supplier. The following rules relating to quantity applies;

|

||||

| Cost | N15.2 | Cost represents the quantity multiplied by the VAT inclusive unit price in

creditor currency of the item received

from (Invoice) or returned to (Credit Note) a supplier. If

the Paid / Received method of the item is Monetary, a cost

value must be entered by the user matching the cost on

the document received from the

supplier. The following rules apply to cost;

|

||||

| Line Total | N15.2 | The total for the item in local currency. | ||||

|

| Field | Type & Length |

Description |

|---|---|---|

| Cost Centre/ Account |

A4/ A8 |

The GLA's funding the

expense.

Pop up Menu - available on field Account.

|

| Quantity | N 9.3 | The number of units received or returned on the GLA.

|

| Cost | N15.2 | Cost represents the quantity multiplied by the VAT inclusive unit price in

creditor currency of the item

|

| % Split | N3.2 | This will only be used where the financing

method of the line is "Percentage". This value indicates contribution

of the cost centre in financing the item. This value range is

between .0001 and 100.00

|

| Account Type | A4 | The Creditor Account Type to be used on the

line. The control GLA of the line is derived from the GLA linked

to account type. Account types are defined in option

{FCSC-21}. The List of Values will list the account type and description where the subsytem of the account type is PM.

|

| GL Note | A30 | An optional note to accompany the GL-transaction. The system will default the reference code plus the order number and creditor name into this field, depending on values available. The user can update the GL note. |

| Budget | A1 | The field displays the budget status of a line.

Valid values are Sufficient, Forced or Insufficient. The field is

only assigned a value once budget control has been performed which is

done when the user commits the document. Once budget has been

performed, if any line on the document is insufficient the program will

automatically drill down to the Override Insufficient Funds

screen where the user can force the lines with insufficient funds

should the user have priviliegdes to override Insufficient funds.

The following describes each value: Sufficient

When budget control

was performed the GLA had sufficient funds,the

field was set to (S)ufficient

Forced

A

user forced budget control on the line that had insufficient funds when budget control was performed. To

force budget means to set the budget flag on a line with

insufficient funds to (F)orce which will result in

programs treating the line as sufficient. A report of all forced records can

be

printed using option {FPMOR2-30}.

Insufficient

When budget control was

performed, the GLA has insufficient funds and the program set

budget control flag to (I)nsufficient. The user must force

the insufficient funds on the line or change

the expense GLA to a GLA that has sufficient funds.

|

| % App | N1.2 | Value range of this field is 0 to 1.000.

|

| Total | N15.2 | Displays the VAT inclusive, total of the line in local currency. Total is calculated by muliplying the cost in given currency for this line with the exchange rate. |

| Distribution Total | N15.2 | Running total of Quantity/Cost being captured that validates against Original values |

| Available to Distribute | N15.2 | Running total of Quantity/Cost being captured that validates against Available values |

|

| Processing Rules |

|

|---|---|

| No special processing rules |

| Date | System Version | By Whom | Job | Description |

|---|---|---|---|---|

| 31-Oct-2007 | v01.0.0.0 | Amanda Nell | t144148 | New manual format. |

| 04-Dec-2007 | v01.0.0.0 | Kobus Kleinhans | t144148 | Manual still to be proofread by the system owner. |

| 20-May-2008 | v01.0.0.1 | Charlene van der Schyff | t150589 | Update creditor status by creditor |

| 25-Mar-2009 | v01.0.0.2 | Marchand Hildebrand | t152121 | Proof Read System Owner |

| 20-Mar-2012 | v01.0.0.2 | Marchand Hildebrand | t185198 | Manual Corrections |

| 05 Nov-2013 | v02.0.0.1 | Kenneth Bovula | t195290 | Increase the reference number length to 15 characters. |